Oracle 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

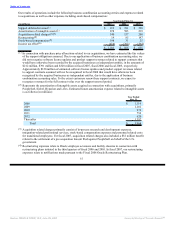

Our results of operations include the following business combination accounting entries and expenses related

to acquisitions as well as other expenses including stock-based compensation:

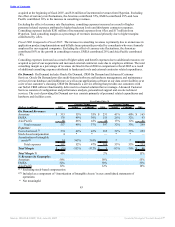

Year Ended May 31,

(in millions) 2007 2006 2005

Support deferred revenue(1) $ 212 $ 391 $ 320

Amortization of intangible assets(2) 878 583 219

Acquisition related charges(3)(5) 140 137 208

Restructuring(4) 19 85 147

Stock-based compensation(5) 198 31 25

Income tax effect(6) (414) (362) (264)

$ 1,033 $ 865 $ 655

(1) In connection with purchase price allocations related to our acquisitions, we have estimated the fair values

of the support obligations assumed. Due to our application of business combination accounting rules, we

did not recognize software license updates and product support revenues related to support contracts that

would have otherwise been recorded by the acquired businesses as independent entities, in the amounts of

$212 million, $391 million and $320 million in fiscal 2007, fiscal 2006 and fiscal 2005, respectively.

Approximately $120 million of estimated software license updates and product support revenues related

to support contracts assumed will not be recognized in fiscal 2008 that would have otherwise been

recognized by the acquired businesses as independent entitles, due to the application of business

combination accounting rules. To the extent customers renew these support contracts, we expect to

recognize revenues for the full contract value over the support renewal period.

(2) Represents the amortization of intangible assets acquired in connection with acquisitions, primarily

PeopleSoft, Siebel, Hyperion and i-flex. Estimated future amortization expense related to intangible assets

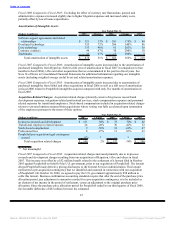

is as follows (in millions):

Year Ended

May 31,

2008 $ 1,114

2009 1,101

2010 976

2011 756

2012 620

Thereafter 1,397

Total $ 5,964

(3) Acquisition related charges primarily consist of in-process research and development expenses,

integration-related professional services, stock-based compensation expenses and personnel related costs

for transitional employees. For fiscal 2007, acquisition related charges also included a $52 million benefit

related to the settlement of a pre-acquisition lawsuit filed against PeopleSoft on behalf of the U.S.

government.

(4) Restructuring expenses relate to Oracle employee severance and facility closures in connection with

restructuring plans initiated in the third quarters of fiscal 2006 and 2005. In fiscal 2007, our restructuring

expenses relate to notifications made pursuant to the Fiscal 2006 Oracle Restructuring Plan.

37

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠