Pep Boys 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

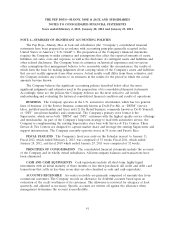

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 2, 2013, January 28, 2012 and January 29, 2011

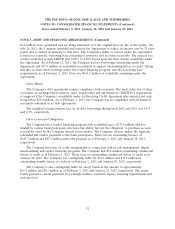

NOTE 5—DEBT AND FINANCING ARRANGEMENTS

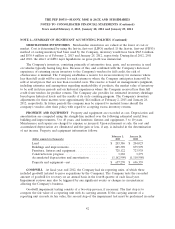

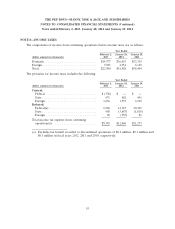

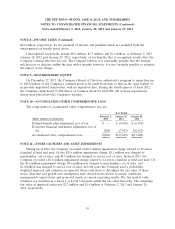

The following are the components of debt and financing arrangements:

February 2, January 28,

(dollar amounts in thousands) 2013 2012

7.50% Senior Subordinated Notes, due December 2014 ..... $ — $147,565

Senior Secured Term Loan, due October 2013 ........... — 147,557

Senior Secured Term Loan, due October 2018 ........... 200,000 —

Revolving Credit Agreement, through July 2016 .......... — —

Long-term debt ................................ 200,000 295,122

Current maturities ............................... (2,000) (1,079)

Long-term debt less current maturities ............... $198,000 $294,043

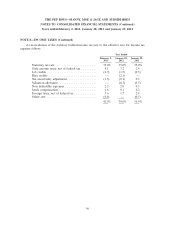

Senior Secured Term Loan Facility due October 2018

On October 11, 2012, the Company entered into the Second Amended and Restated Credit

Agreement that (i) increased the size of the Company’s Senior Secured Term Loan (the ‘‘Term Loan’’)

to $200.0 million, (ii) extended the maturity of the Term Loan from October 27, 2013 to October 11,

2018, (iii) reset the interest rate under the Term Loan to the London Interbank Offered Rate

(LIBOR), subject to a floor of 1.25%, plus 3.75% and (iv) added an additional 16 of the Company’s

owned locations to the collateral pool securing the Term Loan. The amended and restated Term Loan

was deemed to be substantially different than the prior Term Loan, and therefore the modification of

the debt was treated as a debt extinguishment. As of February 2, 2013, 142 stores collateralized the

Term Loan. The Company recorded $6.5 million of deferred financing costs related to the Second

Amended and Restated Credit Agreement. The amount outstanding under the Term Loan as of

February 2, 2013 was $200.0 million.

Net proceeds from the amended and restated Term Loan together with cash on hand were used to

settle the Company’s outstanding interest rate swap on the Term Loan as structured prior to its

amendment and restatement and to satisfy and discharge all of the Company’s outstanding 7.5% Senior

Subordinated Notes (‘‘Notes’’) due 2014. The settlement of the interest rate swap resulted in the

reclassification of $7.5 million of accumulated other comprehensive loss to interest expense. The

Company recognized, in interest expense, $1.9 million of deferred financing costs related to the Notes

and the Term Loan as structured prior to its amendment and restatement. The interest payment and

the swap settlement payment are presented within cash flows from operations on the consolidated

statement of cash flows.

On October 11, 2012, the Company entered into two new interest rate swaps for a notional

amount of $50.0 million each that together were designated as a cash flow hedge on the first

$100.0 million of the Term Loan. The interest rate swaps convert the variable LIBOR portion of the

interest payments due on the first $100.0 million of the Term Loan to a fixed rate of 1.855%.

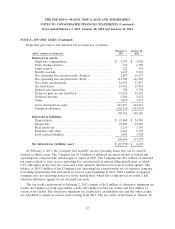

Revolving Credit Agreement, Through July 2016

On January 16, 2009 the Company entered into a Revolving Credit Agreement (the ‘‘Agreement’’)

with available borrowings up to $300.0 million and a maturity of January 2014. Total incurred fees of

51