Oracle 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

granted at not less than fair market value, become exercisable over four years, and expire no more than ten

years from the date of grant. The Directors’ Plan provides for automatic grants of options to each

non-employee director upon first becoming a director and thereafter on an annual basis, as well as automatic

nondiscretionary grants for chairing certain Board committees. The Board has the discretion to replace any

automatic option grant under the Directors’ Plan with awards of restricted stock, restricted stock units or other

stock-based awards. The number of shares subject to any such stock award will be no more than the

equivalent value of the options, as determined on any reasonable basis by the Board, which would otherwise

have been granted under the applicable automatic option grant. The Board will determine the particular terms

of any such stock awards at the time of grant, but the terms will be consistent with those of options, as

described below, granted under the Directors’ Plan with respect to vesting or forfeiture schedules and

treatment on termination of status as a director. At May 31, 2007, options to purchase approximately

3 million shares of common stock were outstanding under the 1993 Directors’ Plan, of which less than

3 million were vested. Approximately 3 million shares are available for future option awards under this plan;

however, no more than 2 million shares may be used for grants other than options.

In connection with certain of our acquisitions, principally PeopleSoft, Siebel and Hyperion, we assumed all of

the outstanding stock options and restricted stock of the acquiree’s respective stock plans. These stock options

and restricted stock generally retain all of the rights, terms and conditions of the respective plans under which

options were originally granted. As of May 31, 2007, options to purchase 78 million shares of common stock

and 2 million shares of restricted stock were outstanding under these plans.

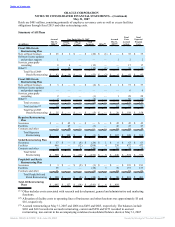

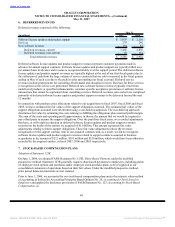

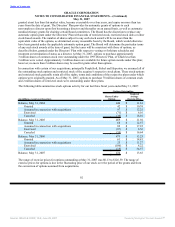

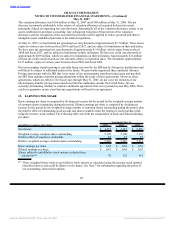

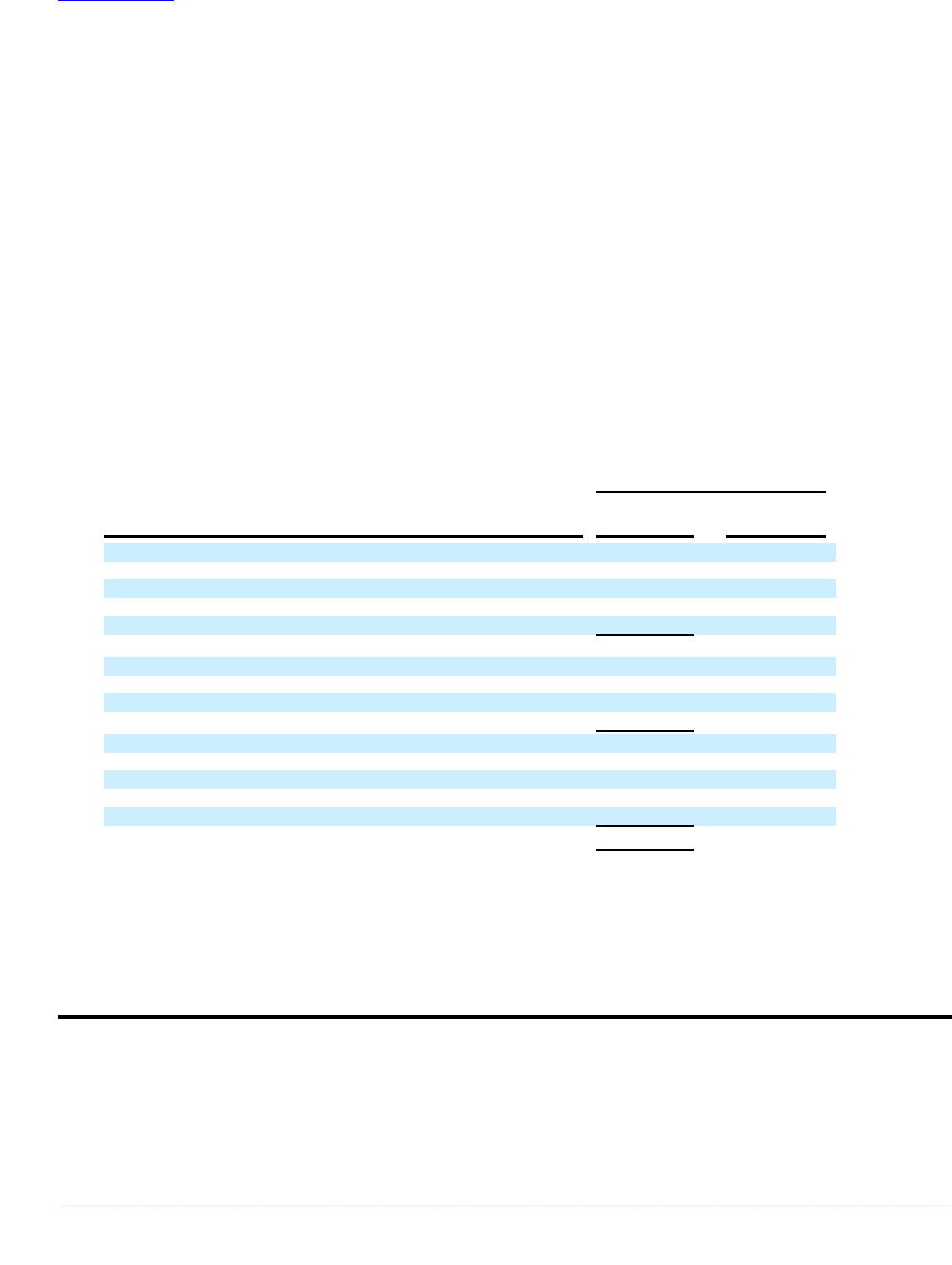

The following table summarizes stock options activity for our last three fiscal years ended May 31, 2007:

Options Outstanding

Weighted

Shares Under Average

(in millions, except exercise price) Option Exercise Price

Balance, May 31, 2004 440 $ 11.61

Granted 42 $ 10.39

Assumed in connection with acquisitions 97 $ 12.25

Exercised (71) $ 6.16

Canceled (39) $ 18.01

Balance, May 31, 2005 469 $ 11.92

Granted 68 $ 12.37

Assumed in connection with acquisitions 82 $ 17.22

Exercised (87) $ 6.56

Canceled (59) $ 16.64

Balance, May 31, 2006 473 $ 13.25

Granted 61 $ 14.81

Assumed in connection with acquisitions 25 $ 11.27

Exercised (106) $ 8.22

Canceled (19) $ 34.57

Balance, May 31, 2007 434 $ 13.65

The range of exercise prices for options outstanding at May 31, 2007 was $0.13 to $126.59. The range of

exercise prices for options is due to the fluctuating price of our stock over the period of the grants and from

the conversion of options assumed from acquisitions.

92

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠