Pep Boys 2012 Annual Report Download - page 83

Download and view the complete annual report

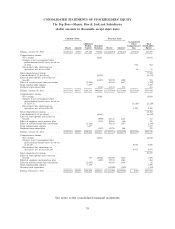

Please find page 83 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

INCOME TAXES The Company uses the asset and liability method of accounting for income

taxes. Deferred income taxes are determined based upon enacted tax laws and rates applied to the

differences between the financial statement and tax bases of assets and liabilities.

The Company recognizes taxes payable for the current year, as well as deferred tax assets and

liabilities for the future tax consequences of events that have been recognized in the Company’s

financial statements or tax returns. The Company must assess the likelihood that any recorded deferred

tax assets will be recovered against future taxable income. To the extent the Company believes it is

more likely than not that the asset will not be recoverable, a valuation allowance must be established.

To the extent the Company establishes a valuation allowance or changes the allowance in a future

period, income tax expense will be impacted.

In evaluating income tax positions, the Company records liabilities for potential exposures. These

tax liabilities are adjusted in the period actual developments give rise to such change. Those

developments could be, but are not limited to, settlement of tax audits, expiration of the statute of

limitations, and changes in the tax code and regulations, along with varying application of tax policy

and administration within those jurisdictions. Refer to Note 8, ‘‘Income Taxes,’’ for further discussion of

income taxes and changes in unrecognized tax benefit.

SALES TAXES The Company presents sales net of sales taxes in its consolidated statements of

operations.

REVENUE RECOGNITION The Company recognizes revenue from the sale of merchandise at

the time the merchandise is sold and the product is delivered to the customer. Service revenues are

recognized upon completion of the service. Service revenue consists of the labor charged for installing

merchandise or maintaining or repairing vehicles, excluding the sale of any installed parts or materials.

The Company records revenue net of an allowance for estimated future returns. The Company

establishes reserves for sales returns and allowances based on current sales levels and historical return

rates. Revenue from gift card sales is recognized upon gift card redemption. The Company’s gift cards

do not have expiration dates. The Company recognizes breakage on gift cards when, among other

things, sufficient gift card history is available to estimate potential breakage and the Company

determines there are no legal obligations to remit the value of unredeemed gift cards to the relevant

jurisdictions. Estimated gift card breakage revenue is immaterial for all periods presented.

The Company’s Customer Loyalty program allows members to earn points for each qualifying

purchase. Points earned allow members to receive a certificate that may be redeemed on future

purchases within 90 days of issuance. The retail value of points earned by loyalty program members is

included in accrued liabilities as deferred income and recorded as a reduction of revenue at the time

the points are earned, based on the historic and projected rate of redemption. The Company

recognizes deferred revenue and the cost of the free products distributed to loyalty program members

when the awards are redeemed. The cost of the free products distributed to program members is

recorded within costs of revenues.

A portion of the Company’s transactions includes the sale of auto parts that contain a core

component. These components represent the recyclable portion of the auto part. Customers are not

charged for the core component of the new part if a used core is returned at the point of sale of the

44