Oracle 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

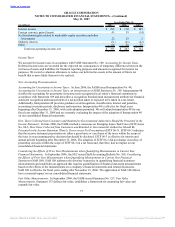

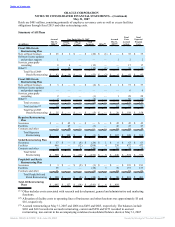

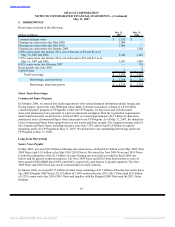

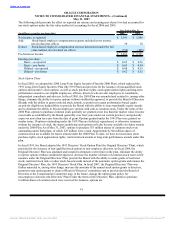

4. ACQUISITION RELATED CHARGES

Acquisition related charges primarily consist of in-process research and development expenses,

integration-related professional services, stock-compensation expenses and personnel related costs for

transitional employees. Stock-based compensation included in acquisition related charges resulted from

unvested options assumed from acquisitions whose vesting was fully accelerated upon termination of the

employees pursuant to the terms of these options.

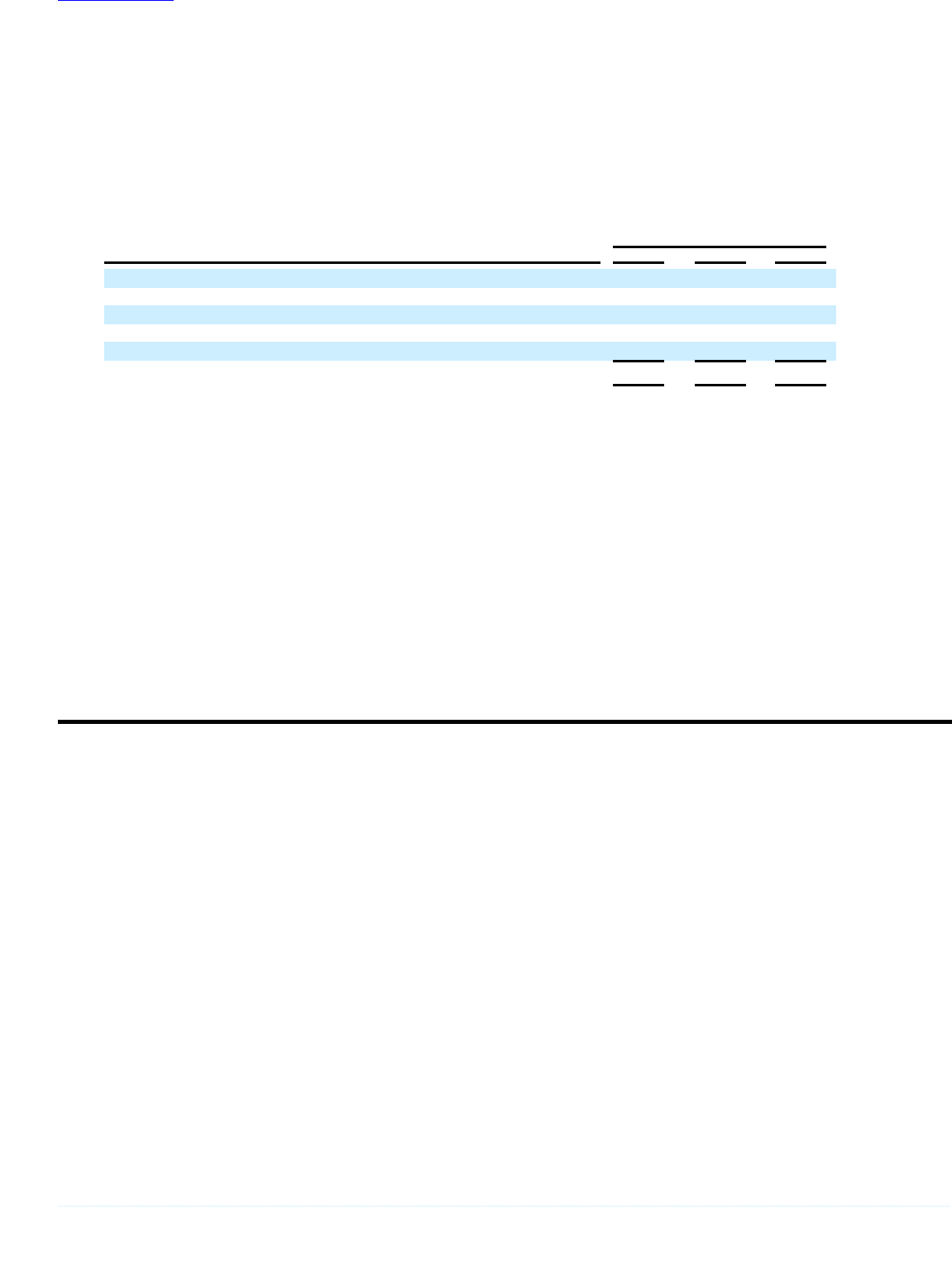

Year Ended May 31,

(in millions) 2007 2006 2005

In-process research and development $ 151 $ 78 $ 46

Transitional employee related costs 24 30 52

Stock-based compensation 9 18 47

Professional fees 8 11 63

PeopleSoft pre-acquisition legal contingency accrual (52) — —

Total acquisition related charges $ 140 $ 137 $ 208

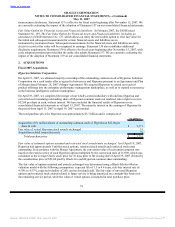

For the year ended May 31, 2007, acquisition related charges included a benefit related to the settlement of a

lawsuit filed against PeopleSoft, Inc. on behalf of the U.S. government. This lawsuit was filed in October

2003, prior to our acquisition of PeopleSoft. The lawsuit alleged PeopleSoft made defective pricing

disclosures to the General Services Administration. This lawsuit represented a pre-acquisition contingency

that we identified and assumed in connection with the PeopleSoft acquisition. On October 10, 2006, we

agreed to pay the U.S. government $98 million to settle this lawsuit. Business combination accounting

standards require that after the end of the purchase price allocation period, any adjustment to amounts

recorded that relate to a pre-acquisition contingency should be included as an element of net income in the

period of settlement, versus an adjustment to the original purchase price allocation. Since the purchase price

allocation period for PeopleSoft ended in the third quarter of our fiscal year 2006, the favorable difference of

$52 million between the estimated exposure recorded for this lawsuit during the purchase price allocation

period and the actual settlement amount has been included in our consolidated statement of operations for the

year ended May 31, 2007.

86

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠