Oracle 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

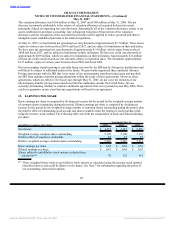

and infrequent history of prior indemnification claims and the unique facts and circumstances involved in

each particular agreement. Historically, payments made by us under these agreements have not had a material

effect on our results of operations, financial position, or cash flows.

Our software license agreements also generally include a warranty that our software products will

substantially operate as described in the applicable program documentation for a period of one year after

delivery. We also warrant that services we perform will be provided in a manner consistent with industry

standards for a period of 90 days from performance of the service. Warranty expense was not significant in

fiscal 2007, fiscal 2006 or fiscal 2005.

We occasionally are required, for various reasons, to enter into agreements with financial institutions that

provide letters of credit on our behalf to parties we conduct business with in ordinary course. Such

agreements have not had a material effect on our results of operations, financial position or cash flows.

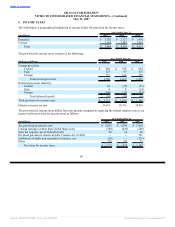

18. COMMITMENTS

Lease Commitments

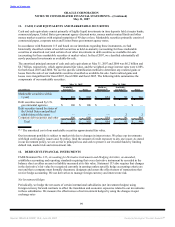

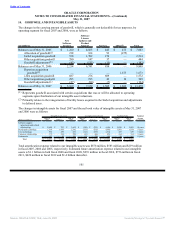

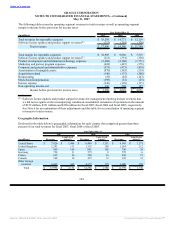

We lease certain facilities and furniture and equipment under operating leases. As of May 31, 2007, future

minimum annual operating lease payments and future minimum payments to be received from non-cancelable

subleases were as follows:

Year Ended

(in millions) May 31,

2008 $ 339

2009 301

2010 242

2011 162

2012 124

Thereafter 280

Future minimum operating lease payments 1,448

Less: Minimum payments to be received from non-cancelable subleases (190)

Total, net $ 1,258

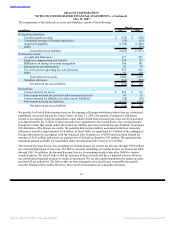

Lease commitments include future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities, as discussed in Note 3. We have approximately $364 million

in facility obligations, net of estimated sublease income and other costs, in accrued restructuring for these

locations in our consolidated balance sheet at May 31, 2007.

Rent expense was $224 million, $175 million and $174 million for fiscal years 2007, 2006 and 2005,

respectively, net of sublease income of approximately $32 million, $23 million and $10 million, respectively.

Certain lease agreements contain renewal options providing for an extension of the lease term.

Unconditional Purchase Obligations

In the ordinary course of business, we enter into certain unconditional purchase obligations with our

suppliers, which are agreements that are enforceable, legally binding and specify certain minimum quantity

and pricing terms. As of May 31, 2007, our unconditional purchase obligations total $73 million for fiscal

2008, $196 million for fiscal 2009, $3 million for fiscal 2010, $3 million for fiscal 2011, $3 million for fiscal

2012 and $14 million thereafter.

106

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠