Oracle 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

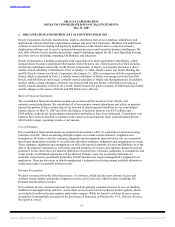

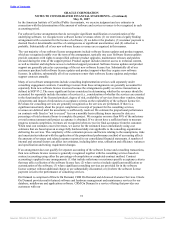

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

measurement disclosures. Statement 157 is effective for fiscal years beginning after November 15, 2007. We

are currently evaluating the impact of the adoption of Statement 157 on our consolidated financial statements.

Fair Value Option for Financial Assets and Financial Liabilities: In February 2007, the FASB issued

Statement No. 159, The Fair Value Option for Financial Assets and Financial Liabilities, including an

amendment of FASB Statement No. 115, which allows an entity the irrevocable option to elect fair value for

the initial and subsequent measurement for certain financial assets and liabilities on an

instrument-by-instrument basis. Subsequent measurements for the financial assets and liabilities an entity

elects to record at fair value will be recognized in earnings. Statement 159 also establishes additional

disclosure requirements. Statement 159 is effective for fiscal years beginning after November 15, 2007, with

early adoption permitted provided that the entity also adopts Statement 157. We are currently evaluating the

impact of the adoption of Statement 159 on our consolidated financial statements.

2. ACQUISITIONS

Fiscal 2007 Acquisitions

Hyperion Solutions Corporation

On April 13, 2007, we obtained majority ownership of the outstanding common stock of Hyperion Solutions

Corporation via a cash tender offer as agreed to between us and Hyperion pursuant to an Agreement and Plan

of Merger dated February 28, 2007 (Merger Agreement). We acquired Hyperion to extend our reach of

product offerings into the enterprise performance management marketplace, as well as to expand our presence

in the business intelligence software marketplace.

On April 19, 2007, we completed the merger of our wholly-owned subsidiary with and into Hyperion and

converted each remaining outstanding share of Hyperion common stock not tendered, into a right to receive

$52.00 per share in cash, without interest. We have included the financial results of Hyperion in our

consolidated financial statements as of April 13, 2007. The minority interest in the earnings of Hyperion for

the period from April 13, 2007 to April 19, 2007 was nominal.

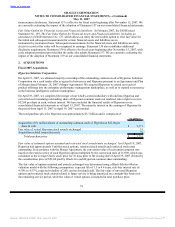

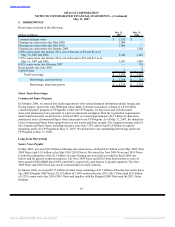

The total purchase price for Hyperion was approximately $3.3 billion and is comprised of:

(in millions)

Acquisition of 61 million shares of outstanding common stock of Hyperion at $52.00 per

share in cash $ 3,171

Fair value of vested Hyperion stock awards exchanged 51

Acquisition related transaction costs 29

Total purchase price $ 3,251

Fair value of estimated options assumed and restricted stock awards/units exchanged: As of April 19, 2007,

Hyperion had approximately 6 million stock options, restricted stock awards and restricted stock units

outstanding. In accordance with the Merger Agreement, the conversion value of each option assumed was

based on the exercise price of each Hyperion option multiplied by the conversion ratio of 0.3598, which was

calculated as the average Oracle stock price for 10 days prior to the closing date of April 19, 2007 divided by

the consideration price of $52.00 paid by Oracle for each Hyperion common share outstanding.

The fair value of options assumed and awards exchanged was determined using a Black-Scholes-Merton

valuation model with the following assumptions: expected life of 1.5 to 4.4 years, risk-free interest rate of

4.50% to 4.57%, expected volatility of 26% and no dividend yield. The fair value of unvested Hyperion

options and restricted stock awards related to future service is being amortized on a straight-line basis over

the remaining service period, while the value of vested options is included in total purchase price.

78

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠