Pep Boys 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

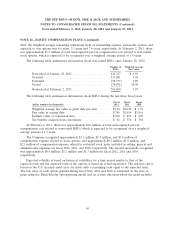

NOTE 14—EQUITY COMPENSATION PLANS (Continued)

Incentive stock options and non-qualified stock options granted under the 1990 and 2009 plans to

non-officers vest fully on the third anniversary of their grant date and officers vest in equal tranches

over three or four year periods. Generally, all options granted prior to March 3, 2004 carry an

expiration date of ten years and options granted on or after March 3, 2004 carry an expiration date of

seven years. RSUs previously granted to non-officers vest fully on the third anniversary of their grant

date. RSUs previously granted to officers vest in equal tranches over three or four year periods.

The Company has also granted RSUs under the 2009 plan in conjunction with its non-qualified

deferred compensation plan. Under the deferred compensation plan, the first 20% of an officer’s bonus

deferred into the Company’s stock fund is matched by the Company on a one-for-one basis with RSUs

that vest over a three-year period, with one third vesting on each of the first three anniversaries of the

grant date.

The exercise price, term and other conditions applicable to future stock option and RSU grants

under the 2009 plan are generally determined by the Board of Directors; provided that the exercise

price of stock options must be at least 100% of the quoted market price of the common stock on the

grant date. The Company currently satisfies all share requirements resulting from RSU conversions and

option exercises from its treasury stock. The Company believes its treasury share balance at February 2,

2013 is adequate to satisfy such activity during the next twelve-month period.

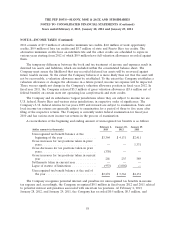

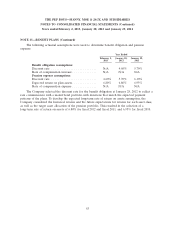

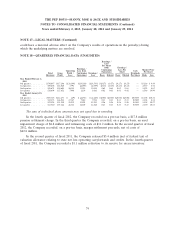

The following table summarizes the options under the plans:

Fiscal Year 2012

Weighted

Average

Exercise

Shares Price

Outstanding—beginning of year ....................... 2,008,430 $ 8.97

Granted ........................................ 287,574 9.97

Exercised ........................................ (274,769) 7.00

Forfeited ........................................ (55,283) 11.32

Expired ......................................... (287,359) 15.89

Outstanding—end of year ............................ 1,678,593 8.20

Vested and expected to vest options—end of year .......... 1,630,311 8.15

Options exercisable—end of year ...................... 1,153,837 7.07

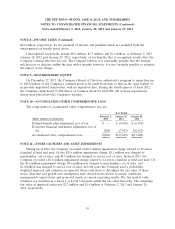

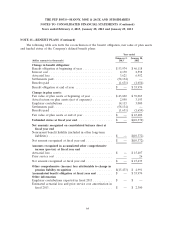

The following table summarizes information about options during the last three fiscal years (dollars

in thousands except per option):

Fiscal Fiscal Fiscal

2012 2011 2010

Weighted average fair value at grant date per option ....... $4.65 $5.38 $4.28

Intrinsic value of options exercised .................... $874 $202 $609

The aggregate intrinsic value of outstanding options, exercisable options and expected to vest

options at February 2, 2013 was $5.5 million, $5.2 million and $0.3 million, respectively. At February 2,

68