Oracle 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(losses) included in non-operating income, net in the accompanying consolidated statements of operations

were $17 million, $15 million and $(28) million in fiscal 2007, 2006 and 2005, respectively. The unrealized

gains (losses) of our outstanding foreign currency forward contracts were $5 million and $(0.3) million at

May 31, 2007 and 2006, respectively.

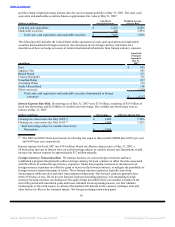

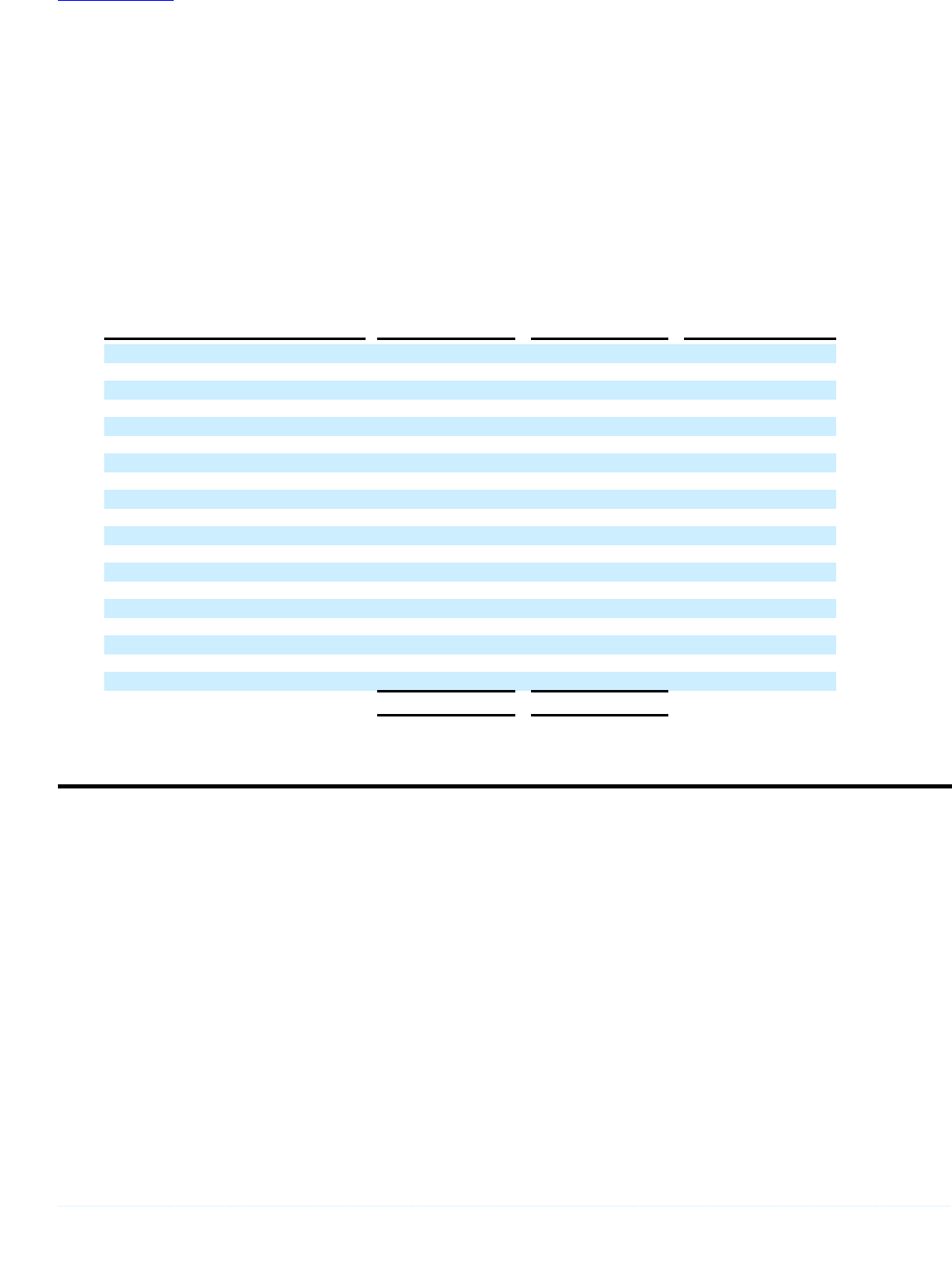

The tables below present the notional amounts (at contract exchange rates) and the weighted average

contractual foreign currency exchange rates for the outstanding forward contracts as of May 31, 2007.

Notional weighted average exchange rates listed in the tables below are quoted using market conventions. All

of our forward contracts mature within one year with the substantial majority maturing within 90 days or less

as of May 31, 2007.

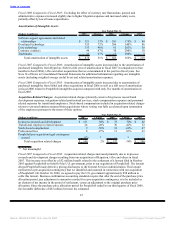

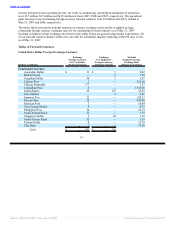

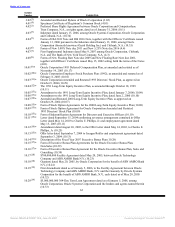

Tables of Forward Contracts:

United States Dollar Foreign Exchange Contracts

Exchange Exchange Notional

Foreign Currency U.S. Dollars for Weighted Average

for U.S. Dollars Foreign Currency Exchange Rate

(Dollars in millions) (Notional Amount) (Notional Amount) (Market Convention)

Functional Currency:

Australian Dollar $ 11 $ 5 0.82

British Pound — 6 1.98

Canadian Dollar 30 7 1.07

Chilean Peso 3 — 526.10

Chinese Renminbi 177 — 7.57

Columbian Peso 6 — 1,925.00

Indian Rupee 29 123 45.82

Israel Shekel — 4 4.01

Japanese Yen 25 — 120.22

Korean Won 18 — 926.90

Mexican Peso 7 — 10.84

New Zealand Dollar 4 — 0.72

Philippine Peso 14 — 46.12

Saudi Arabian Riyal 32 — 3.75

Singapore Dollar 2 84 1.52

South African Rand 12 — 7.19

Taiwan Dollar 4 — 32.79

Thai Baht 7 — 33.50

Total $ 381 $ 229

57

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠