Pep Boys 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

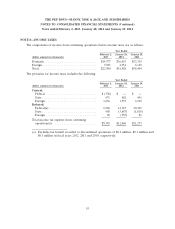

NOTE 5—DEBT AND FINANCING ARRANGEMENTS (Continued)

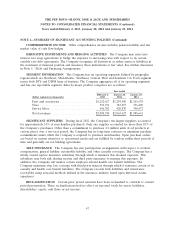

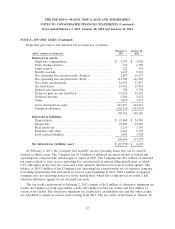

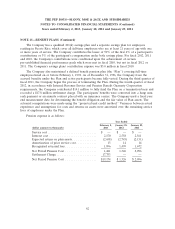

The annual maturities under the Senior Secured Term Loan, due October 2018, for the next five

fiscal years are:

(dollar amounts in thousands) Long-Term

Fiscal Year Debt

2013 ................................................... $ 2,000

2014 ................................................... 2,000

2015 ................................................... 2,000

2016 ................................................... 2,000

2017 ................................................... 2,000

Thereafter ............................................... 190,000

Total ................................................... $200,000

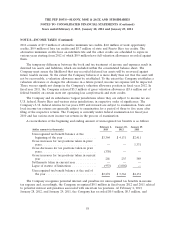

Interest rates that are currently available to the Company for issuance of debt with similar terms

and remaining maturities are used to estimate fair value for debt obligations and are considered a

level 2 measure under the fair value hierarchy. The estimated fair value of long-term debt including

current maturities was $203.5 million and $293.6 million as of February 2, 2013 and January 28, 2012,

respectively

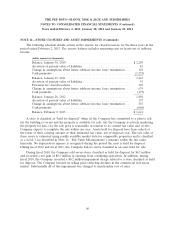

NOTE 6—LEASE AND OTHER COMMITMENTS

In fiscal 2010, the Company sold one property to an unrelated third party. Net proceeds from this

sale were $1.6 million. Concurrent with this sale, the Company entered into an agreement to lease the

property back from the purchaser over a minimum lease term of 15 years. The Company classified this

lease as an operating lease. The Company actively uses this property and considers the lease as a

normal leaseback. The Company recorded a deferred gain of $0.4 million.

In connection with the three acquisitions that occurred during fiscal 2011, the Company assumed

additional lease obligations totaling $120.2 million over an average of 14 years.

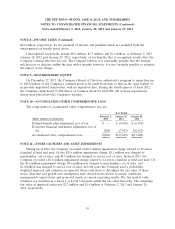

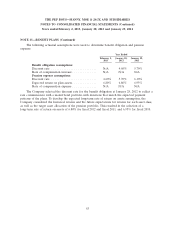

The aggregate minimum rental payments for all leases having initial terms of more than one year

are as follows:

(dollar amounts in thousands) Operating

Fiscal Year Leases

2013 ................................................... 102,609

2014 ................................................... 98,205

2015 ................................................... 91,092

2016 ................................................... 83,707

2017 ................................................... 76,034

Thereafter ............................................... 340,076

Aggregate minimum lease payments ............................ $791,723

53