Oracle 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

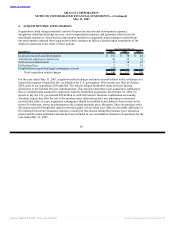

May 31, 2007

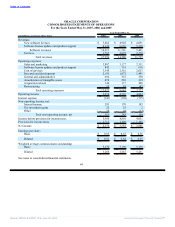

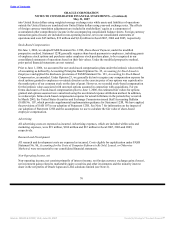

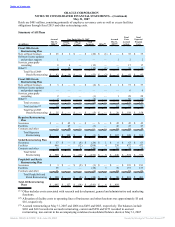

Year Ended May 31,

(in millions) 2007 2006 2005

Interest income $ 295 $ 170 $ 185

Foreign currency gains (losses) 45 39 (14)

Net investment gains related to marketable equity securities and other

investments 22 25 2

Minority interest (71) (41) (42)

Other 64 50 33

Total non-operating income, net $ 355 $ 243 $ 164

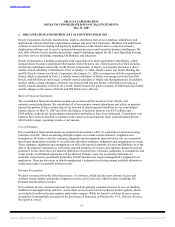

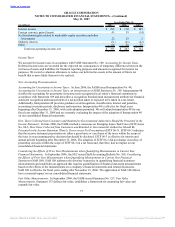

Income Taxes

We account for income taxes in accordance with FASB Statement No. 109, Accounting for Income Taxes.

Deferred income taxes are recorded for the expected tax consequences of temporary differences between the

tax bases of assets and liabilities for financial reporting purposes and amounts recognized for income tax

purposes. We record a valuation allowance to reduce our deferred tax assets to the amount of future tax

benefit that is more likely than not to be realized.

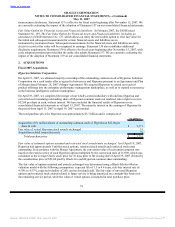

New Accounting Pronouncements

Accounting for Uncertainty in Income Taxes: In June 2006, the FASB issued Interpretation No. 48,

Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109. Interpretation 48

clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements in

accordance with Statement 109 and prescribes a recognition threshold and measurement attribute for financial

statement recognition and measurement of a tax position taken or expected to be taken in a tax return.

Additionally, Interpretation 48 provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. Interpretation 48 is effective for fiscal years

beginning after December 15, 2006, with early adoption permitted. We will adopt Interpretation 48 for our

fiscal year ending May 31, 2008 and are currently evaluating the impact of the adoption of Interpretation 48

on our consolidated financial statements.

How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the

Income Statement: In June 2006, the FASB reached a consensus on Emerging Issues Task Force (EITF) Issue

No. 06-3, How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be

Presented in the Income Statement (That Is, Gross versus Net Presentation) (EITF 06-3). EITF 06-3 indicates

that the income statement presentation on either a gross basis or a net basis of the taxes within the scope of

the issue is an accounting policy decision that should be disclosed. EITF 06-3 is effective for interim and

annual periods beginning after December 15, 2006. The adoption of EITF 06-3 did not change our policy of

presenting our taxes within the scope of EITF 06-3 on a net basis and, therefore, had no impact on our

consolidated financial statements.

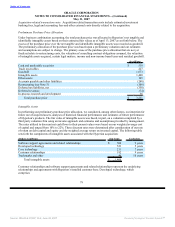

Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year

Financial Statements: In September 2006, the SEC issued Staff Accounting Bulletin No. 108, Considering

the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial

Statements (SAB 108). SAB 108 addresses the diversity in practice in quantifying financial statement

misstatements and establishes an approach that requires quantification of financial statement misstatements

based on the effects of the misstatements on a company’s financial statements and related disclosures.

SAB 108 is effective for fiscal years ending after November 15, 2006. The application of SAB 108 did not

have a material impact on our consolidated financial statements.

Fair Value Measurements: In September 2006, the FASB issued Statement No. 157, Fair Value

Measurements. Statement 157 defines fair value, establishes a framework for measuring fair value and

expands fair value

77

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠