Pep Boys 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

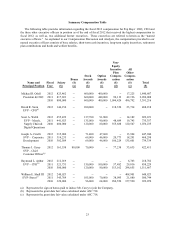

Of the components comprising our executive compensation program, the percentage mix between “at-risk” and

fixed compensation (excluding health and welfare benefits), at target levels, for each of our named executive officers

is set forth in the following table. “At-risk” compensation is only earned and paid if pre-established performance

levels are achieved or the Company’ s stock price appreciates.

Name“At-Risk” Fixed

Michael R. Odell 73% 27%

David R. Stern 61% 39%

Scott A. Webb 63% 37%

Joseph A. Cirelli 46% 54%

Thomas J. Carey 48% 52%

Compensation Philosophy.

Pep Boys’ executive compensation program is designed to:

•Enable Pep Boys to attract, retain, and motivate key executives critical to current and long-term success;

•Provide targeted compensation levels which are competitive with our customized peer group (discussed

below) as to base salary, annual incentives and long-term incentives, and which are reflective of current

and/or expected future company performance levels;

•Support Pep Boys’ long-range business strategy;

•Establish a clear linkage between individual performance objectives and corporate or business unit financial

performance objectives; and

•Align executive compensation with shareholder interests by linking long-term incentives to increasing

shareholder value, utilizing performance metrics where appropriate.

The Compensation Committee has also adopted the following more specific guidelines in formulating the detailed

elements of Pep Boys’ executive compensation program:

•Short term incentives will be structured in a manner which gives primary emphasis to meeting or exceeding

the Company’ s annual financial objectives;

•Long-term incentives will be designed to reward performance over a multi-year time frame, with vesting of

awards to occur over a corresponding time period;

•At the discretion of the Compensation Committee,

•Payout on any short term incentive component may be made contingent upon achievement of the

annual budget. This decision will be made annually, when targets are set for the ensuing year;

•If the long-term incentive plan includes more than one performance dimension, achievement of target

on any one element may be treated as a prerequisite to payout on other goals (i.e.,as a “qualifier”),

whether or not threshold performance is achieved on those other dimensions;

•The Compensation Committee believes that requiring achievement of full target performance in order to

trigger any payout under the annual incentive plan is generally inappropriate due to the risk of incenting

poor decision making at the margin. The Compensation Committee will annually set a “threshold”

performance level which is below the target objective, at which point some amount of incentive

compensation will be paid;