Oracle 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

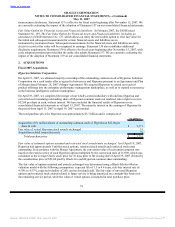

majority interest in i-flex and began consolidating the financial results of i-flex’s operations on a two months

in arrears basis (our reporting periods differ from those of i-flex) with our financial results in our first quarter

of fiscal 2007. Prior to obtaining our majority interest in i-flex we accounted for our investment in i-flex

pursuant to the equity method of accounting. We acquired i-flex to expand our reach into the marketplace for

financial services applications.

On August 14, 2006, the i-flex board of directors approved, and on September 14, 2006, i-flex issued

approximately 4.45 million shares of common stock at a purchase price of 1,307.5 Indian rupees per share

(Preferential Allotment). We purchased the Preferential Allotment for approximately $126 million and

increased our ownership to approximately 55%. i-flex used the proceeds from the Preferential Allotment to

fund the acquisition of Mantas, Inc., a financial services application software company, in October 2006.

As required by Indian law, we published an announcement on September 12, 2006 notifying the public

shareholders of i-flex of our intention to make an open offer to purchase up to 20% of the outstanding equity

of i-flex for 1,475 Indian rupees per share. On December 7, 2006, we increased the price of our open offer by

42% to 2,100 Indian rupees per share including interest, and increased the number of incremental shares that

we were willing to purchase to 35%. We also publicly announced at that time that the offer was the last

opportunity for i-flex shareholders to tender their shares to us for the foreseeable future as we had no intention

of soliciting any additional open offers or delisting i-flex shares for at least the next five years unless i-flex

shares were selling at a price lower than our offer price of 2,100 Indian rupees per share. On January 6, 2007

we accepted the 23 million shares tendered in the offer for approximately $1.1 billion and we increased our

ownership in i-flex to approximately 83%.

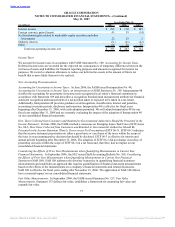

Our cumulative investment in i-flex as of May 31, 2007 was approximately $2.1 billion, which consisted of

$2,039 million of cash paid for common stock and $30 million in transaction costs and other expenses.

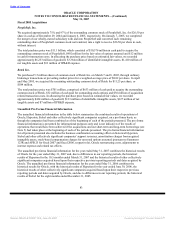

Our cumulative investment in i-flex has been allocated to i-flex’s net tangible and identifiable intangible

assets based on their estimated fair values as of the respective dates of acquisition of the interests. The

minority interest in the net assets of i-flex has been recorded at historical book values. The excess of the

cumulative purchase price over our interest in the net tangible and identifiable intangible assets was recorded

as goodwill. Our preliminary allocation of the cumulative purchase price including the minority interest in the

net assets of i-flex is as follows:

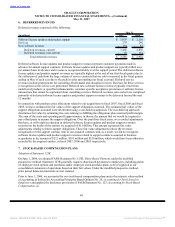

(in millions)

Cash and marketable securities $ 145

Trade receivables 141

Goodwill 1,564

Intangible assets 281

Other assets 125

Accounts payable and other liabilities (53)

Deferred tax liabilities, net (93)

Deferred revenues (25)

In-process research and development 46

Minority interests (62)

Total purchase price $ 2,069

The preliminary allocation of the purchase price was based upon a preliminary valuation and our estimates

and assumptions are subject to change. The primary areas of the purchase price allocation that are not yet

finalized relate to identifiable intangible assets, certain legal matters, income and non-income based taxes and

residual goodwill.

81

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠