Oracle 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

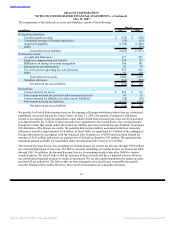

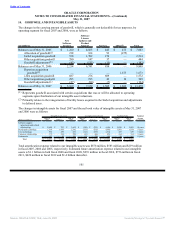

The aforementioned unconditional purchase obligations amounts include a property commitment entered into

by one of our subsidiaries to purchase land and buildings for approximately $342 million, of which

approximately $64 million was paid in fiscal 2007 and $66 million was paid in fiscal 2006. The remaining

commitments for the property will be paid in fiscal 2009.

19. BENEFIT PLANS

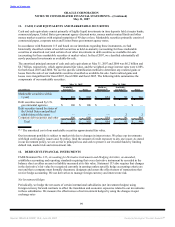

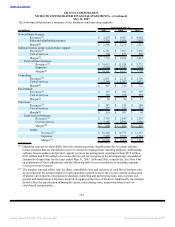

We offer various defined contribution plans for our U.S. and non-U.S. employees. Total defined contribution

plan expense was $198 million, $170 million and $147 million for fiscal years 2007, 2006 and 2005,

respectively. In fiscal 2007, fiscal 2006 and 2005, we increased the number of plan participants in our defined

contribution plans primarily as a result of additional employees from our acquisitions.

In the United States, regular employees can participate in the Oracle Corporation 401(k) Savings and

Investment Plan (Oracle 401(k) Plan). Participants can generally contribute up to 40% of their eligible

compensation on a per-pay-period basis as defined by the plan document or by the section 402(g) limit as

defined by the Internal Revenue Service. We match a portion of employee contributions, currently 50% up to

6% of compensation each pay period, subject to maximum aggregate matching amounts. Our contributions to

the plan, net of forfeitures, were $67 million, $58 million and $46 million in fiscal 2007, 2006 and 2005,

respectively.

We also offer non-qualified deferred compensation plans to certain key employees whereby they may defer a

portion of their annual base and/or variable compensation until retirement or a date specified by the employee

in accordance with the plans. Deferred compensation plan assets and liabilities were approximately

$195 million and $165 million as of May 31, 2007 and 2006, respectively, and are presented in other assets

and other long-term liabilities in the accompanying consolidated balance sheets.

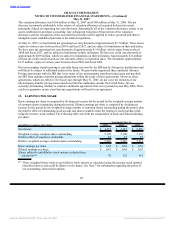

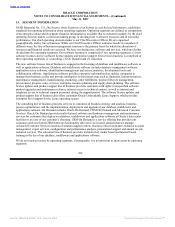

In September 2006, FASB Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132(R) was issued. Statement

158 requires plan sponsors of defined benefit pension and other postretirement benefit plans (Plans) to

recognize the funded status of their Plans in the balance sheet, measure the fair value of plan assets and

benefit obligations as of the date of the balance sheet and provide additional disclosures.

We are the sponsor of a defined benefit pension plan covering certain employees in the United Kingdom and,

on May 31, 2007 we adopted the recognition and disclosure provisions of Statement 158. Statement 158

required us to recognize the funded status (i.e., the difference between the fair value of plan assets and the

projected benefit obligations) of our pension plan in the May 31, 2007 balance sheet, with a corresponding

adjustment to accumulated other comprehensive income, net of tax. The net of tax impact on accumulated

other comprehensive income of adopting Statement 158 was $29 million at May 31, 2007.

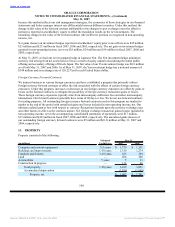

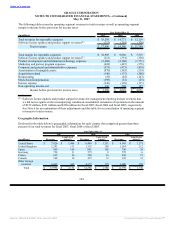

20. RELATED PARTIES

We have entered into transactions with 11 companies over the last three fiscal years in which our Chief

Executive Officer, directly or indirectly, has a controlling interest. These companies purchased software and

services for $2.3 million, $4.7 million and $4.1 million during fiscal 2007, 2006 and 2005, respectively. In

addition, we purchased goods and services from five of these companies for $1.8 million, $1.0 million and

$0.8 million in fiscal 2007, 2006 and 2005, respectively.

In connection with our acquisition of PeopleSoft, we assumed a sublease with a company in which our Chief

Executive Officer holds a controlling interest and we received payments of $0.1 million and $0.2 million

during fiscal 2006 and 2005, respectively. The sublease was terminated in the first quarter of fiscal 2006

when this company entered into a direct lease with the landlord.

In fiscal 2006 and 2005, we received $0.1 million and $0.6 million, respectively, for purchases of software

and services from two companies affiliated with two other members of our Board of Directors who are, or

were,

107

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠