Oracle 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

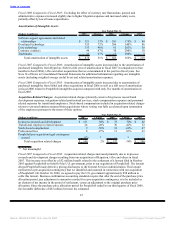

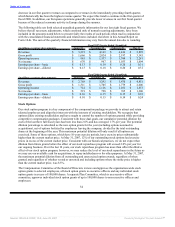

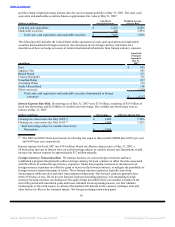

and the related weighted average interest rates for our investment portfolio at May 31, 2007. The cash, cash

equivalent and marketable securities balances approximate fair value at May 31, 2007:

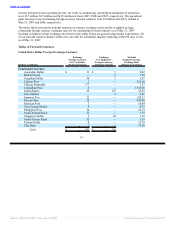

Amortized Weighted Average

(Dollars in millions) Principal Amount Interest Rate

Cash and cash equivalents $ 6,218 4.08%

Marketable securities 802 2.89%

Total cash, cash equivalents and marketable securities $ 7,020 3.95%

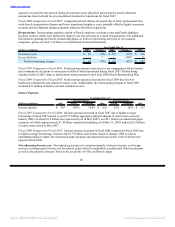

The following table includes the United States dollar equivalent of cash, cash equivalents and marketable

securities denominated in foreign currencies. See discussion of our foreign currency risk below for a

description of how we hedge net assets of certain international subsidiaries from foreign currency exposure.

Amortized

Principal

Amount at

May 31,

(in millions) 2007

Euro $ 892

Japanese Yen 681

British Pound 371

Chinese Renminbi 336

Canadian Dollar 237

Australian Dollar 218

South African Rand 118

Other currencies 1,359

Total cash, cash equivalents and marketable securities denominated in foreign

currencies $ 4,212

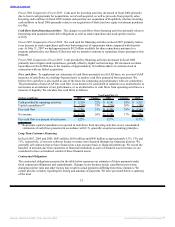

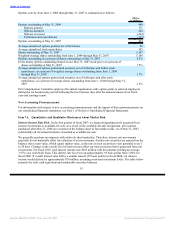

Interest Expense Rate Risk. Borrowings as of May 31, 2007 were $7.6 billion, consisting of $5.6 billion of

fixed rate borrowings and $2.0 billion of variable rate borrowings. Our variable rate borrowings were as

follows at May 31, 2007:

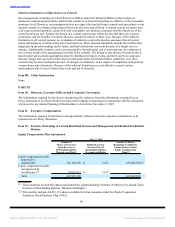

(Dollars in millions) Borrowings Effective Interest Rate

Floating rate senior notes due May 2009(1) $ 1,000 5.38%

Floating rate senior notes due May 2010(1) 1,000 5.42%

Total borrowings subject to variable interest rate

fluctuations $ 2,000

(1) The 2009 and 2010 Notes bear interest at a floating rate equal to three-month LIBOR plus 0.02% per year

and 0.06% per year, respectively.

Interest expense for fiscal 2007 was $343 million. Based on effective interest rates at May 31, 2007, a

50 basis point increase in interest rates on our borrowings subject to variable interest rate fluctuations would

increase our interest expense by approximately $17 million annually.

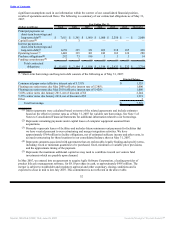

Foreign Currency Transaction Risk. We transact business in various foreign currencies and have

established a program that primarily utilizes foreign currency forward contracts to offset the risks associated

with the effects of certain foreign currency exposures. Under this program, increases or decreases in our

foreign currency exposures are offset by gains or losses on the forward contracts, to mitigate the possibility of

foreign currency transaction gains or losses. These foreign currency exposures typically arise from

intercompany sublicense fees and other intercompany transactions. Our forward contracts generally have

terms of 90 days or less. We do not use forward contracts for trading purposes. All outstanding foreign

currency forward contracts (excluding our Yen equity hedge described below) are marked to market at the

end of the period with unrealized gains and losses included in non-operating income, net. Our ultimate

realized gain or loss with respect to currency fluctuations will depend on the currency exchange rates and

other factors in effect as the contracts mature. Net foreign exchange transaction gains

56

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠