Pep Boys 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GENERAL INFORMATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors for use

at this year’ s Annual Meeting. The meeting will be held on Wednesday, June 12, 2013, at the Pep Boys’ Store

Support Center located at 3111 West Allegheny Avenue, Philadelphia, Pennsylvania and will begin promptly at 9:00

a.m.

The Company’s Proxy Statement and 2012 Annual Report are available at www.proxyvote.com.

We are pleased to be using a procedure approved by the Securities and Exchange Commission (SEC) that allows

companies to furnish their proxy materials to shareholders over the Internet instead of mailing full sets of the printed

materials. We believe that this procedure reducescosts, providesgreater flexibility to our shareholders and reduces

the environmental impact of our Annual Meeting. On or about April 26, 2013, we started mailing to our

shareholders a Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability contains

instructions on how to access and read our Proxy Statement and our 2012 Annual Report on the Internet and to vote

online. If you received a Notice of Internet Availability by mail, you will not receive paper copies of the

Proxy Materials in the mail unless you request them. Instead, the Notice of Internet Availability instructs you on

how to access and read the Proxy Statement and Annual Report and how you may submit your proxy over the

Internet. If you would like to receive a printed copy of the materials, please follow the instructions on the Notice of

Internet Availability for requesting the materials, and we will promptly mail the materials to you.

We are mailing to shareholders, or making available to shareholders via the Internet, this Proxy Statement, form

of proxy card, and our 2012 Annual Report on or about April 26, 2013.

What is the purpose of the meeting?

At the meeting, shareholders will vote on:

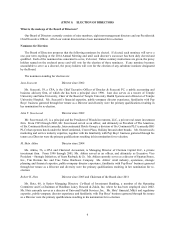

•The election of directors.

•An advisory resolution on executive compensation.

•The ratification of the appointment of our independent registered public accounting firm.

In addition, we will answer questions posed by shareholders.

Who may vote at the meeting?

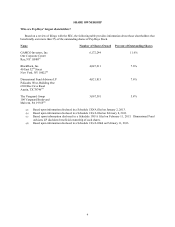

Common stock is the only class of stock that Pep Boys has outstanding and is referred to in this Proxy Statement

as “Pep Boys Stock.” You may vote those shares of Pep Boys Stock that you owned as of the close of business on

the record date, April 5, 2013. As of the record date, 53,192,530 shares were outstanding.

What are the voting rights of Pep Boys’ shareholders?

Each shareholder is entitled to one vote per share on all matters including in uncontested elections of directors.

In contested elections of directors, elections where the number of nominees exceeds the number of directors to be

elected, each shareholder is entitled to vote cumulatively. Cumulative voting entitles each shareholder to the number

of votes equal to the number of shares owned by the shareholder multiplied by the number of directors to be elected.

Accordingly and without satisfying any condition precedent, a shareholder may cast all of his votes for one nominee

for director or allocate his votes among all the nominees.