Pep Boys 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In fiscal 2012, cash used in financing activities was $34.8 million, as compared to cash provided by

financing activities of $20.0 million in the prior year period. During the third quarter of 2012, we

increased the amount of our borrowing under our amended and restated Senior Secured Term Loan

from $150.0 to $200.0 million and used those proceeds together with cash on hand to repay, in full, the

$147.0 million principal amount then outstanding under our 7.5% Senior Subordinated Notes due 2014

and to settle our outstanding interest rate swap (see Note 5 to the Consolidated Financial Statements).

As a result of the refinancing, we reduced our total debt by $95.1 million and extended its maturity to

2018. While this refinancing activity resulted in a one-time charge to interest expense of $11.2 million,

it also reduced our annual interest expense by approximately $11.0 million.

Our trade payable program, which has an availability of $175.0 million, is funded by various bank

participants who have the ability, but not the obligation, to purchase, directly from our vendors,

account receivables owed by Pep Boys. In fiscal 2012, we increased net borrowings on our trade payable

program by $64.5 million to $149.7 million as of February 2, 2013 from $85.2 million as of January 28,

2012 (classified as trade payable program liability on the consolidated balance sheet).

In fiscal 2011, we paid $2.4 million in financing costs to amend and restate our revolving credit

agreement to reduce its interest rate by 75 basis points and to extend its maturity to July 2016 and paid

a cash dividend of $6.3 million.

In the fourth quarter of fiscal 2012, our Board of Directors authorized a program to repurchase up

to $50.0 million of our common stock. During the fourth quarter of fiscal 2012, we used $0.3 million to

repurchase shares under the program.

We anticipate that cash on hand and cash generated by operating activities will exceed our

expected cash requirements in fiscal 2013. In addition, we expect to have excess availability under our

existing revolving credit agreement during the entirety of fiscal 2013. As of February 2, 2013 we had

undrawn availability on our revolving credit facility of $141.2 million. As of February 2, 2013 we had

$59.2 million of cash and cash equivalents on hand.

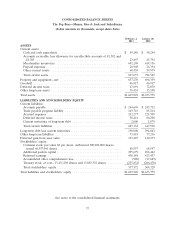

Our working capital was $126.5 million and $166.6 million at February 2, 2013 and January 28,

2012, respectively. Our total debt, net of cash on hand, as a percentage of our net capitalization, was

20.8% and 32.0% at February 2, 2013 and January 28, 2012, respectively.

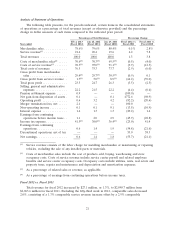

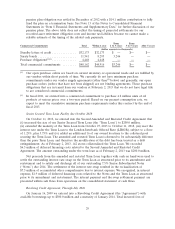

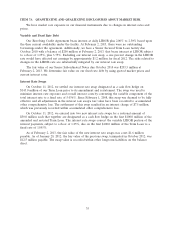

Contractual Obligations

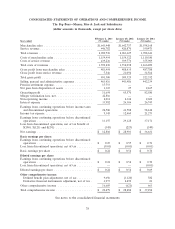

The following chart represents our total contractual obligations and commercial commitments as of

February 2, 2013:

From From

Contractual Obligations Total Within 1 year 1 to 3 years 3 to 5 years After 5 years

(dollars amounts in thousands)

Long-term debt(1) ................ $ 200,000 $ 2,000 $ 4,000 $ 4,000 $190,000

Operating leases ................. 791,723 102,609 189,296 159,742 340,076

Expected scheduled interest payments

on long-term debt .............. 59,533 10,675 21,048 20,645 7,165

Other long-term obligations(2) ....... 13,915 — — — —

Total contractual obligations ......... $1,065,171 $115,284 $214,344 $184,387 $537,241

(1) Long-term debt includes current maturities.

(2) Comprised of deferred compensation items of $6.1 million, income tax liabilities of $1.8 million

and asset retirement obligations of $6.0 million. We made voluntary contributions of $3.0 million

and $5.0 million to our defined benefit pension plan in fiscal 2011 and 2010, respectively. The

28