Pep Boys 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

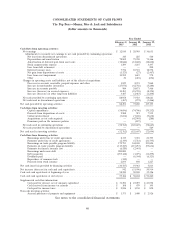

CONSOLIDATED STATEMENTS OF CASH FLOWS

The Pep Boys—Manny, Moe & Jack and Subsidiaries

(dollar amounts in thousands)

Year Ended

February 2, January 28, January 29,

2013 2012 2011

Cash flows from operating activities:

Net earnings ................................................ $ 12,810 $ 28,903 $ 36,631

Adjustments to reconcile net earnings to net cash provided by continuing operations:

Net loss from discontinued operations ............................. 345 225 540

Depreciation and amortization ................................. 78,805 79,390 74,366

Amortization of deferred gain from asset sales ....................... (12,846) (12,602) (12,602)

Stock compensation expense ................................... 1,299 3,237 3,497

Loss from debt retirement .................................... — — 200

Deferred income taxes ....................................... 7,576 10,301 18,572

Net gain from dispositions of assets .............................. (1,323) (27) (2,467)

Loss from asset impairment ................................... 10,555 1,619 970

Other ................................................. 30 (421) (694)

Changes in operating assets and liabilities, net of the effects of acquisitions:

Decrease in accounts receivable, prepaid expenses and other .............. 3,829 2,391 7,060

Increase in merchandise inventories .............................. (27,074) (42,756) (5,284)

Increase in accounts payable ................................... 984 24,871 7,466

Increase (decrease) in accrued expenses ............................ 10,481 (18,745) (8,394)

Increase (decrease) in other long-term liabilities ...................... 3,487 (2,463) (1,200)

Net cash provided by continuing operations ............................ 88,958 73,923 118,661

Net cash used in discontinued operations .............................. (467) (273) (1,466)

Net cash provided by operating activities ............................... 88,491 73,650 117,195

Cash flows from investing activities:

Capital expenditures ........................................ (54,696) (74,746) (70,252)

Proceeds from dispositions of assets .............................. 5,588 515 7,515

Collateral investment ....................................... (3,654) (7,638) (9,638)

Acquisitions, net of cash acquired. ............................... — (42,901) (288)

Premiums paid on life insurance policies ........................... — (837) —

Net cash used in continuing operations ............................... (52,762) (125,607) (72,663)

Net cash provided by discontinued operations ........................... — — 569

Net cash used in investing activities ................................... (52,762) (125,607) (72,094)

Cash flows from financing activities:

Borrowings under line of credit agreements ......................... 2,319 5,721 21,795

Payments under line of credit agreements .......................... (2,319) (5,721) (21,795)

Borrowings on trade payable program liability ........................ 179,751 144,180 121,824

Payments on trade payable program liability ......................... (115,247) (115,253) (99,636)

Payments for finance issuance cost ............................... (6,520) (2,441) —

Borrowings under new debt ................................... 200,000 — —

Debt payments ........................................... (295,122) (1,079) (11,279)

Dividends paid ........................................... — (6,344) (6,323)

Repurchase of common stock .................................. (342) — —

Proceeds from stock issuance .................................. 2,693 898 1,227

Net cash (used in) provided by financing activities ......................... (34,787) 19,961 5,813

Net increase (decrease) in cash and cash equivalents ........................ 942 (31,996) 50,914

Cash and cash equivalents at beginning of year ........................... 58,244 90,240 39,326

Cash and cash equivalents at end of year ............................... 59,186 $ 58,244 $ 90,240

Supplemental cash flow information:

Cash paid for interest, net of amounts capitalized ..................... $ 31,290 $ 23,097 $ 23,098

Cash received from income tax refunds ............................ $ 108 $ 479 $ 195

Cash paid for income taxes .................................... $ 2,826 $ 1,150 $ 890

Non-cash investing activities:

Accrued purchases of property and equipment ....................... $ 1,371 $ 1,400 $ 2,926

See notes to the consolidated financial statements

40