Pep Boys 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11APR201321311061

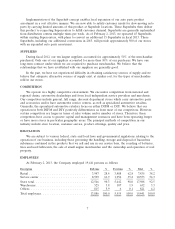

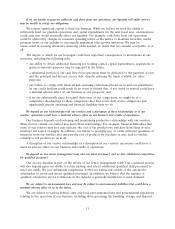

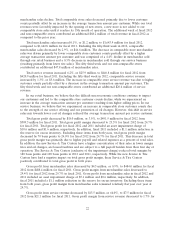

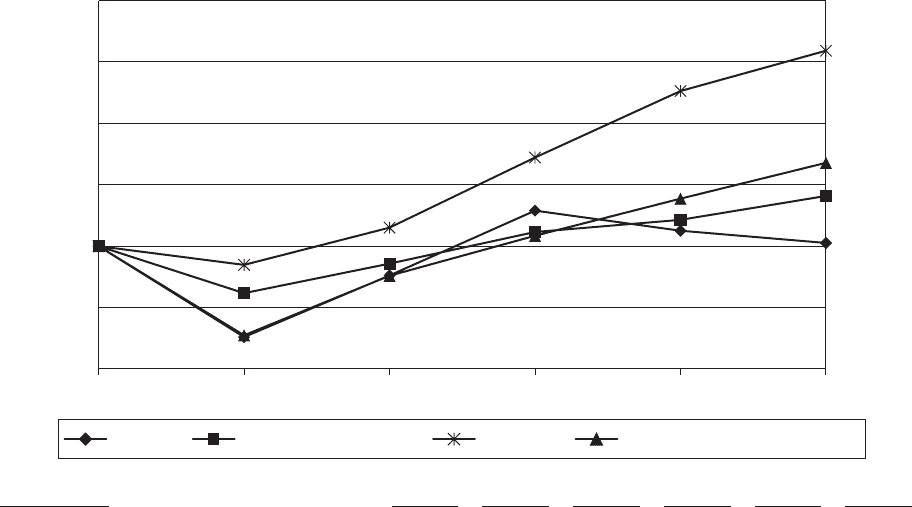

STOCK PRICE PERFORMANCE

The following graph compares the cumulative total return on shares of Pep Boys stock over the

past five years with the cumulative total return on shares of companies in (1) the Standard & Poor’s

SmallCap 600 Index, (2) the S&P 600 Automotive Retail Index and (3) an index of peer and

comparable companies as determined by the Company. The comparison assumes that $100 was invested

in January 2008 in Pep Boys Stock and in each of the indices and assumes reinvestment of dividends.

The S&P 600 Automotive Retail Index consists of companies in the S&P SmallCap 600 index that meet

the definition of the automotive retail classification, and is currently comprised of: Group 1

Automotive, Inc.; Lithia Motors, Inc.; Monro Muffler Brake, Inc.; Sonic Automotive, Inc.; and The Pep

Boys—Manny, Moe & Jack. The companies currently comprising the Peer Group are: Aaron’s, Inc.;

Advance Auto Parts, Inc.; AutoZone, Inc.; Big 5 Sporting Goods Corp.; Cabelas, Inc.; Conn’s, Inc.;

Dick’s Sporting Goods, Inc.; HHGregg, Inc.; Midas, Inc. (included through FYE 2012); Monro Muffler

Brake, Inc.; O’Reilly Automotive, Inc.; PetSmart, Inc.; RadioShack Corp.; Rent-A-Center, Inc.; Tractor

Supply Co.; West Marine, Inc.

Comparison of Cumulative Five Year Total Return

$0

$50

$100

$150

$200

$250

$300

Jan-08 Jan-09 Jan-10 Jan-11 Jan-13Jan-12

Pep Boys S&P SmallCap 600 Index Peer Group S&P 600 Automotive Retail Index

Company/Index Jan. 2008 Jan. 2009 Jan. 2010 Jan. 2011 Jan. 2012 Jan. 2013

Pep Boys ........................ $100.00 25.97 76.15 128.94 112.58 102.61

S&P SmallCap 600 Index ............ $100.00 61.72 85.77 111.55 121.45 140.91

Peer Group ...................... $100.00 84.75 115.09 172.22 226.38 259.22

S&P 600 Automotive Retail Index ...... $100.00 27.39 75.91 108.48 138.70 167.89

16