Oracle 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

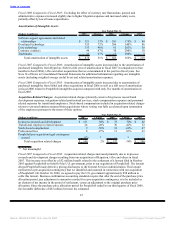

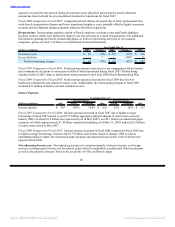

Fiscal 2006 Compared to Fiscal 2005: Excluding the effect of currency rate fluctuations, general and

administrative expenses increased slightly due to higher litigation expenses and increased salary costs,

partially offset by lower bonus expenditures.

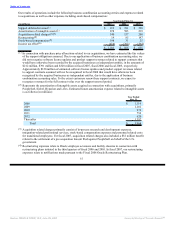

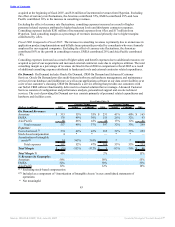

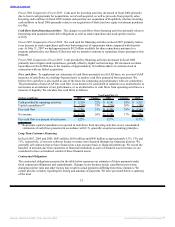

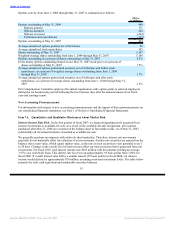

Amortization of Intangible Assets:

Year Ended May 31,

(Dollars in millions) 2007 Change 2006 Change 2005

Software support agreements and related

relationships $ 321 33% $ 241 174% $ 88

Developed technology 355 72% 206 140% 86

Core technology 133 46% 91 203% 30

Customer contracts 44 47% 30 200% 10

Trademarks 25 67% 15 200% 5

Total amortization of intangible assets $ 878 51% $ 583 166% $ 219

Fiscal 2007 Compared to Fiscal 2006: Amortization of intangible assets increased due to the amortization of

purchased intangibles from Hyperion, Siebel (a full year of amortization in fiscal 2007 in comparison to four

months in fiscal 2006), i-flex and other acquisitions that we consummated in the past two fiscal years. See

Note 14 of Notes to Consolidated Financial Statements for additional information regarding our intangible

assets (including weighted average useful lives) and related amortization expenses.

Fiscal 2006 Compared to Fiscal 2005: Amortization of intangible assets increased due to amortization of

purchased intangibles from Siebel and other acquisitions in fiscal 2006 as well as a full year of amortization

in fiscal 2006 related to PeopleSoft intangibles acquired compared with only five months of amortization in

fiscal 2005.

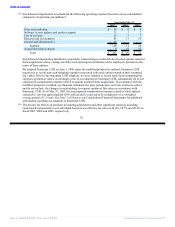

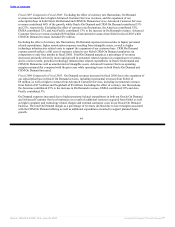

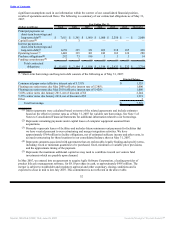

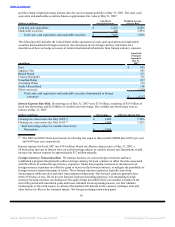

Acquisition Related Charges: Acquisition related charges primarily consist of in-process research and

development expenses, integration-related professional services, stock-compensation expenses and personnel

related expenses for transitional employees. Stock-based compensation included in acquisition related charges

relates to unvested options assumed from acquisitions whose vesting was fully accelerated upon termination

of the employees pursuant to the terms of these options.

Year Ended May 31,

(Dollars in millions) 2007 Change 2006 Change 2005

In-process research and development $ 151 94% $ 78 70% $ 46

Transitional employee related expenses 24 -20% 30 -42% 52

Stock-based compensation 9 -50% 18 -62% 47

Professional fees 8 -27% 11 -83% 63

PeopleSoft pre-acquisition legal contingency

accrual (52) * — * —

Total acquisition related charges $ 140 2% $ 137 -34% $ 208

* Not meaningful

Fiscal 2007 Compared to Fiscal 2006: Acquisition related charges increased primarily due to in-process

research and development charges resulting from our acquisitions of Hyperion, i-flex and others in fiscal

2007. This increase was offset by a $52 million benefit related to the settlement of a lawsuit filed in October

2003 against PeopleSoft on behalf of the U.S. government, prior to our acquisition of PeopleSoft. The lawsuit

alleged PeopleSoft made defective pricing disclosures to the General Services Administration. This lawsuit

represented a pre-acquisition contingency that we identified and assumed in connection with our acquisition

of PeopleSoft. On October 10, 2006, we agreed to pay the U.S. government approximately $98 million to

settle this lawsuit. Business combination accounting standards require that after the end of the purchase price

allocation period, any adjustment to amounts recorded for a pre-acquisition contingency is to be included as

an element of net income in the period of settlement, versus an adjustment to the original purchase price

allocation. Since the purchase price allocation period for PeopleSoft ended in our third quarter of fiscal 2006,

the favorable difference of $52 million between the estimated

47

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠