Oracle 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

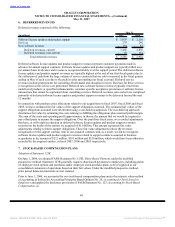

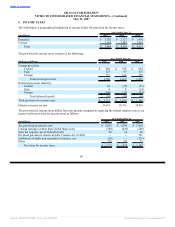

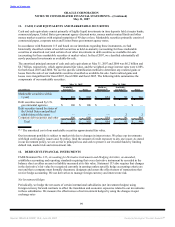

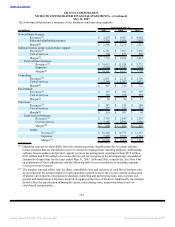

Weighted Average

Options Outstanding Remaining Options Exercisable Weighted Average

as of May 31, 2007 Contractual Life Weighted Average as of May 31, 2007 Exercise Price of

Range of Exercise Prices (in millions) (in years) Exercise Price (in millions) Exercisable Options

$ 0.13—$ 6.60 34 1.28 $ 4.52 34 $ 4.53

$ 6.61—$ 6.87 71 2.01 $ 6.87 71 $ 6.87

$ 6.88—$ 9.90 60 5.55 $ 8.96 45 $ 8.76

$ 9.91—$ 11.85 30 4.59 $ 10.79 18 $ 10.88

$11.86—$ 12.34 49 7.85 $ 12.32 12 $ 12.30

$12.35—$ 14.26 41 6.36 $ 12.88 24 $ 12.91

$14.27—$ 14.57 55 8.80 $ 14.57 2 $ 14.53

$14.58—$ 20.64 54 4.71 $ 17.40 46 $ 17.40

$20.65—$126.59 40 2.87 $ 38.78 40 $ 38.86

$ 0.13—$126.59 434 4.97 $ 13.65 292 $ 13.93

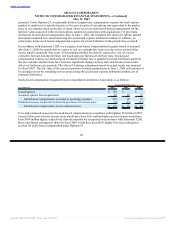

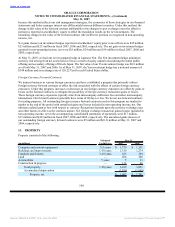

Options outstanding that have vested and that are expected to vest as of May 31, 2007 are as follows:

Weighted

Average In-the-Money Aggregate

Outstanding Weighted Remaining Options as of Intrinsic

Options Average Contract Term May 31, 2007 Value(1)

(in millions) Exercise Price (in years) (in millions) (in millions)

Vested 292 $ 13.93 3.5 241 $ 2,378

Expected to vest(2) 120 $ 12.97 7.9 120 758

Total 412 $ 13.65 4.8 361 $ 3,136

(1) The aggregate intrinsic value was calculated based on the difference between our closing stock price on

May 31, 2007 of $19.38 and the exercise prices for all in-the-money options outstanding.

(2) The unrecognized compensation expense calculated under the fair value method for shares expected to

vest (unvested shares net of expected forfeitures) as of May 31, 2007 was approximately $356 million and

is expected to be recognized over a weighted average period of 1.3 years. Approximately 22 million

shares outstanding as of May 31, 2007 are not expected to vest.

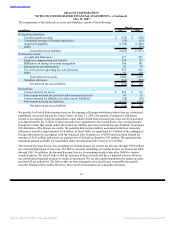

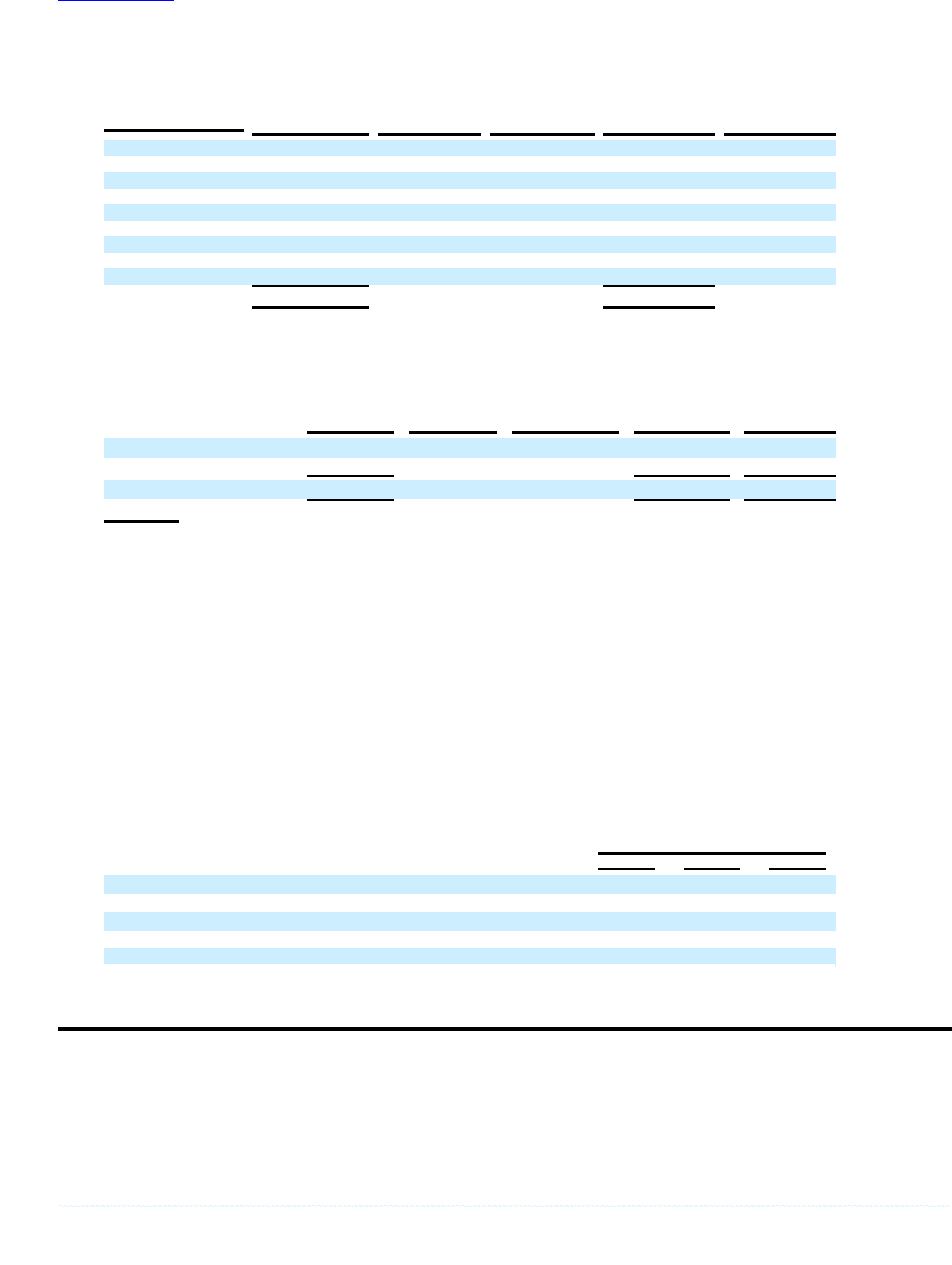

Valuation of Options Granted

We estimate the fair value of our options using the Black-Scholes-Merton option-pricing model, which was

developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully

transferable. Option valuation models require the input of assumptions, including stock price volatility.

Changes in the input assumptions can materially affect the fair value estimates. The fair value of employee

and director stock options granted, including options assumed from acquisitions, were estimated at the date of

grant (or date of acquisition for acquired options assumed). The weighted average assumptions used were as

follows:

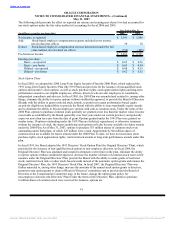

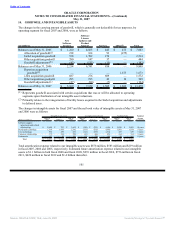

Year Ended May 31,

2007 2006 2005

Expected life (in years) 4.9 4.5 4.7

Risk-free interest rate 5.0% 4.3% 3.0%

Volatility 26% 26% 33%

Dividend yield — — —

Weighted-average fair value of grants $ 6.17 $ 3.89 $ 4.72

93

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠