Pep Boys 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

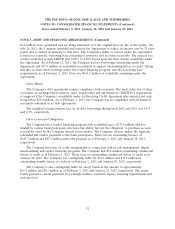

NOTE 8—INCOME TAXES

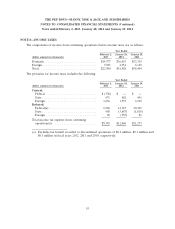

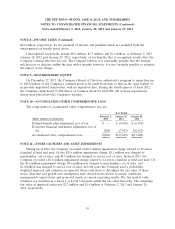

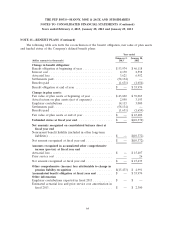

The components of income from continuing operations before income taxes are as follows:

Year Ended

February 2, January 28, January 29,

(dollar amounts in thousands) 2013 2012 2011

Domestic ............................. $14,577 $36,633 $52,319

Foreign ............................... 7,923 4,954 6,125

Total ................................. $22,500 $41,588 $58,444

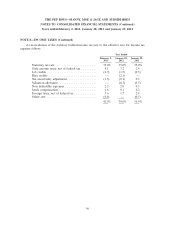

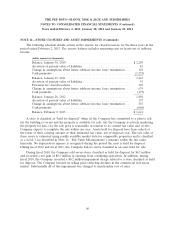

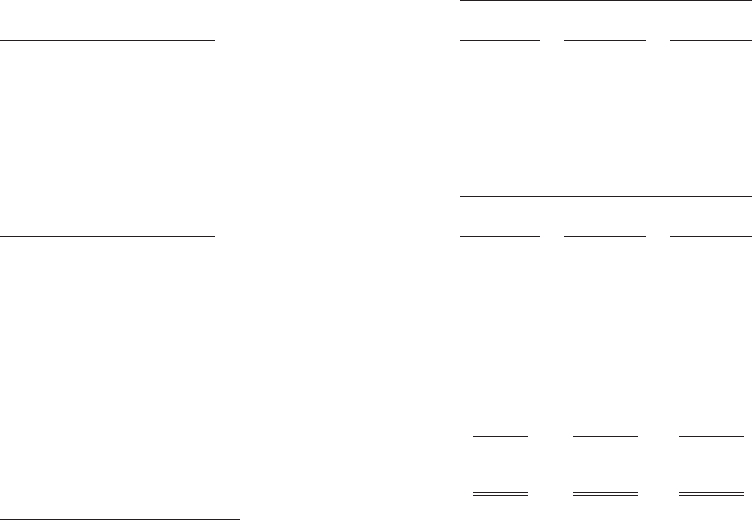

The provision for income taxes includes the following:

Year Ended

February 2, January 28, January 29,

(dollar amounts in thousands) 2013 2012 2011

Current:

Federal ............................. $(338) $ — $ —

State ............................... 471 602 491

Foreign ............................. 1,636 1,557 2,210

Deferred:

Federal(a) ........................... 6,548 14,743 20,309

State ............................... 988 (3,887) (1,818)

Foreign ............................. 40 (555) 81

Total income tax expense from continuing

operations(a) ......................... $9,345 $12,460 $21,273

(a) Excludes tax benefit recorded to discontinued operations of $0.2 million, $0.1 million and

$0.3 million in fiscal years 2012, 2011 and 2010, respectively.

55