Oracle 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

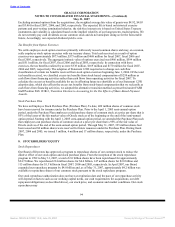

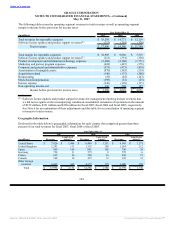

The valuation allowance was $166 million at May 31, 2007 and $189 million at May 31, 2006. The net

decrease is primarily attributable to the release of valuation allowance of acquired deferred tax assets,

principally federal net operating loss carryforwards. Substantially all of the valuation allowance relates to tax

assets established in purchase accounting. Any subsequent reduction of that portion of the valuation

allowance and the recognition of the associated tax benefits will be applied to reduce goodwill and then to

intangible assets established pursuant to the related acquisition.

At May 31, 2007, we had federal net operating loss carryforwards of approximately $1.7 billion. These losses

expire in various years between fiscal 2018 and fiscal 2027, and are subject to limitations on their utilization.

We have state net operating loss carryforwards of approximately $1.9 billion, which expire between fiscal

2008 and fiscal 2027, and are subject to limitations on their utilization. We have tax credit carryforwards of

approximately $209 million, which are subject to limitations on their utilization. Approximately $72 million

of these tax credit carryforwards are not currently subject to expiration dates. The remainder, approximately

$137 million, expire in various years between fiscal 2010 and fiscal 2026.

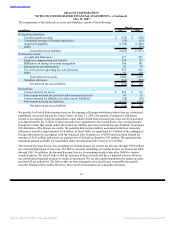

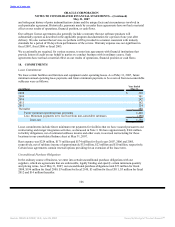

Our intercompany transfer pricing is currently being reviewed by the IRS and by foreign tax jurisdictions and

will likely be subject to additional audits in the future. We previously negotiated three unilateral Advance

Pricing Agreements with the IRS that cover many of our intercompany transfer pricing issues and preclude

the IRS from making a transfer pricing adjustment within the scope of these agreements. However, these

agreements, which are effective for fiscal years through May 31, 2006, do not cover all elements of our

intercompany transfer pricing issues and do not bind tax authorities outside the United States. We are

currently determining whether to structure additional agreements that cover periods beyond May 2006. There

can be no guarantee in any event that any negotiations will result in an agreement.

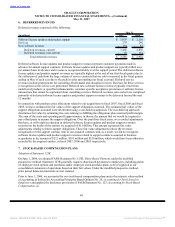

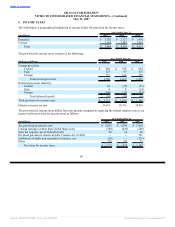

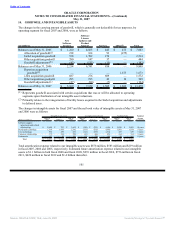

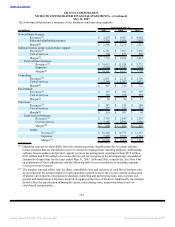

10. EARNINGS PER SHARE

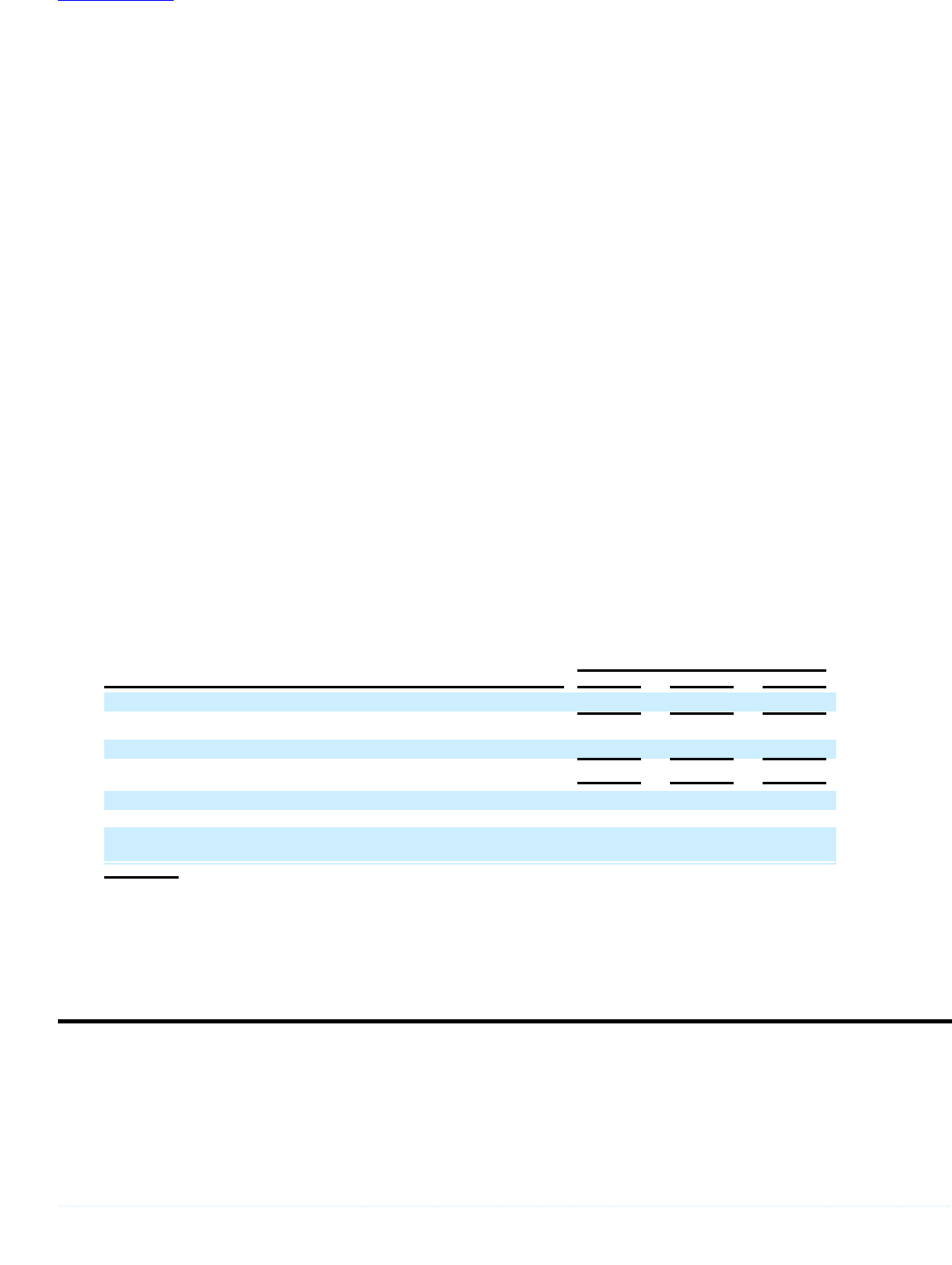

Basic earnings per share is computed by dividing net income for the period by the weighted-average number

of common shares outstanding during the period. Diluted earnings per share is computed by dividing net

income for the period by the weighted-average number of common shares outstanding during the period, plus

the dilutive effect of outstanding stock awards and shares issuable under the employee stock purchase plan

using the treasury stock method. The following table sets forth the computation of basic and diluted earnings

per share:

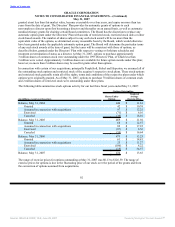

Year Ended May 31,

(in millions, except per share data) 2007 2006 2005

Net income $ 4,274 $ 3,381 $ 2,886

Weighted-average common shares outstanding 5,170 5,196 5,136

Dilutive effect of employee stock plans 99 91 95

Dilutive weighted-average common shares outstanding 5,269 5,287 5,231

Basic earnings per share $ 0.83 $ 0.65 $ 0.56

Diluted earnings per share $ 0.81 $ 0.64 $ 0.55

Shares subject to anti-dilutive stock options excluded from

calculation(1) 76 123 141

(1) These weighted shares relate to anti-dilutive stock options as calculated using the treasury stock method

(described above) and could be dilutive in the future. See Note 7 for information regarding the prices of

our outstanding, unexercised options.

98

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠