Pep Boys 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012

ANNUAL

REPORT

2012 ANNUAL

REPORT

NOTICE OF ANNUAL MEETING & PROXY STATEMENT

Table of contents

-

Page 1

2012 REPORT ANNUAL NOTICE OF ANNUAL MEETING & PROXY STATEMENT ANNUAL -

Page 2

... both new physical locations and an expanded on-line presence. Our Service & Tire Centers and our e-SERVE digital platform are designed to make it easier for our targeted customers to develop a relationship with Pep Boys. While 2012 began with the uncertainty of a potential go-private transaction... -

Page 3

...: It is our pleasure to invite you to Pep Boys 2012 Annual Meeting of Shareholders. This year' s meeting will be held on Wednesday, June 12, 2013, at Pep Boys' Store Support Center located at 3111 West Allegheny Avenue, Philadelphia, Pennsylvania. The meeting will begin promptly at 9:00 a.m. At the... -

Page 4

... Public Accounting Firm' s Fees ...14 EXECUTIVE COMPENSATION ...15 Compensation Discussion and Analysis ...15 Compensation Committee Report ...22 Summary Compensation Table ...23 Grants of Plan Based Awards ...25 Outstanding Equity Awards at Fiscal Year-End Table ...26 Option Exercises and Stock... -

Page 5

...of Directors for use at this year' s Annual Meeting. The meeting will be held on Wednesday, June 12, 2013, at the Pep Boys' Store Support Center located at 3111 West Allegheny Avenue, Philadelphia, Pennsylvania and will begin promptly at 9:00 a.m. The Company's Proxy Statement and 2012 Annual Report... -

Page 6

... is available 24 hours a day and will be accessible until 11:59 P.M. Eastern Time on June 11, 2013. You will be able to confirm that the system has properly recorded your vote. If you vote by telephone, you do NOT need to return a proxy card or voting instruction form. • Mail. If you received... -

Page 7

... is required to tender a resignation to the Board of Directors. The Board of Directors will then accept or reject the resignation, or take other appropriate action, based upon the best interests of Pep Boys and our shareholders and will publicly disclose its decision and rationale within 90 days. In... -

Page 8

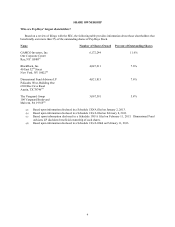

... beneficially own more than 5% of the outstanding shares of Pep Boys Stock. Name GAMCO Investors, Inc. One Corporate Center Rye, NY 10580(a) BlackRock, Inc. 40 East 52nd Street New York, NY 10022(b) Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746(c) The... -

Page 9

...do Pep Boys' directors and executive officers own? The following table shows how many shares our directors and executive officers named in the Summary Compensation Table beneficially owned on July 13, 2012. The business address for each of such individuals is 3111 West Allegheny Avenue, Philadelphia... -

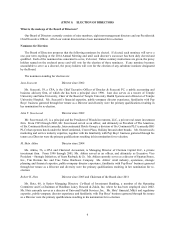

Page 10

..., where he has been employed since 2002. Mr. Hotz currently serves as a director of Universal Health Services, Inc. Mr. Hotz' financial, M&A and regulatory expertise, public-company director experience and familiarity with Pep Boys' business garnered through his tenure as a Director were the primary... -

Page 11

... in June 2010. He joined Pep Boys in September 2007 as Executive Vice President- Chief Operating Officer, after having most recently served as the Executive Vice President and General Manager of Sears Retail & Specialty Stores. Mr. Odell joined Sears in its finance department in 1994 where he served... -

Page 12

.... As required by the New York Stock Exchange (NYSE), promptly following our 2012 Annual Meeting, our President & Chief Executive Officer certified to the NYSE that he was not aware of any violation by Pep Boys of NYSE corporate governance listing standards. Diversity. While the Board has not... -

Page 13

.... Pep Boys has no personal loans extended to its executive officers or directors. Director Attendance at the Annual Meeting. All Board members are expected encouraged to attend the Annual Meeting of Shareholders. All nominees then standing for election attended the 2012 Annual Meeting. Communicating... -

Page 14

... with Pep Boys requiring disclosure under Item 404 of SEC Regulation S-K. No executive officer of Pep Boys serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of Pep Boys' Board of Directors or Compensation... -

Page 15

..., judgment and diversity (age, gender, ethnicity and personal experiences) and his or her independence from Pep Boys. Such qualifications are evaluated against our then current requirements, as expressed by the full Board and our President & Chief Executive Officer, and the current make up of the... -

Page 16

... time-based RSUs and vested "in the money" stock options. Non-employee directors have five years from their appointment to Board to achieve their expected ownership level. If in a shortfall position, (i) a non-employee director may not sell Pep Boys Stock and (ii) all net after-tax shares acquired... -

Page 17

... Audit Committee reviews Pep Boys' financial statements and makes recommendations to the full Board of Directors on matters concerning the audits of Pep Boys' books and records. Each committee member is "independent" as defined by the listing standards of the New York Stock Exchange. Ms. Scaccetti... -

Page 18

... 2011 were for of tax compliance services in connection with tax audits and appeals. The Audit Committee annually engages Pep Boys' independent registered public accounting firm and preapproves, for the following fiscal year, their services related to the annual audit and interim quarterly reviews... -

Page 19

... total shareholder return in the subsequent three-year period in order to deliver any value to our executives. The remaining 40% balance were delivered in the form of stock options, which the Company also views as performancebased since options only have value if the Company' s per share stock price... -

Page 20

.../or expected future company performance levels; Support Pep Boys' long-range business strategy; Establish a clear linkage between individual performance objectives and corporate or business unit financial performance objectives; and Align executive compensation with shareholder interests by linking... -

Page 21

... companies with average revenues, market capitalization and employee count closer to that of Pep Boys, for fiscal 2013, the Compensation Committee has revised the peer group to add Asbury Automotive, Finish Line, Hibbett Sports, Lithia Motors, Pier 1 Imports, Williams Sonoma and Zale Corporation... -

Page 22

... and also communicated with the chair of the Compensation Committee outside of meetings. Pay Governance worked with management (including the President & Chief Executive Officer, Senior Vice President - Human Resources and Senior Vice President - General Counsel & Secretary) from time-to-time for... -

Page 23

...compensation through equity grants directly aligns the interests of management with that of the Company' s shareholders. The Stock Incentive Plan provides for the grant of stock options at exercise prices equal to the fair market value (the mean of the high and low quoted selling prices) of Pep Boys... -

Page 24

... align the interests of management with that of its shareholders, the first 20% of an officer' s bonus deferred into Pep Boys Stock is matched by the Company on a one-for-one basis with Pep Boys Stock that vests over three years. In order to keep our executive compensation program competitive... -

Page 25

... provide our named executive officers with health and welfare benefits, including medical and dental coverage, life insurance valued at one times salary, long term disability coverage and an auto allowance. Employment Agreements. In August 2012, we entered into revised Change of Control Agreements... -

Page 26

...Analysis with management. Based upon our review and discussion with management, we have recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and in Pep Boys' Annual Report on Form 10-K for the fiscal year ended February 2, 2013 filed... -

Page 27

..., the compensation provided to our named executive officers consists of base salaries, short-term cash incentives, long-term equity incentives, retirement plan contributions and heath and welfare benefits. Fiscal Name and Principal Position Year Michael R. Odell President & CEO 2012 2011 2010 2012... -

Page 28

...Stern joined Pep Boys on September 10, 2012 as Executive Vice President - Chief Financial Officer. Mr. Carey joined Pep Boys on August 6, 2012 as Senior Vice President - Chief Customer Officer. Mr. Arthur resigned from the Company on June 29, 2012. Mr. Shull ceased his employment with the Company on... -

Page 29

... annual equity grants made in fiscal 2012 in respect of fiscal 2011 service and (iii) inducement grants made to named executive officers that joined the Company in fiscal 2012. Estimated Potential Payouts Under Non-Equity Incentive Plan Awards(a) All Other Option Awards: Number of Securities... -

Page 30

Outstanding Equity Awards at Fiscal Year-End Table The following table shows information regarding unexercised stock options and unvested RSUs held by the named executive officers as of February 2, 2013. Option Awards Stock Awards Market Value of Shares or Units of Stock That Number of Have Not ... -

Page 31

... by Pep Boys and the number of years of participation in the plan. Benefits payable under this plan are not subject to deduction for Social Security or other offset amounts. The maximum annual benefit for any employee under this plan is $20,000. Mr. Cirelli is the only named executive officer that... -

Page 32

... (but not retirement benefits or auto allowances) and the vesting of all equity awards if such officer is terminated within two years following a change of control. A trust agreement has been established to better assure the named executive officers of the satisfaction of Pep Boys' obligations under... -

Page 33

... upon a change of control as of February 2, 2013. Name Michael R. Odell David R. Stern Scott A. Webb Joseph A. Cirelli Thomas J. Carey 2X Base Salary ($) 1,660,000 800,000 918,000 630,000 700,000 2X Target Bonus ($) 1,660,000 600,000 688,500 283,500 315,000 2X Health and Welfare Benefits ($) 62... -

Page 34

...of our Annual Incentive Bonus Program and long-term incentive awards, as well as the terms of our employment agreements with the named executive officers, are all designed to enable Pep Boys to attract and maintain top talent while, at the same time, creating a close relationship between performance... -

Page 35

...FIRM The Board of Directors, upon the recommendation of the Audit Committee, has appointed the firm of Deloitte & Touche LLP to serve as our independent registered public accounting firms with respect to the consolidated financial statements of Pep Boys and its subsidiaries for fiscal 2013. Deloitte... -

Page 36

... of ownership and reports of changes in ownership of Pep Boys Stock. Based solely upon a review of copies of such reports, we believe that during fiscal 2012, our directors, executive officers and 10% holders complied with all applicable Section 16(a) filing requirements. COST OF SOLICITATION OF... -

Page 37

...COPY OF OUR ANNUAL REPORT ON FORM 10-K (INCLUDING THE FINANCIAL STATEMENTS AND THE SCHEDULES THERETO) AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR OUR MOST RECENT FISCAL YEAR. SUCH WRITTEN REQUEST SHOULD BE DIRECTED TO: Pep Boys 3111 West Allegheny Avenue Philadelphia, PA 19132 Attention... -

Page 38

... or organization) 3111 West Allegheny Avenue, Philadelphia, PA (Address of principal executive office) 23-0962915 (I.R.S. employer identification no.) 19132 (Zip code) 215-430-9000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the... -

Page 39

... ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 40

... also closed four Service & Tire Centers and two Supercenters. As of February 2, 2013, the Company operated 567 Supercenters, 185 Service & Tire Centers and six Pep Express stores located in 35 states and Puerto Rico. These locations consist of approximately 12,780,000 of gross square feet of retail... -

Page 41

... years: NUMBER OF STORES AT END OF FISCAL YEARS 2009 THROUGH 2012 2012 Year End 2011 Year End 2010 Year End 2009 Year End State Opened Closed Opened Closed Opened Closed Alabama ...Arizona ...Arkansas ...California ...Colorado ...Connecticut ...Delaware ...Florida ...Georgia ...Illinois... -

Page 42

...of people ...and their cars. More than just words, we are moving our entire business model towards a more focused customer centered strategy. We have added a Chief Customer Officer to our senior executive team to help guide the development of our strategy around our target customer segments. We also... -

Page 43

... customer choosing Pep Boys for all of their automotive needs in the future. Information gathered through our rewards program, customer surveys and focus groups helps us to understand the customer experience that our target customer segments expect and the services and products that will best meet... -

Page 44

... services (except body work) and installs tires, parts and accessories. Each Pep Boys Supercenter and Pep Express store carries a similar product line, with variations based on the number and type of cars in the market where the store is located, while a Pep Boys Service & Tire Center carries tires... -

Page 45

... target customers live, work and shop. STORE OPERATIONS AND MANAGEMENT Most Pep Boys stores are open seven days a week. Most Supercenters have a Retail Manager and Service Manager (Service & Tire Centers only have a Service Manager, while Pep Express stores only have a Retail Manager) who report to... -

Page 46

..., the sale of small engine merchandise and the ownership and operation of real property. EMPLOYEES At February 2, 2013, the Company employed 19,441 persons as follows: Description Full-time % Part-time % Total % Retail ...Service center ...Store total ...Warehouses ...Offices ...Total employees... -

Page 47

... references to our website herein are intended as inactive textual references only. Copies of our SEC reports are also available free of charge. Please call our investor relations department at 215-430-9105 or write Pep Boys, Investor Relations, 3111 West Allegheny Avenue, Philadelphia, PA 19132 to... -

Page 48

...-Store Operations since March 2013 Senior Vice President-Chief Customer Officer since August 2012 Senior Vice President-Business Development since November 2007 Senior Vice President-Human Resources since July 2007 Senior Vice President-General Counsel & Secretary since March 2009 Michael R. Odell... -

Page 49

... company of Big O Tires, Tire Kingdom and National Tire & Battery. Mr. Fee has over 20 years experience in operations and human resources in the tire and automotive service and repair business. Brian D. Zuckerman was named Senior Vice President-General Counsel & Secretary on March 1, 2009 after... -

Page 50

...require significant capital to fund our business. While we believe we have the ability to sufficiently fund our planned operations and capital expenditures for the next fiscal year...that the number of qualified automotive service technicians in the industry is generally insufficient to meet demand. We... -

Page 51

... customers, such as generators, power tools and canopies. • online retailers Commercial • mass merchandisers, wholesalers and jobbers (some of which are associated with national parts distributors or associations). Service Do-It-For-Me • regional and local full service automotive repair shops... -

Page 52

... economy-as during periods of poor economic conditions, customers may defer vehicle maintenance or repair, and during periods of good economic conditions, consumers may opt to purchase new vehicles rather than service the vehicles they currently own and replace worn or damaged parts; • gas prices... -

Page 53

... of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico. The Company leases an administrative regional office of approximately 3,500 square feet in Los Angeles, California. Of the 758 store locations operated by the Company at February 2, 2013, 232 are owned and 526 are leased. As of... -

Page 54

.... ITEM 4 MINE SAFETY DISCLOSURES Not applicable. PART II MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The common stock of The Pep Boys-Manny, Moe & Jack is listed on the New York Stock Exchange under the symbol ''PBY.'' There were... -

Page 55

...Automotive, Inc.; PetSmart, Inc.; RadioShack Corp.; Rent-A-Center, Inc.; Tractor Supply Co.; West Marine, Inc. Comparison of Cumulative Five Year Total Return $300 $250 $200 $150 $100 $50 $0 Jan-08 Pep Boys Company/Index Jan-09 Jan-10 Jan-11 Peer Group Jan. 2009 Jan-12 Jan-13 S&P SmallCap 600... -

Page 56

... price range: High ...Low ...OTHER STATISTICS Return on average stockholders' equity(11) . . Common shares issued and outstanding ...Capital expenditures ...Number of stores ...Number of service bays ...(1) Feb. 2, 2013 Jan. 28, 2012 Jan. 29, 2011 Jan. 30, 2010 Jan. 31, 2009 (53 weeks) (52 weeks... -

Page 57

... the cost of products sold, buying, warehousing and store occupancy costs. Gross profit from service revenue includes the cost of installed products sold, buying, warehousing, service payroll and related employee benefits and occupancy costs. Occupancy costs include utilities, rents, real estate and... -

Page 58

...Service & Tire Centers and 6 Pep Express stores located in 35 states and Puerto Rico. EXECUTIVE SUMMARY Net earnings for fiscal 2012 were $12.8 million, or $0.24 per share, as compared to $28.9 million, or $0.54 per share, reported for fiscal 2011. Excluding certain unusual items, the year over year... -

Page 59

...on ensuring that Pep Boys is the best place to shop and care for your car and are moving our entire business model towards a more focused customer centered strategy. See ''ITEM 1 BUSINESS-BUSINESS STRATEGY.'' RESULTS OF OPERATIONS The following discussion explains the material changes in our results... -

Page 60

... parts or materials. Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real... -

Page 61

... fiscal 2012 from 24.7% for fiscal 2011. This decrease in total gross profit margin was primarily due to higher payroll and related expenses as a percent of total sales. In addition, the new Service & Tire Centers have a higher concentration of their sales in lower margin tires and oil changes, are... -

Page 62

... is limited to labor sales (excludes any revenue from installed parts and materials) and costs of service revenues includes the fully loaded service center payroll and related employee benefits and service center occupancy costs. Gross profit from service revenue for fiscal 2012 and 2011 included an... -

Page 63

... points. The Big 10 locations were dilutive to total gross profit margin primarily due to mix of sales being more highly concentrated in tires which have lower product margins combined with higher rent and payroll costs as a percent of total sales. The organic new stores opened by the Company, which... -

Page 64

...prior year. In accordance with GAAP, service revenue is limited to labor sales (excludes any revenue from installed parts and materials) and costs of service revenue includes the fully loaded service center payroll, and related employee benefits, and service center occupancy costs. Gross profit from... -

Page 65

...related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and maintenance and depreciation and amortization expenses. Gross profit from retail sales includes the cost of products sold, buying, warehousing and store... -

Page 66

... one Service & Tire Center and one Pep Express store to Supercenters, and the addition of one new Supercenter. In fiscal 2012 we sold our regional administrative office in Los Angeles, CA for approximately $5.6 million, net of closing costs. During fiscal 2011, we acquired 99 Service & Tire Centers... -

Page 67

...vendors, account receivables owed by Pep Boys. In fiscal 2012, we increased net borrowings on our trade payable program by $64.5 million to $149.7 million as of February 2, 2013 from $85.2 million as of January 28, 2012 (classified as trade payable program liability on the consolidated balance sheet... -

Page 68

... commitment to purchase 4.2 million units of oil products at various prices over a two-year period. Based on our present consumption rate, we expect to meet the cumulative minimum purchase requirements under this contract by the end of fiscal 2013. Senior Secured Term Loan Facility due October 2018... -

Page 69

... in connection with our risk management, import merchandising and vendor financing programs. We had $5.2 million of outstanding commercial letters of credit as of February 2, 2013. As of January 28, 2012, there were no outstanding commercial letters of credit. We were contingently liable for... -

Page 70

... savings plan for employees residing in Puerto Rico, which cover all full-time employees who are at least 21 years of age with one or more years of service. We contribute the lesser of 50% of the first 6% of a participant's contributions or 3% of the participant's compensation. For fiscal 2012, 2011... -

Page 71

... cause management's conclusion on impairment to change, requiring an adjustment of these assets to their then current fair market value. • We have a share-based compensation plan, which includes stock options and restricted stock units, or RSUs. We account for our share-based compensation plans on... -

Page 72

... situations where we have granted stock options and RSUs with market conditions, we have used Monte Carlo simulations in estimating the fair value of the award. The pricing model and generally accepted valuation techniques require management to make assumptions and to apply judgment to determine the... -

Page 73

... allowed an entity to present components of other comprehensive income (''OCI'') as part of its statement of changes in shareholders' equity. With the issuance of ASU 2011-05, companies are now required to report all components of OCI either in a single continuous statement of total comprehensive... -

Page 74

... rate swap. The fair value of our Senior Subordinated Notes due October 2018 was $203.5 million at February 2, 2013. We determine fair value on our fixed rate debt by using quoted market prices and current interest rates. Interest Rate Swaps On October 11, 2012, we settled our interest rate swap... -

Page 75

... DATA REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited the accompanying consolidated balance sheets of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') as... -

Page 76

CONSOLIDATED BALANCE SHEETS The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data) February 2, 2013 January 28, 2012 ASSETS Current assets: Cash and cash equivalents ...Accounts receivable, less allowance for $1,303 ...Merchandise inventories ...Prepaid ... -

Page 77

... Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except per share data) February 2, 2013 (53 weeks) January 28, 2012 (52 weeks) January 29, 2011 (52 weeks) Year ended Merchandise sales ...Service revenue ...Total revenues ...Costs of merchandise sales ...Costs of service... -

Page 78

... benefit costs, net of tax of $5,729 ...Fair market value adjustment on derivatives, net of tax of $4,208 ...Total comprehensive income ...Effect of stock options and related tax benefits ...Effect of employee stock purchase plan . . Effect of restricted stock unit conversions Stock compensation... -

Page 79

... under line of credit agreements . Payments under line of credit agreements . . Borrowings on trade payable program liability Payments on trade payable program liability . Payments for finance issuance cost ...Borrowings under new debt ...Debt payments ...Dividends paid ...Repurchase of common stock... -

Page 80

.... These Service & Tire Centers are designed to capture market share and leverage the existing Supercenter and support infrastructure. The Company currently operates stores in 35 states and Puerto Rico. FISCAL YEAR END The Company's fiscal year ends on the Saturday nearest to January 31. Fiscal 2012... -

Page 81

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) MERCHANDISE INVENTORIES Merchandise inventories are valued at the ... -

Page 82

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) to determine the amount of impairment loss, if any. The second ... -

Page 83

... and the product is delivered to the customer. Service revenues are recognized upon completion of the service. Service revenue consists of the labor charged for installing merchandise or maintaining or repairing vehicles, excluding the sale of any installed parts or materials. The Company records... -

Page 84

... part is returned by the customer at the point of sale. COSTS OF REVENUES Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits, service center occupancy costs... -

Page 85

... current year ...Balance, January 28,2012 ...Additions related to sales in the current year ...Warranty costs incurred in the current year ...Balance, February 2, 2013 ... $ 673 12,122 (12,122) 673 11,920 (11,729) 864 $ $ ADVERTISING The Company expenses the costs of advertising the first time... -

Page 86

...DIFM lines of business. The Company aggregates all of its operating segments and has one reportable segment. Sales by major product categories are as follows: February 2, 2013 Year ended January 28, 2012 January 29, 2011 (dollar amounts in thousands) Parts and accessories ...Tires ...Service labor... -

Page 87

... PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 1-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) RECENT ACCOUNTING STANDARDS In May of 2011, the FASB issued ASU 2011... -

Page 88

...area, the assets related to seven service and tire centers located in the Houston, Texas area and all outstanding shares of capital stock of Tire Stores Group Holding Corporation which operated an 85-store chain in Florida, Georgia and Alabama under the name Big 10. Collectively, the acquired stores... -

Page 89

... $59,160 668 610 $60,438 $59,280 89 610 $59,979 February 2, 2013 January 28, 2012 Casualty and medical risk insurance ...Accrued compensation and related taxes Sales tax payable ...Other ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... $152,606 27,641 11,556 40,474 $232,277 $147... -

Page 90

... maturities ...Long-term debt less current maturities ...Senior Secured Term Loan Facility due October 2018 $198,000 On October 11, 2012, the Company entered into the Second Amended and Restated Credit Agreement that (i) increased the size of the Company's Senior Secured Term Loan (the ''Term Loan... -

Page 91

... with its risk management, import merchandising and vendor financing programs. The Company had $5.2 million outstanding commercial letters of credit as of February 2, 2013. There were no outstanding commercial letters of credit as of January 28, 2012. The Company was contingently liable for... -

Page 92

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 5-DEBT AND FINANCING ARRANGEMENTS (Continued) The annual maturities under the Senior Secured Term Loan, due October 2018, ... -

Page 93

...being recognized in costs of merchandise sales and costs of service revenues over the minimum term of these leases. NOTE 7-ASSET RETIREMENT OBLIGATIONS The Company records asset retirement obligations as incurred and when reasonably estimable, including obligations for which the timing and/or method... -

Page 94

... PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 8-INCOME TAXES The components of income from continuing operations before income taxes are as follows: February 2, 2013 Year... -

Page 95

... tax expense follows: February 2, 2013 Year Ended January 28, 2012 January 29, 2011 Statutory tax rate ...State income taxes, net of federal tax Job credits ...Hire credits ...Tax uncertainty adjustment ...Valuation allowance ...Non deductible expenses ...Stock compensation ...Foreign taxes, net of... -

Page 96

... tax accounts are as follows: (dollar amounts in thousands) February 2, 2013 January 28, 2012 Deferred tax assets: Employee compensation ...Store closing reserves ...Legal reserve ...Benefit accruals ...Net operating loss carryforwards-Federal Net operating loss carryforwards-State . . Tax credit... -

Page 97

... to income tax are U.S. federal, Puerto Rico and various states jurisdictions, in respective order of significance. The Company's U.S. federal returns for tax years 2009 and forward are subject to examination. State and local income tax returns are generally subject to examination for a period of... -

Page 98

... currently possible to estimate the impact of the change. NOTE 9-STOCKHOLDERS' EQUITY On December 12, 2012, the Company's Board of Directors authorized a program to repurchase up to $50.0 million of the Company's common stock to be made from time to time in the open market or in privately negotiated... -

Page 99

... fiscal 2010, the Company recorded a $0.2 million impairment charge related to a store classified as held for disposal. The Company lowered its selling price reflecting declines in the commercial real estate market. Substantially all of this impairment was charged to merchandise cost of sales. 60 -

Page 100

... of tax benefit of $(186), $(121) and $(291) ...Net earnings ...Basic average number of common shares outstanding during period ...Common shares assumed issued upon exercise of dilutive stock options, net of assumed repurchase, at the average market price ...Diluted average number of common shares... -

Page 101

... 2, 2013, January 28, 2012 and January 29, 2011 NOTE 13-BENEFIT PLANS (Continued) The Company has a qualified 401(k) savings plan and a separate savings plan for employees residing in Puerto Rico, which cover all full-time employees who are at least 21 years of age with one or more years of service... -

Page 102

... were used to determine benefit obligation and pension expense: February 2, 2013 Year Ended January 28, 2012 January 29, 2011 Benefit obligation assumptions: Discount rate ...Rate of compensation increase . Pension expense assumptions: Discount rate ...Expected return on plan assets . Rate of... -

Page 103

... obligation, fair value of plan assets and funded status of the Company's defined benefit plans: Year ended February 2, January 28, 2013 2012 (dollar amounts in thousands) Change in benefit obligation: Benefit obligation at beginning of year Interest cost ...Actuarial loss ...Settlements paid... -

Page 104

... periodic investment strategy changes, market value fluctuations, the length of time it takes to fully implement investment allocation positions (such as private equity and real estate), and the timing of benefit payments and contributions. Short term investments and exchange-traded derivatives were... -

Page 105

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 13-BENEFIT PLANS (Continued) investments with values based on quoted market prices, but for which the funds are not valued ... -

Page 106

... for the non-qualified deferred compensation plan and the Account Plan. The Company plans to fund this liability by remitting the officers' deferrals to a Rabbi Trust where these deferrals are invested in variable life insurance policies. These assets are included in non-current other assets and are... -

Page 107

... other conditions applicable to future stock option and RSU grants under the 2009 plan are generally determined by the Board of Directors; provided that the exercise price of stock options must be at least 100% of the quoted market price of the common stock on the grant date. The Company currently... -

Page 108

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 14-EQUITY COMPENSATION PLANS (Continued) 2013, the weighted average remaining contractual term of outstanding options, ... -

Page 109

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 14-EQUITY COMPENSATION PLANS (Continued) both a market and a service condition, the Monte Carlo simulation model is used. ... -

Page 110

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended February 2, 2013, January 28, 2012 and January 29, 2011 NOTE 14-EQUITY COMPENSATION PLANS (Continued) During fiscal 2011, the Company began an employee stock purchase plan which ... -

Page 111

...using observable market data. The inputs used to value the variable life insurance policy fall within Level 2 of the fair value hierarchy. Derivative liability: The Company has two interest rate swaps designated as cash flow hedges on $100.0 million of the Company's Senior Secured Term Loan facility... -

Page 112

...real estate market, the Company reduced its prices for certain properties held for disposal and recorded impairment charges of $0.2 million in fiscal 2010. The fair values were based on selling prices of comparable properties, net of expected disposal costs. These measures of fair value, and related... -

Page 113

... of fiscal 2012, the Company recorded, on a pre-tax basis, merger settlement proceeds, net of costs of $42.8 million. In the second quarter of fiscal 2011, the Company released $3.4 million (net of federal tax) of valuation allowance relating to state net loss operating carryforwards and credits. In... -

Page 114

... reported within the time periods specified in the SEC's rules and forms and is accumulated and communicated to management, including our principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. There were no changes to the Company... -

Page 115

... (COSO). Based on this assessment, management determined that the Company's internal control over financial reporting as of February 2, 2013 was effective. Deloitte & Touche LLP, the Company's independent registered public accounting firm, has issued an attestation report, which is included on page... -

Page 116

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited the internal control over financial reporting of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') as of February 2, 2013, based... -

Page 117

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the fiscal year ended January February 2, 2013 of the Company and our report dated April 18, 2013 expressed an unqualified opinion on... -

Page 118

...the ''Investor Relations-Corporate Governance'' section of our website. As required by the New York Stock Exchange (''NYSE''), promptly following our 2012 Annual Meeting, our Chief Executive Officer certified to the NYSE that he was not aware of any violation by Pep Boys of NYSE corporate governance... -

Page 119

... of The Pep Boys-Manny, Moe & Jack are included in Item 8 Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets-February 2, 2013 and January 28, 2012 ...Consolidated Statements of Operations and Comprehensive Income-Years ended February 2, 2013, January 28, 2012 and... -

Page 120

... Pep Boys Savings Plan-Puerto Rico. The Pep Boys Deferred Compensation Plan, as amended and restated The Pep Boys Annual Incentive Bonus Plan (amended and restated as of January 31, 2009) Account Plan Incorporated by reference from the Company's Form 10-K for the fiscal year ended January 29, 2011... -

Page 121

... herewith Filed herewith Filed herewith Filed herewith Filed herewith (1) Management contract or compensatory plan or arrangement. (2) In accordance with Rule 406T of Regulation S-T, the XBRL related information in Exhibit 101 to this Annual Report on Form 10-K shall not be deemed to be ''filed... -

Page 122

.... Dated: April 18, 2013 THE PEP BOYS-MANNY, MOE & JACK (REGISTRANT) By: /s/ DAVID R. STERN David R. Stern Executive Vice President- Chief Financial Officer (Principal Financial Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 123

Signature Capacity Date /s/ JANE SCACCETTI Jane Scaccetti Director April 18, 2013 /s/ JOHN T. SWEETWOOD John T. Sweetwood Director April 18, 2013 /s/ ANDREA M. WEISS Andrea M. Weiss Director April 18, 2013 /s/ NICK WHITE Nick White Director April 18, 2013 84 -

Page 124

... FURNISHED PURSUANT TO THE REQUIREMENTS OF FORM 10-K THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS AND RESERVES (dollar amounts in thousands) Column A Column C Column D Additions Additions Balance at Charged to Charged to Beginning Costs and Other of... -

Page 125

... schedule of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') and the effectiveness of the Company's internal control over financial reporting appearing in this Annual Report on Form 10-K of the Company for the fiscal year ended February 2, 2013. DELOITTE & TOUCHE LLP Philadelphia... -

Page 126

... 31.1 CERTIFICATION PURSUANT TO RULES 13a-14(a) AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Michael R. Odell, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack... -

Page 127

...31.2 CERTIFICATION PURSUANT TO RULES 13a-14(a) AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, David R. Stern, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack; Based... -

Page 128

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended February 2, 2013, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, Michael R. Odell, Principal Executive Officer of the Company, certify, pursuant... -

Page 129

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended February 2, 2013, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, David R. Stern, Executive Vice President and Chief Financial Officer of the... -

Page 130

... Investor Relations Annual Shareholder Meeting Wednesday, June 12, 2013 at 9:00 a.m. Pep Boys Store Support Center 3111 W. Allegheny Avenue Philadelphia, PA To obtain copies of our periodic reports and earnings releases, write to: Investor Relations Department at address below or call the investor... -

Page 131

3111 West Allegheny Avenue • Philadelphia, PA 19132