Oracle 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

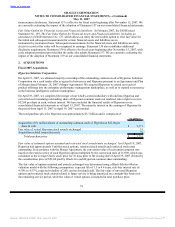

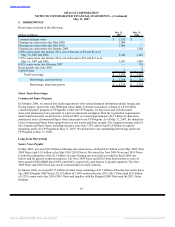

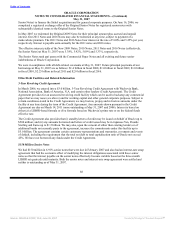

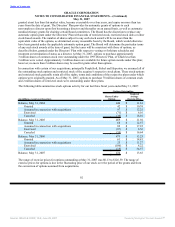

5. BORROWINGS

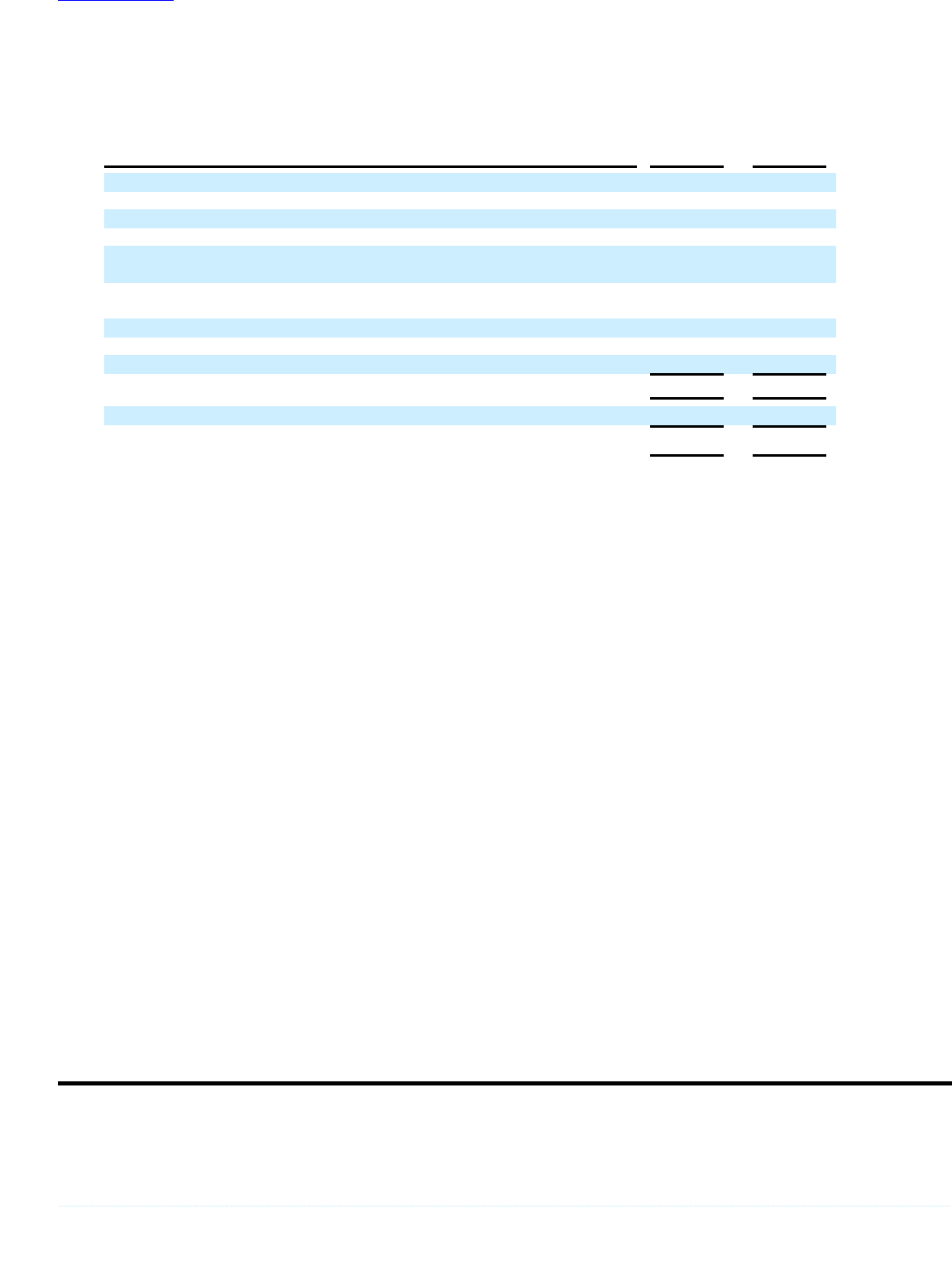

Borrowings consisted of the following:

May 31, May 31,

(Dollars in millions) 2007 2006

Commercial paper notes $ 1,355 $ —

Floating rate senior notes due May 2009 1,000 —

Floating rate senior notes due May 2010 1,000 —

Floating rate senior notes due January 2009 — 1,500

5.00% senior notes due January 2011, net of discount of $6 and $8 as of

May 31, 2007 and 2006 2,244 2,242

5.25% senior notes due January 2016, net of discount of $9 and $11 as of

May 31, 2007 and 2006 1,991 1,989

6.91% senior notes due February 2007 — 150

Notes payable due June 2006 — 6

Capital leases 3 7

Total borrowings $ 7,593 $ 5,894

Borrowings, current portion $ 1,358 $ 159

Borrowings, long-term portion $ 6,235 $ 5,735

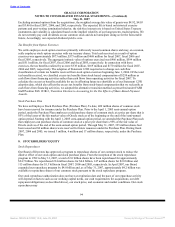

Short-Term Borrowings

Commercial Paper Program

In February 2006, we entered into dealer agreements with various financial institutions and an Issuing and

Paying Agency Agreement with JPMorgan Chase Bank, National Association, relating to a $3.0 billion

commercial paper program (CP Program). Under the CP Program, we may issue and sell unsecured

short-term promissory notes pursuant to a private placement exemption from the registration requirements

under federal and state securities laws. In fiscal 2007, we issued approximately $2.1 billion of short-term

promissory notes (Commercial Paper Notes) pursuant to our CP Program. As of May 31, 2007, the maturities

of the Commercial Paper Notes ranged between two weeks and three months. The weighted average yield of

the Commercial Paper Notes, including issuance costs was 5.33% and we had $1.6 billion of capacity

remaining under our CP Program at May 31, 2007. We did not have any outstanding borrowings under our

CP Program at May 31, 2006.

Long-Term Borrowings

Senior Notes Payable

In May 2007, we issued $2.0 billion of floating rate senior notes, of which $1.0 billion is due May 2009 (New

2009 Notes) and $1.0 billion is due May 2010 (2010 Notes). We issued the New 2009 Notes and 2010 Notes

to fund the redemption of the $1.5 billion of senior floating rate notes that we issued in fiscal 2006 (see

below) and for general corporate purposes. The New 2009 Notes and 2010 Notes bear interest at a rate of

three-month USD LIBOR plus 0.02% and 0.06%, respectively, and interest is payable quarterly. The New

2009 Notes and 2010 Notes may not be redeemed prior to their maturity.

In January 2006, we issued $5.75 billion of senior notes consisting of $1.5 billion of floating rate senior notes

due 2009 (Original 2009 Notes), $2.25 billion of 5.00% senior notes due 2011 (2011 Notes) and $2.0 billion

of 5.25% senior notes due 2016 (2016 Notes and together with the Original 2009 Notes and the 2011 Notes,

Original

87

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠