Oracle 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

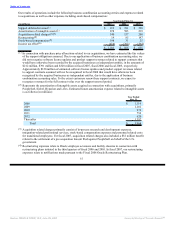

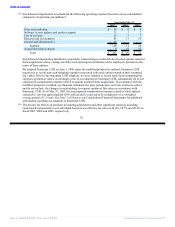

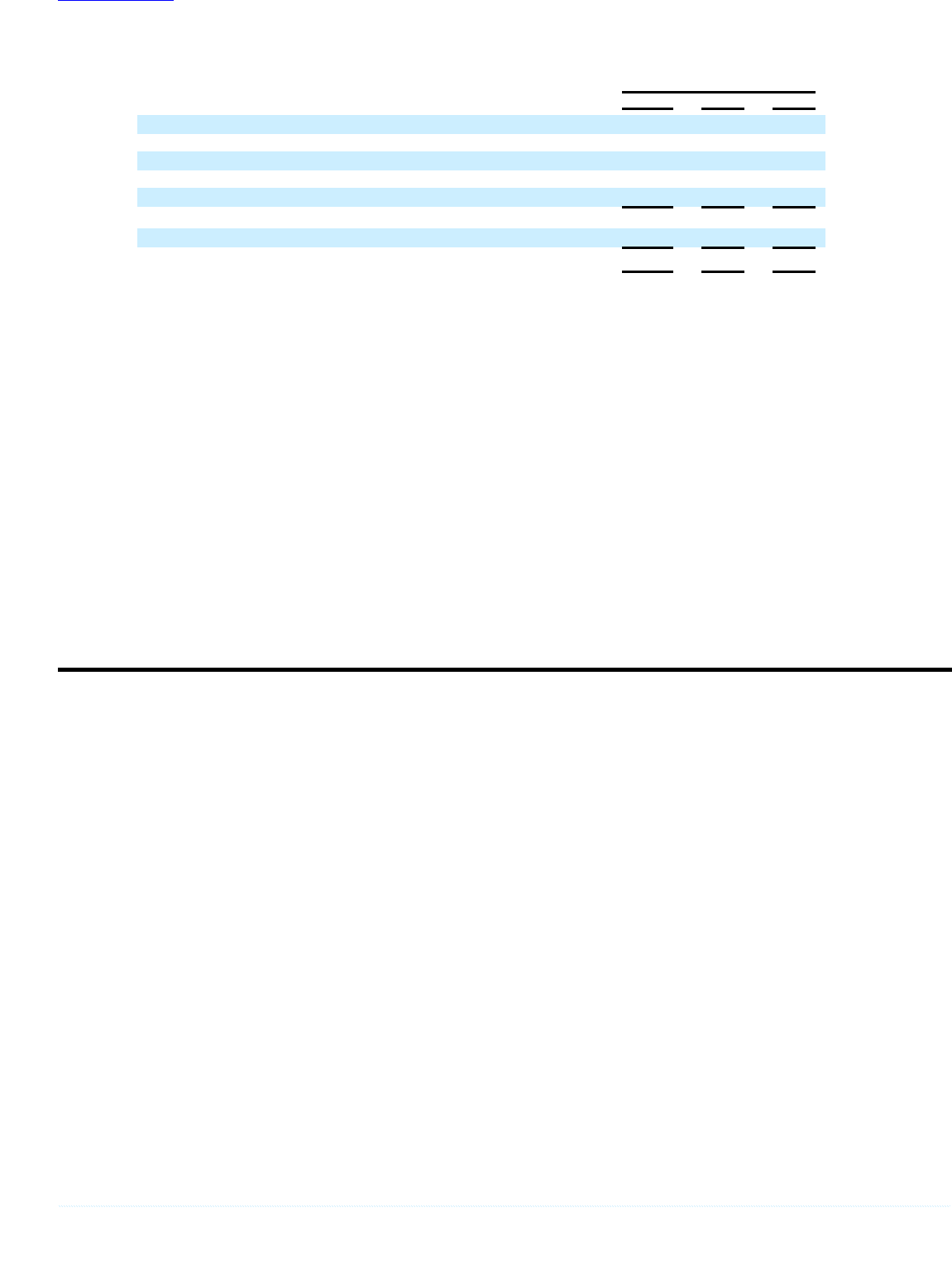

(5) Stock-based compensation is included in the following operating expense line items of our consolidated

statements of operations (in millions):

Year Ended May 31,

2007 2006 2005

Sales and marketing $ 38 $ 8 $ 6

Software license updates and product support 11 3 2

Cost of services 15 7 7

Research and development 85 13 10

General and administrative 49 — —

Subtotal 198 31 25

Acquisition related charges 9 18 47

Total $ 207 $ 49 $ 72

Stock-based compensation included in acquisition related charges resulted from unvested options assumed

from acquisitions whose vesting was fully accelerated upon termination of the employees pursuant to the

terms of these options.

We adopted Statement 123R on June 1, 2006 under the modified prospective method. Statement 123R

requires us to record non-cash operating expenses associated with stock option awards at their estimated

fair values. Prior to our Statement 123R adoption, we were required to record stock-based compensation

expenses at intrinsic values. Accordingly, prior to our adoption of Statement 123R, substantially all of our

stock-based compensation expense related to options assumed from acquisitions. In accordance with the

modified prospective method, our financial statements for prior periods have not been restated to reflect,

and do not include, the changes in methodology to expense options at fair values in accordance with

Statement 123R. As of May 31, 2007, the unrecognized compensation expense related to stock options

expected to vest was approximately $356 million and is expected to be recognized over a weighted

average period of 1.3 years. See Note 7 of Notes to our Consolidated Financial Statements for additional

information regarding our adoption of Statement 123R.

(6) The income tax effects on purchase accounting adjustments and other significant expenses including

stock-based compensation were calculated based on our effective tax rates of 28.6%, 29.7% and 28.8% in

fiscal 2007, 2006 and 2005, respectively

38

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠