Pep Boys 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

NOTE 17—LEGAL MATTERS (Continued)

could have a material adverse effect on the Company’s results of operations in the period(s) during

which the underlying matters are resolved.

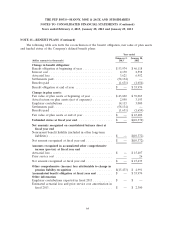

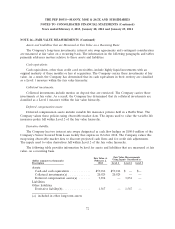

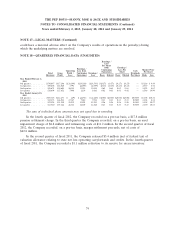

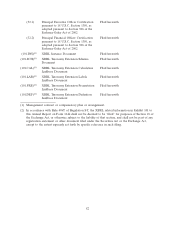

NOTE 18—QUARTERLY FINANCIAL DATA (UNAUDITED)

Earnings /

Loss

Per Share

from Earnings /

Earnings / Continuing Loss Per Market Price

Operating Loss from Cash

Operations Share Per Share

Total Gross Profit / Continuing Earnings / Dividends

Revenues Profit Loss Operations Loss Basic Diluted Basic Diluted Per Share High Low

Year Ended February 2,

2013

4th quarter ......... $530,847 $117,206 $(16,394) $(14,320) $(14,543) $(0.27) (0.27) (0.27) (0.27) — $11.16 $ 9.48

3rd quarter ......... 509,608 116,040 3,791 (6,695) (6,759) (0.13) (0.13) (0.13) (0.13) — 10.57 8.76

2nd quarter ......... 525,671 130,601 16,315 33,034 33,048 0.62 0.61 0.62 0.61 — 14.93 8.67

1st quarter ......... 524,604 127,652 7,940 1,134 1,062 0.02 0.02 0.02 0.02 — 15.46 14.90

Year Ended January 28,

2012

4th quarter ......... $505,318 $112,273 $ (29) $ (4,191) $ (4,420) $(0.08) $(0.08) $(0.08) $(0.08) $0.0300 $12.08 $10.21

3rd quarter ......... 522,173 126,921 17,347 7,022 7,011 0.13 0.13 0.13 0.13 0.0300 12.04 8.18

2nd quarter ......... 522,594 135,210 21,939 13,891 13,943 0.26 0.26 0.26 0.26 0.0300 14.28 10.27

1st quarter ......... 513,540 135,122 26,311 12,405 12,368 0.23 0.23 0.23 0.23 0.0300 14.70 10.53

The sum of individual share amounts may not equal due to rounding.

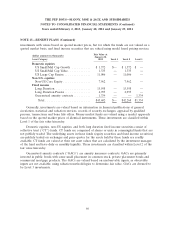

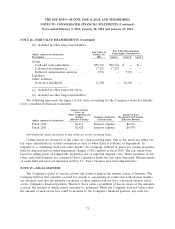

In the fourth quarter of fiscal 2012, the Company recorded on a pre-tax basis, a $17.8 million

pension settlement charge. In the third quarter the Company recorded, on a pre-tax basis, an asset

impairment charge of $8.8 million and refinancing costs of $11.2 million. In the second quarter of fiscal

2012, the Company recorded, on a pre-tax basis, merger settlement proceeds, net of costs of

$42.8 million.

In the second quarter of fiscal 2011, the Company released $3.4 million (net of federal tax) of

valuation allowance relating to state net loss operating carryforwards and credits. In the fourth quarter

of fiscal 2011, the Company recorded a $1.1 million reduction to its reserve for excess inventory.

74