Oracle 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

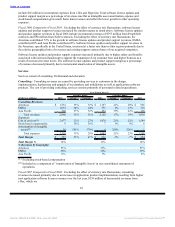

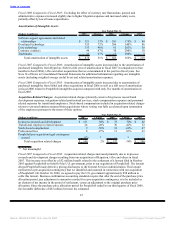

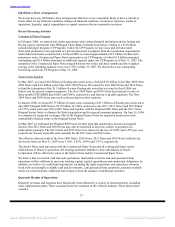

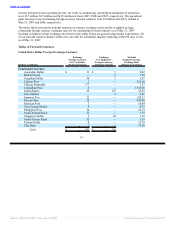

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2007 Actual Constant 2006 Actual Constant 2005

Interest income $ 295 74% 72% $ 170 -8% -8% $ 185

Foreign currency gains

(losses) 45 15% 19% 39 -368% -374% (14)

Net investment gains

related to equity

securities 22 -11% -10% 25 1301% 1292% 2

Minority interest (71) 72% 70% (41) -2% -2% (42)

Other 64 28% 22% 50 52% 52% 33

Total non-operating

income, net $ 355 46% 45% $ 243 49% 50% $ 164

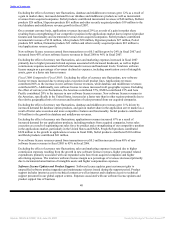

Fiscal 2007 Compared to Fiscal 2006: Non-operating income, net increased in fiscal 2007 primarily due to

higher interest income attributable to an increase in average interest rates (the weighted average interest rate

earned on cash, cash equivalents and marketable securities increased from 3.04% in fiscal 2006 to 3.97% in

fiscal 2007), partially offset by higher minority interests’ share in the net profits of i-flex and Oracle Japan.

Fiscal 2006 Compared to Fiscal 2005: Non-operating income, net increased in fiscal 2006 as a result of

higher foreign currency gains on our Japanese net investment hedge and the Chinese currency revaluation,

$14 million of equity in earnings associated with our interest in i-flex and higher gains on sales of equity

securities. Interest income decreased slightly due to lower average cash, cash equivalents and marketable

securities balances, partially offset by higher interest rates. The weighted average interest rate earned on cash,

cash equivalents and marketable securities increased from 1.93% in fiscal 2005 to 3.04% in fiscal 2006.

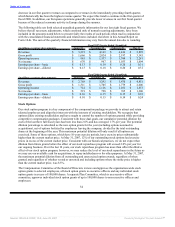

Provision for Income Taxes: The effective tax rate in all periods is the result of the mix of income earned in

various tax jurisdictions that apply a broad range of income tax rates. The provision for income taxes differs

from the tax computed at the federal statutory income tax rate due primarily to state taxes and earnings

considered as indefinitely reinvested in foreign operations. Future effective tax rates could be adversely

affected if earnings are lower than anticipated in countries where we have lower statutory rates, by

unfavorable changes in tax laws and regulations, or by adverse rulings in tax related litigation.

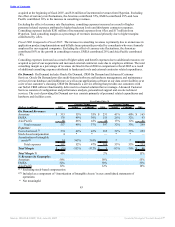

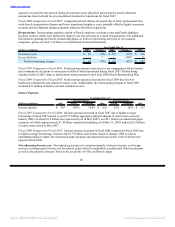

Year Ended May 31,

(Dollars in millions) 2007 Change 2006 Change 2005

Provision for income taxes $ 1,712 20% $ 1,429 23% $ 1,165

Effective tax rate 28.6% 29.7% 28.8%

Fiscal 2007 Compared to Fiscal 2006: Provision for income taxes increased in fiscal 2007 primarily due to

higher earnings before tax, partially offset by a lower effective tax rate. Our effective tax rate for fiscal 2007

was slightly lower than in fiscal 2006 primarily due to additional research and development tax credits as well

as agreements reached with foreign tax authorities on certain tax positions.

Fiscal 2006 Compared to Fiscal 2005: Provision for income taxes increased in fiscal 2006 due to higher

earnings before tax and a higher effective tax rate. The increase in the effective tax rate in fiscal 2006 is

primarily attributable to a higher percentage of earnings in high tax jurisdictions as compared with other

lower tax rate jurisdictions. In addition, we did not benefit from certain non-recurring tax events in fiscal

2006 that occurred in fiscal 2005, including the settlement of audits and expiration of statutes of limitations

on certain tax assessments and the true-up of estimated tax accruals upon the filing of our prior year tax

returns. We also incurred higher non-deductible in-process research and development charges in fiscal 2006.

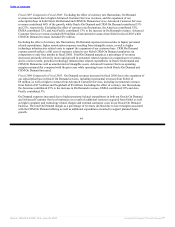

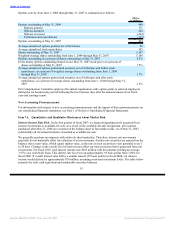

Liquidity and Capital Resources

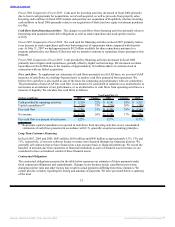

May 31,

(Dollars in millions) 2007 Change 2006 Change 2005

Working capital $ 3,496 -31% $ 5,044 1,210% $ 385

Cash, cash equivalents and marketable

securities $ 7,020 -8% $ 7,605 59% $ 4,771

49

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠