Oracle 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

be effected from time to time through open market purchases or pursuant to a Rule 10b5-1 plan. Our stock

repurchase program may be accelerated, suspended, delayed or discontinued at any time.

Rights Agreement

In connection with the Reorganization, on January 31, 2006 our Board of Directors distributed preferred stock

purchase rights as a dividend at the rate of one right for each share of our common stock held by stockholders

of record as of January 31, 2006 pursuant to a preferred shares rights agreement dated January 31, 2006

(Rights Agreement), which was based on the preferred shares rights agreement of Old Oracle prior to the

Reorganization. The Board of Directors also authorized the issuance of a right for each share of common

stock issued after the record date, until the occurrence of certain specified events. The Rights Agreement was

adopted to provide protection to stockholders in the event of an unsolicited attempt to acquire us.

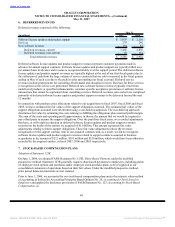

Each right is initially exercisable for one-six thousand seven hundred fiftieth of a share of our Series A Junior

Participating Preferred Stock at a price of $125 per one-six thousand seven hundred fiftieth of a share, subject

to adjustment. The rights are not exercisable until the earlier of: (1) ten days (or such later date as may be

determined by the Board of Directors) following an announcement that a person or group has acquired

beneficial ownership of 15% or more of our common stock or (2) ten days (or such later date as may be

determined by the Board of Directors) following the commencement of a tender offer which, if successfully

consummated, would result in a person or group obtaining beneficial ownership of 15% or more of our

outstanding common stock, subject in each case to certain exceptions (the earlier of such dates being called

the distribution date). After the distribution date, holders of rights (other than the 15% or greater holder) will

be entitled to receive upon exercise of the right and payment of exercise price, shares of our common stock

(or, in certain types of transactions, common stock of the acquirer) having a market value of two times the

exercise price of the right. Alternatively, we may require the exchange of rights, at a rate of one share of

common stock for each right, without payment of exercise price, under certain circumstances.

We are entitled to redeem the rights, for $0.00148 per right, at the discretion of the Board of Directors, until

certain specified times. The Board of Directors also has the ability to amend the Rights Agreement without

approval of the holders of the rights, subject to certain limitations. Unless earlier redeemed or exchanged, the

rights will expire at the close of business on March 31, 2008.

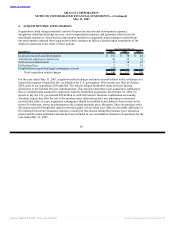

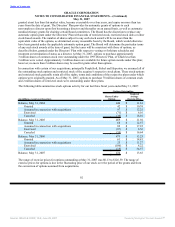

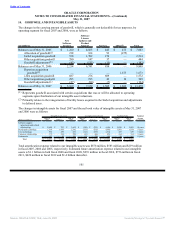

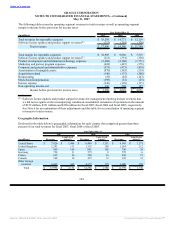

Accumulated Other Comprehensive Income

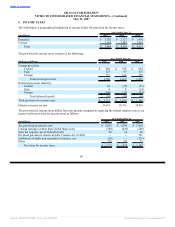

The following table summarizes, as of each balance sheet date, the components of our accumulated other

comprehensive income, net of income taxes (income tax effects were insignificant for all periods presented):

May 31,

(in millions) 2007 2006

Foreign currency translation adjustment $ 390 $ 308

Unrealized loss on derivatives (9) (37)

Unrealized gain on investments 2 6

Minimum benefit plan liability adjustment — (19)

Unrealized components of defined benefit pension plan, net 20 —

Accumulated other comprehensive income $ 403 $ 258

95

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠