Oracle 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

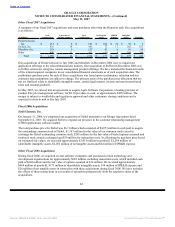

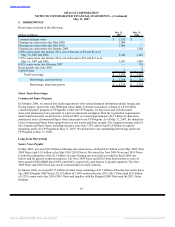

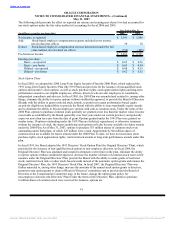

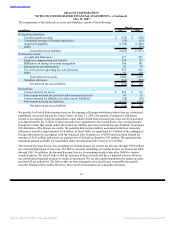

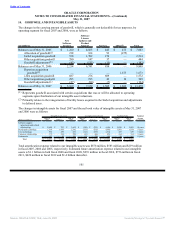

The following table presents the effect on reported net income and earnings per share if we had accounted for

our stock options under the fair value method of accounting for fiscal 2006 and 2005:

Year Ended May 31,

(in millions, except for per share data) 2006 2005

Net income, as reported $ 3,381 $ 2,886

Add: Stock-based employee compensation expense included in net income,

net of related tax effects 39 70

Deduct: Stock-based employee compensation expense determined under the fair

value method, net of related tax effects (158) (205)

Pro forma net income $ 3,262 $ 2,751

Earnings per share:

Basic—as reported $ 0.65 $ 0.56

Basic—pro forma $ 0.63 $ 0.54

Diluted—as reported $ 0.64 $ 0.55

Diluted—pro forma $ 0.62 $ 0.52

Stock Option Plans

In fiscal 2001, we adopted the 2000 Long-Term Equity Incentive Plan (the 2000 Plan), which replaced the

1991 Long-Term Equity Incentive Plan (the 1991 Plan) and provides for the issuance of non-qualified stock

options and incentive stock options, as well as stock purchase rights, stock appreciation rights and long-term

performance awards to our eligible employees, officers, directors who are also employees or consultants,

independent consultants and advisers. In fiscal 2005, the 2000 Plan was amended and restated to, among other

things, eliminate the ability to reprice options without stockholder approval, to provide the Board of Directors

(Board) with the ability to grant restricted stock awards, to permit us to grant performance-based equity

awards for eligible tax deductibility, to provide the Board with the ability to issue transferable equity awards

and to eliminate the ability to buyout employees’ options with cash or common stock. Under the terms of the

2000 Plan, options to purchase common stock generally are granted at not less than fair market value, become

exercisable as established by the Board (generally over four years under our current practice), and generally

expire no more than ten years from the date of grant. Options granted under the 1991 Plan were granted on

similar terms. If options outstanding under the 1991 Plan are forfeited, repurchased, or otherwise terminate

without the issuance of stock, the shares underlying such options will also become available for future awards

under the 2000 Plan. As of May 31, 2007, options to purchase 353 million shares of common stock were

outstanding under both plans, of which 229 million were vested. Approximately 346 million shares of

common stock are available for future awards under the 2000 Plan. To date, we have not issued any stock

purchase rights, stock appreciation rights, restricted stock awards or long-term performance awards under this

plan.

In fiscal 1993, the Board adopted the 1993 Directors’ Stock Option Plan (the Original Directors’ Plan), which

provided for the issuance of non-qualified stock options to non-employee directors. In fiscal 2004, the

Original Directors’ Plan was amended and restated to eliminate a term limit on the plan, eliminate the ability

to reprice options without stockholder approval, decrease the number of shares of common stock reserved for

issuance under the Original Directors’ Plan, provide the Board with the ability to make grants of restricted

stock, restricted stock units or other stock-based awards instead of the automatic option grants and rename the

Original Directors’ Plan, the 1993 Directors’ Stock Plan. In fiscal 2007, the Original Directors’ Plan was

further amended to, among other things, increase the amounts of the annual stock option grants to directors,

permit pro rata option grants to chairs of Board of Directors’ committees and to provide that the Board of

Directors or the Compensation Committee may, in the future, change the option grant policy for

non-employee directors (the Directors’ Plan) Under the terms of the Directors’ Plan, options to purchase

8 million shares of common stock were reserved for issuance, options are

91

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠