Pep Boys 2012 Annual Report Download - page 84

Download and view the complete annual report

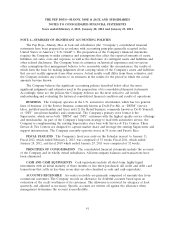

Please find page 84 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

new part; otherwise the Company charges customers a specified amount for the core component. The

Company refunds that same amount upon the customer returning a used core to the store at a later

date. The Company does not recognize sales or cost of sales for the core component of these

transactions when a used part is returned by the customer at the point of sale.

COSTS OF REVENUES Costs of merchandise sales include the cost of products sold, buying,

warehousing and store occupancy costs. Costs of service revenue include service center payroll and

related employee benefits, service center occupancy costs and cost of providing free or discounted

towing services to customers. Occupancy costs include utilities, rents, real estate and property taxes,

repairs, maintenance, depreciation and amortization expenses.

VENDOR SUPPORT FUNDS The Company receives various incentives in the form of discounts

and allowances from its vendors based on purchases or for services that the Company provides to the

vendors. These incentives received from vendors include rebates, allowances and promotional funds and

are generally based upon a percentage of the gross amount purchased. Funds are recorded when title

of goods purchased have transferred to the Company as the amount is known and not contingent on

future events. The amount of funds to be received are subject to vendor agreements and ongoing

negotiations that may be impacted in the future based on changes in market conditions, vendor

marketing strategies and changes in the profitability or sell-through of the related merchandise for the

Company.

Generally vendor support funds are earned based on purchases or product sales. These incentives

are treated as a reduction of inventories and are recognized as a reduction to cost of sales as the

inventories are sold. Certain vendor allowances are used exclusively for promotions and to offset

certain other direct expenses if the Company determines the allowances are for specific, identifiable

incremental expenses. Vendor support funds used to offset direct advertising costs were immaterial for

the year ended February 2, 2013, $2.5 million for the year ended January 28, 2012, and immaterial for

the year ended January 29, 2011.

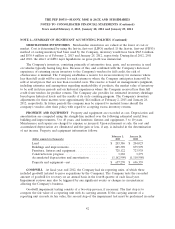

WARRANTY RESERVE The Company provides warranties for both its merchandise sales and

service labor. Warranties for merchandise are generally covered by the respective vendors, with the

Company covering any costs above the vendor’s stipulated allowance. Service labor is warranted in full

by the Company for a limited specific time period. The Company establishes its warranty reserves

based on historical experience. These costs are included in either costs of merchandise sales or costs of

service revenue in the consolidated statement of operations.

45