Pep Boys 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 3 LEGAL PROCEEDINGS

The Company is party to various actions and claims arising in the normal course of business. The

Company believes that amounts accrued for awards or assessments in connection with all such matters

are adequate and that the ultimate resolution of these matters will not have a material adverse effect

on the Company’s financial position. However, there exists a possibility of loss in excess of the amounts

accrued, the amount of which cannot currently be estimated. While the Company does not believe that

the amount of such excess loss will be material to the Company’s financial position, any such loss could

have a material adverse effect on the Company’s results of operations in the period(s) during which the

underlying matters are resolved.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5 MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of The Pep Boys—Manny, Moe & Jack is listed on the New York Stock

Exchange under the symbol ‘‘PBY.’’ There were 4,173 registered shareholders as of March 30, 2013.

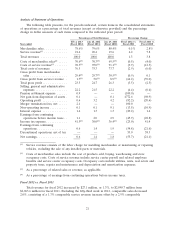

The following table sets forth for the periods listed, the high and low sale prices and the cash dividends

paid on the Company’s common stock.

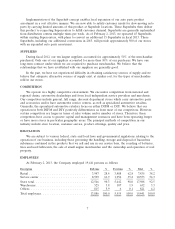

MARKET PRICE PER SHARE

Market Price Per

Share Cash Dividends

High Low Per Share

Fiscal 2012

Fourth quarter ........................... $11.16 $ 9.48 $ —

Third quarter ............................ 10.57 8.76 —

Second quarter ........................... 14.93 8.67 —

First quarter ............................. 15.46 14.90 —

Fiscal 2011

Fourth quarter ........................... $12.08 $10.21 $0.03

Third quarter ............................ 12.04 8.18 0.03

Second quarter ........................... 14.28 10.27 0.03

First quarter ............................. 14.70 10.53 0.03

On January 29, 2012, the Board of Directors suspended all future cash dividend payments. On

December 12, 2012, the Board of Directors of the Company authorized a program to repurchase up to

$50.0 million of the Company’s common stock. The program is effective immediately and has no

expiration date. During the fourth quarter of fiscal 2012, the Company repurchased 35,000 shares of

Common Stock for $342,000. All of these repurchased shares were placed into the Company’s treasury.

A portion of the treasury shares will be used by the Company to provide benefits to employees under

its compensation plans.

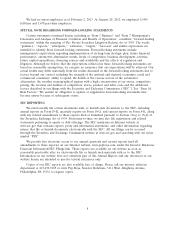

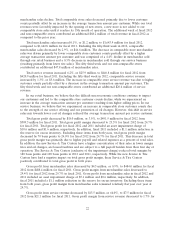

EQUITY COMPENSATION PLANS

The following table sets forth the Company’s shares authorized for issuance under its equity

compensation plans at February 2, 2013:

Number of Number of securities

securities to be Weighted remaining available

issued upon average for future issuance

exercise of exercise price under equity

outstanding of outstanding compensation plans

options, options, (excluding securities

warrants and warrants and reflected in the first

rights (a) rights (b) column (a))

Equity compensation plans approved by security

holders ................................. 2,751,725 $5.10 2,901,018

15