Pep Boys 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

How are candidates identified and evaluated?

Identification. The Nominating and Governance Committee considers all candidates recommended by our

shareholders, directors and senior management on an equal basis. The Nominating and Governance Committee’ s

preference is to identify nominees using our own resources, but has the authority to and will engage search firms(s)

as necessary.

Qualifications. The Nominating and Governance Committee evaluates each candidate’ s professional background

and experience, judgment and diversity (age, gender, ethnicity and personal experiences) and his or her

independence from Pep Boys. Such qualifications are evaluated against our then current requirements, as expressed

by the full Board and our President & Chief Executive Officer, and the current make up of the full Board.

Evaluations. Candidates are evaluated on the basis of their resume, third party references, public reputation and

personnel interviews. Before a candidate can be recommended to the full Board, such candidate is generally

interviewed by each member of the Nominating and Governance Committee and meets, in person, with at least one

member of the Nominating and Governance Committee, the Chairman of the Board and the President & Chief

Executive Officer.

How are directors compensated?

Cash Retainer. Each non-management director (other than the Chairman of the Board) receives an annual cash

retainer of $35,000. Our Chairman of the Board receives an annual director’ s fee of $100,000.

Committee Compensation. Directors serving on our committees (other than the Chairman of the Board) also

receive the following annual cash fees.

Chair Member

Audit $20,000 $12,000

Compensation $15,000 $ 7,500

Nominating and Governance $10,000 $ 5,000

Equity Grants. Our 2009 Stock Incentive Plan provides for an annual equity grant having an aggregate value of

$55,000 to non-management directors. The Stock Incentive Plan is administered, interpreted and implemented by

the Compensation Committee.

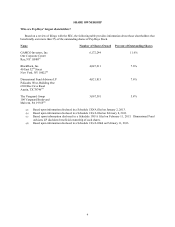

The following table details the compensation paid to non-employee directors during the fiscal year ended

February 2, 2013.

Director Compensation Table

Name

Fees Earned or

Paid in Cash

($)

Equity Awards

($)

Total

($)

M. Shân Atkins 50,000 55,000 105,000

Robert H. Hotz 100,000 55,000 155,000

James A. Mitarotonda 47,500 55,000 102,500

Jane Scaccetti 60,000 55,000 115,000

John T. Sweetwood 45,000 55,000 100,000

Nick White 41,000 55,000 96,000

Irvin D. Reid(1) 39,000-- 39,000

James A. Williams(1) 35,250 -- 35,250

(1) Messrs. Reid and Williams retired from our Board on September 12, 2012.