Oracle 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

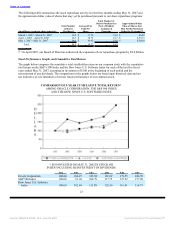

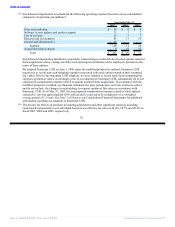

recognized under Opinion 25 related to options assumed from acquisitions. For pro forma disclosures, the

estimated fair values for options granted and options assumed were amortized using the accelerated expense

attribution method. In addition, we reduced pro forma stock compensation expense for actual forfeitures in

the periods they occurred. In March 2005, the Securities and Exchange Commission issued Staff Accounting

Bulletin (SAB) No. 107, which provides supplemental implementation guidance for Statement 123R. We

have applied the provisions of SAB 107 in our adoption of Statement 123R. See Note 7 of Notes to

Consolidated Financial Statements for information on the impact of our adoption of Statement 123R and the

assumptions we use to calculate the fair value of share-based employee compensation.

Upon our adoption of Statement 123R, we were required to estimate the awards that we ultimately expect to

vest and to reduce stock-based compensation expense for the effects of estimated forfeitures of awards over

the expense recognition period. Although we estimated forfeitures based on historical experience, forfeitures

in the future may differ. Under Statement 123R, the forfeiture rate must be revised if actual forfeitures differ

from our original estimates. Also in connection with our adoption of Statement 123R, we elected to recognize

awards granted after our adoption date under the straight-line amortization method.

We estimate the fair value of employee stock options using a Black-Scholes valuation model. The fair value

of an award is affected by our stock price on the date of grant as well as other assumptions including the

estimated volatility of our stock price over the term of the awards and the estimated period of time that we

expect employees to hold their stock options. The risk-free interest rate assumption is based upon United

States treasury interest rates appropriate for the expected life of the awards. We use the implied volatility of

our publicly traded stock options in order to estimate future stock price trends as we believe that implied

volatility is more representative of future stock price trends than historical volatility. In order to determine the

estimated period of time that we expect employees to hold their stock options, we have used historical rates of

employee groups by job classification. Our expected dividend rate is zero since we do not currently pay cash

dividends on our common stock and do not anticipate doing so in the foreseeable future.

We record deferred tax assets for stock-based awards that result in deductions on our income tax returns,

based on the amount of stock-based compensation recognized and the statutory tax rate in the jurisdiction in

which we will receive a tax deduction. Differences between the deferred tax assets recognized for financial

reporting purposes and the actual tax deduction reported on our income tax returns are recorded in additional

paid-in capital. If the tax deduction is less than the deferred tax asset, such shortfalls reduce our pool of

excess tax benefits. If the pool of excess tax benefits is reduced to zero, then subsequent shortfalls would

increase our income tax expense. Our pool of excess tax benefits is computed in accordance with the

alternative transition method as prescribed under FASB Staff Position FAS 123R-3, Transition Election to

Accounting for the Tax Effects of Share-Based Payment Awards.

The accounting guidance under Statement 123R is relatively new and several interpretations have been

released since the pronouncement has been issued. Additional interpretations may be released and the

application of these principles may be subject to further refinement over time. In addition, to the extent we

change the terms of our employee stock-based compensation programs, refine different assumptions in future

periods such as forfeiture rates that differ from our estimates and implement the change in our expense

attribution method from accelerated to straight-line, which we elected when adopting Statement 123R, the

stock-based compensation expense that we record in future periods may differ significantly from what we

have recorded during our fiscal 2007 reporting periods.

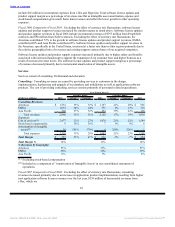

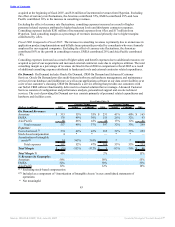

Allowances for Doubtful Accounts and Returns

We make judgments as to our ability to collect outstanding receivables and provide allowances for the portion

of receivables when collection becomes doubtful. Provisions are made based upon a specific review of all

significant outstanding invoices. For those invoices not specifically reviewed, provisions are provided at

differing rates, based upon the age of the receivable, the collection history associated with the geographic

region that the receivable was recorded and current economic trends. If the historical data we use to calculate

the allowance for doubtful accounts does not reflect the future ability to collect outstanding receivables,

additional provisions for doubtful accounts may be needed and the future results of operations could be

materially affected.

33

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠