Oracle 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

points. The aforementioned increases in operating expenses were partially offset by lower restructuring

expenses and the settlement of a pre-acquisition PeopleSoft related contingency that benefited our operating

expenses (see Acquisition Related Charges discussion below).

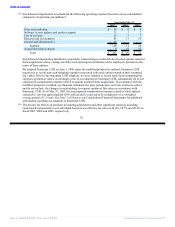

Operating margins as a percentage of total revenues were flat in fiscal 2007 and were favorably affected by

foreign currency rate fluctuations of 5 percentage points. Our revenues grew at a faster rate than our operating

expenses, excluding amortization costs of intangible assets and stock-based compensation expenses. The

increases in those cost categories offset the slower growth in other operating expenses.

International operations will continue to provide a significant portion of our total revenues. As a result, total

revenues and expenses will be affected by changes in the relative strength of the United States dollar against

certain major international currencies.

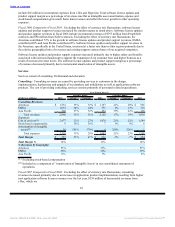

Fiscal 2006 Compared to Fiscal 2005: Total revenues increased in fiscal 2006 due to strong sales execution,

incremental revenues from acquisitions and a strengthening in our competitive position. Excluding the effect

of currency rate fluctuations, software license updates and product support revenues contributed 50% to the

growth in total revenues, new software licenses contributed 32% and services revenues contributed 18%.

Excluding the effects of currency rate fluctuations, the Americas contributed 65% to the increase in total

revenues, EMEA contributed 22% and Asia Pacific contributed 13%. Total revenues in the Americas,

specifically in the United States, increased at a faster rate than in other regions primarily due to the relative

geographical mix of revenues from our acquired companies.

Operating expenses were favorably affected by 1 percentage point as a result of the strengthening of the

United States dollar relative to other major international currencies. Excluding the effect of currency rate

fluctuations, the increase in operating expenses is primarily due to higher headcount levels and associated

personnel related costs in sales and marketing, consulting and research and development, higher commissions

due to the increase in revenues and greater amortization of intangible assets, offset partially by lower

restructuring and acquisition related expenses. Operating margins as a percentage of total revenues decreased

slightly in fiscal 2006 due to higher costs associated with acquisitions, principally amortization of intangible

assets.

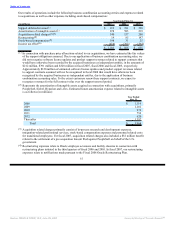

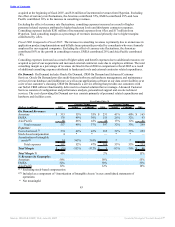

Supplemental Disclosure Related to Acquisition Accounting and Stock-Based Compensation

To supplement our consolidated financial information we believe the following information is helpful to an

overall understanding of our past financial performance and prospects for the future. You should review the

introduction under “Results of Operations” (above) for a discussion of the inherent limitations in comparing

pre- and post-acquisition information.

36

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠