Oracle 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

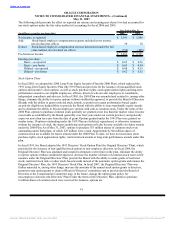

Senior Notes) to finance the Siebel acquisition and for general corporate purposes. On June 16, 2006, we

completed a registered exchange offer of the Original Senior Notes for registered senior notes with

substantially identical terms to the Original Senior Notes.

In May 2007 we redeemed the Original 2009 Notes for their principal amount plus accrued and unpaid

interest. Our 2011 Notes and 2016 Notes may also be redeemed at any time, subject to payment of a

make-whole premium. The 2011 Notes and 2016 Notes bear interest at the rate of 5.00% and 5.25% per year,

respectively. Interest is payable semi-annually for the 2011 notes and 2016 notes.

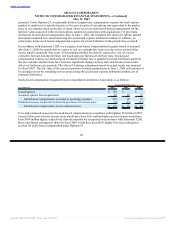

The effective interest yields of the New 2009 Notes, 2010 Notes, 2011 Notes and 2016 Notes (collectively,

the Senior Notes) at May 31, 2007 were 5.38%, 5.42%, 5.09% and 5.33%, respectively.

The Senior Notes rank pari passu with the Commercial Paper Notes and all existing and future senior

indebtedness of Oracle Corporation.

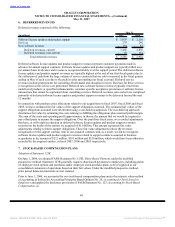

We were in compliance with all debt-related covenants at May 31, 2007. Future principal payments of our

borrowings at May 31, 2007 are as follows: $1.4 billion in fiscal 2008, $1.0 billion in fiscal 2009, $1.0 billion

in fiscal 2010, $2.25 billion in fiscal 2011 and $2.0 billion in fiscal 2016.

Other Debt Facilities and Related Information

5-Year Revolving Credit Agreement

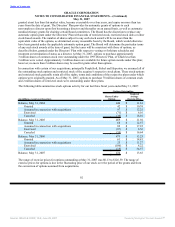

In March 2006, we entered into a $3.0 billion, 5-Year Revolving Credit Agreement with Wachovia Bank,

National Association, Bank of America, N.A. and certain other lenders (Credit Agreement). The Credit

Agreement provides for an unsecured revolving credit facility which can be used to backstop any commercial

paper that we may issue (see above) and for working capital and other general corporate purposes. Subject to

certain conditions stated in the Credit Agreement, we may borrow, prepay and re-borrow amounts under the

facility at any time during the term of the Credit Agreement. Any amounts drawn pursuant to the Credit

Agreement are due on March 14, 2011 (none outstanding at May 31, 2007 and 2006). Interest is based on

either (a) a LIBOR-based formula or (b) a formula based on Wachovia’s prime rate or on the federal funds

effective rate.

The Credit Agreement also provides that (i) standby letters of credit may be issued on behalf of Oracle up to

$500 million; and (ii) any amounts borrowed and letters of credit issued may be in Japanese Yen, Pounds

Sterling and Euros up to $1.5 billion. We may also, upon the consent of either then existing lenders or of

additional banks not currently party to the agreement, increase the commitments under this facility up to

$5.0 billion. The agreement contains certain customary representations and warranties, covenants and events

of default, including the requirement that the total net debt to total capitalization ratio of Oracle not exceed

45%. We have not borrowed any funds under the Credit Agreement.

$150 Million Senior Notes

We had $150 million in 6.91% senior notes that were due in February 2007 and also had an interest-rate swap

agreement that had the economic effect of modifying the interest obligations associated with these senior

notes so that the interest payable on the senior notes effectively became variable based on the three-month

LIBOR set quarterly until maturity. Both the senior notes and interest-rate swap agreement were settled and

neither is outstanding as of May 31, 2007.

88

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠