Oracle 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

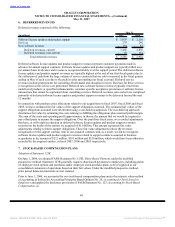

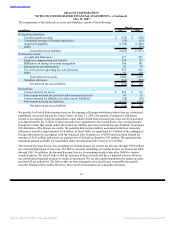

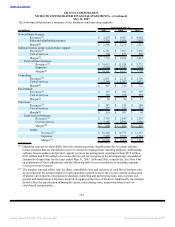

Excluding assumed options from the acquisitions, the weighted average fair value of grants was $4.92, $4.03

and $3.46 for fiscal 2007, 2006, and 2005, respectively. The expected life is based on historical exercise

patterns and post-vesting termination behavior, the risk-free interest rate is based on United States Treasury

instruments and volatility is calculated based on the implied volatility of our longest-term, traded options. We

do not currently pay cash dividends on our common stock and do not anticipate doing so for the foreseeable

future. Accordingly, our expected dividend yield is zero.

Tax Benefits from Option Exercises

We settle employee stock option exercises primarily with newly issued common shares and may, on occasion,

settle employee stock option exercises with our treasury shares. Total cash received as a result of option

exercises was approximately $873 million, $573 million and $468 million for fiscal 2007, fiscal 2006 and

fiscal 2005, respectively. The aggregate intrinsic value of options exercised was $986 million, $594 million

and $511 million, for fiscal 2007, fiscal 2006 and fiscal 2005, respectively. In connection with these

exercises, the tax benefits realized by us were $338 million, $169 million and $170 million for fiscal 2007,

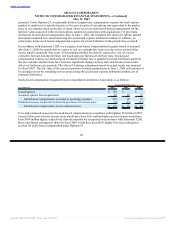

2006 and 2005, respectively. The adoption of Statement 123R required us to change our cash flow

classification of certain tax benefits received from stock option exercises beginning June 1, 2006. Of the total

tax benefits received, we classified excess tax benefits from stock-based compensation of $259 million as

cash flows from financing activities rather than cash flows from operating activities for fiscal 2007. To

calculate the excess tax benefits available for use in offsetting future tax shortfalls as of our Statement 123R

adoption date, which also affects the excess tax benefits from stock-based compensation that we reclassify as

cash flows from financing activities, we adopted the alternative transition method as prescribed under FASB

Staff Position FAS 123R-3, Transition Election to Accounting for the Tax Effects of Share-Based Payment

Awards.

Stock Purchase Plan

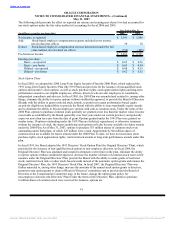

We have an Employee Stock Purchase Plan (Purchase Plan). To date, 409 million shares of common stock

have been reserved for issuance under the Purchase Plan. Prior to the April 1, 2005 semi-annual option

period, under the Purchase Plan employees could purchase shares of common stock at a price per share that is

85% of the lesser of the fair market value of Oracle stock as of the beginning or the end of the semi-annual

option period. Starting with the April 1, 2005 semi-annual option period, we amended the Purchase Plan such

that employees can purchase shares of common stock at a price per share that is 95% of the fair value of

Oracle stock as of the end of the semi-annual option period. Through May 31, 2007, 325 million shares had

been issued and 84 million shares were reserved for future issuances under the Purchase Plan. During fiscal

2007, 2006 and 2005, we issued 3 million, 6 million and 17 million shares, respectively, under the Purchase

Plan.

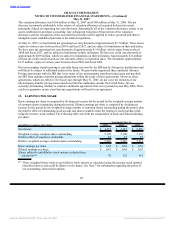

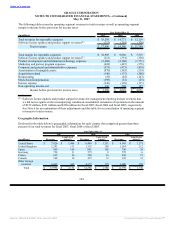

8. STOCKHOLDERS’ EQUITY

Stock Repurchases

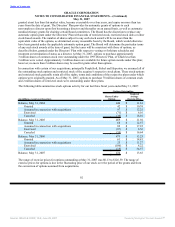

Our Board of Directors has approved a program to repurchase shares of our common stock to reduce the

dilutive effect of our stock option and stock purchase plans. From the inception of the stock repurchase

program in 1992 to May 31, 2007, a total of 2.0 billion shares have been repurchased for approximately

$24.7 billion. We repurchased 234 million shares for $4.0 billion, 147 million shares for $2.0 billion and

115 million shares for $1.3 billion in fiscal 2007, 2006 and 2005, respectively. In April 2007, our Board

expanded our repurchase program by $4.0 billion and, as of May 31, 2007, approximately $4.2 billion was

available to repurchase shares of our common stock pursuant to the stock repurchase program.

Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity

will depend on factors such as our working capital needs, our cash requirements for acquisitions, our debt

repayment obligations (as described above), our stock price, and economic and market conditions. Our stock

repurchases may

94

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠