Oracle 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

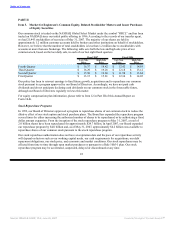

The following table summarizes the stock repurchase activity for the three months ending May 31, 2007 and

the approximate dollar value of shares that may yet be purchased pursuant to our share repurchase programs:

Total Number of

Shares Purchased as Approximate Dollar

Total Number Average Price Part of Publicly Value of Shares that

of Shares Paid Per Announced May Yet Be Purchased

(in millions, except per share amounts) Purchased Share Programs Under the Programs(1)

March 1, 2007 - March 31, 2007 19.8 $ 17.32 19.8 $ 864.9

April 1, 2007 - April 30, 2007 16.7 $ 18.73 16.7 $ 4,552.3

May 1, 2007 - May 31, 2007 18.0 $ 19.02 18.0 $ 4,209.0

Total 54.5 $ 18.32 54.5

(1) In April 2007, our Board of Directors authorized the expansion of our repurchase program by $4.0 billion.

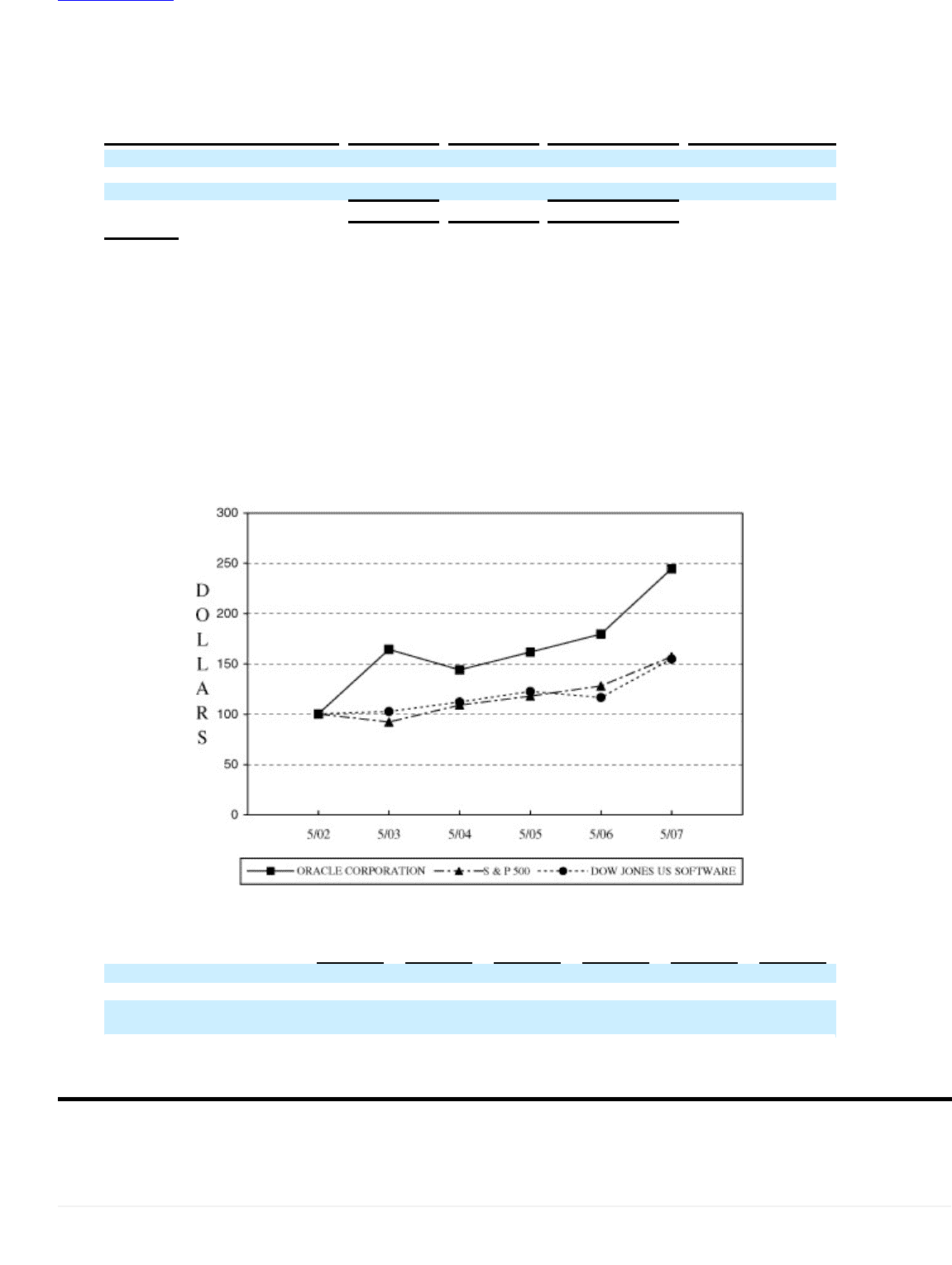

Stock Performance Graphs and Cumulative Total Return

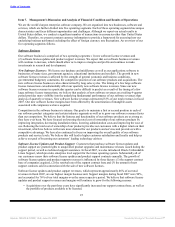

The graph below compares the cumulative total stockholder return on our common stock with the cumulative

total return on the S&P’s 500 Index and the Dow Jones U.S. Software Index for each of the last five fiscal

years ended May 31, 2007, assuming an investment of $100 at the beginning of such period and the

reinvestment of any dividends. The comparisons in the graphs below are based upon historical data and are

not indicative of, nor intended to forecast, future performance of our common stock.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN*

AMONG ORACLE CORPORATION, THE S&P 500 INDEX

AND THE DOW JONES U.S. SOFTWARE INDEX

* $100 INVESTED ON MAY 31, 2002 IN STOCK OR

INDEX-INCLUDING REINVESTMENT OF DIVIDENDS.

5/02 5/03 5/04 5/05 5/06 5/07

Oracle Corporation 100.00 164.27 143.94 161.62 179.55 244.70

S&P 500 Index 100.00 91.94 108.79 117.75 127.92 157.08

Dow Jones U.S. Software

Index 100.00 102.44 111.89 122.40 116.41 154.75

23

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠