Pep Boys 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sales was comprised of a 1.3% increase in comparable store service revenue offset by a 2.9% decrease

in comparable store merchandise sales.

We believe that the industry fundamentals of increasing vehicle complexity and customer

preference for DIFM remain solid over the long-term resulting in consistent demand for maintenance

and repair services. Consistent with this long-term trend, we have adopted a long-term strategy of

growing our automotive service business, while maintaining our DIY customer base by offering the

newest and broadest product assortment in the automotive aftermarket.

In the short-term, however, we believe the challenging macroeconomic environment, including

persistent high unemployment and negative consumer confidence in the overall U.S. economy,

negatively impacted our fiscal year 2012 sales. Another macroeconomic factor affecting our customers

and our industry is gasoline prices. Gasoline prices have not only increased to historical highs in recent

years, but have also experienced significant spikes in prices during each year. We believe that these

gasoline price trends challenged our customer’s spending relative to discretionary and deferrable

purchases. Given the nature of these macroeconomic factors, we cannot predict whether or for how

long these trends may continue, nor can we predict to what degree these trends will affect us in the

future.

Our primary response to fluctuations in customer demand is to adjust our product assortment,

store staffing and advertising messages. In the challenging macroeconomic environment that our

customers have experienced in the last few years, we leaned toward a needs-based product assortment,

reduced staffing levels and delivered a promotional advertising message. In addition, we work

continuously to make it easy for customers to choose us to do it for them and to expand our online

efforts to make Pep Boys the most convenient place to shop for all of their automotive needs. In fiscal

2012, we reached another e-SERVE milestone with the launch of buy on-line, ship to home, which

complements our previously implemented on-line capabilities of service appointment scheduling,

TreadSmart (tires from information to installation) and buy on-line, pick up in store.

We are encouraged that during calendar year 2012, miles driven, which favorably impacts sales of

our services and non-discretionary products, grew 0.3%, after declining in 2011. For fiscal 2013 and

beyond, we are focusing our efforts on ensuring that Pep Boys is the best place to shop and care for

your car and are moving our entire business model towards a more focused customer centered strategy.

See ‘‘ITEM 1 BUSINESS—BUSINESS STRATEGY.’’

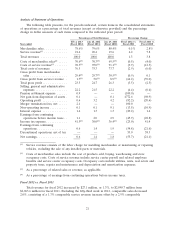

RESULTS OF OPERATIONS

The following discussion explains the material changes in our results of operations for the years

ended February 2, 2013 and January 28, 2012 and January 29, 2011.

20