Oracle 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

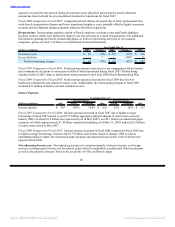

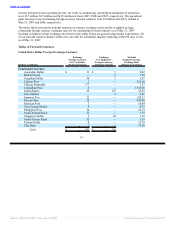

Euro Foreign Exchange Contracts

Exchange Exchange Notional

Foreign Currency Euros for Weighted Average

for Euros Foreign Currency Exchange Rate

(Euros in millions) (Notional Amount) (Notional Amount) (Market Convention)

Functional Currency:

Swiss Franc € 5 € — 1.64

Danish Krone 3 — 7.45

British Pound 42 — 0.68

Indian Rupee — 4 54.31

Israeli Shekel 4 — 5.44

Norwegian Krone 4 — 8.11

Polish Zloty 5 — 3.83

Saudi Arabian Riyal 3 — 5.07

Slovakian Koruna 1 — 34.08

Swedish Krona 5 — 9.26

United States Dollar 19 — 1.35

South African Rand 27 — 9.73

Total € 118 € 4

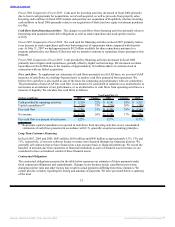

Net Investment Risk. Periodically, we hedge the net assets of certain international subsidiaries (net

investment hedges) using foreign currency forward contracts to offset the translation and economic exposures

related to our investments in these subsidiaries. We measure the effectiveness of net investment hedges by

using the changes in spot exchange rates because this method reflects our risk management strategies, the

economics of those strategies in our financial statements and better manages interest rate differentials between

different countries. Under this method, the change in fair value of the forward contract attributable to the

changes in spot exchange rates (the effective portion) is reported in stockholders’ equity to offset the

translation results on the net investments. The remaining change in fair value of the forward contract (the

ineffective portion) is recognized in non-operating income, net.

Net gains (losses) on investment hedges reported in stockholders’ equity prior to tax effects were $45 million,

$23 million and $(23) million in fiscal 2007, 2006 and 2005, respectively. The net gain on investment hedges

reported in non-operating income, net were $28 million, $24 million and $14 million in fiscal 2007, 2006 and

2005, respectively.

At May 31, 2007, we had one net investment hedge in Japanese Yen. The Yen investment hedge minimizes

currency risk arising from net assets held in Yen as a result of equity capital raised during the initial public

offering and secondary offering of Oracle Japan. The fair value of our Yen investment hedge was $0.2 million

at May 31, 2007 and 2006. As of May 31, 2007, the Yen investment hedge has a notional amount of

$548 million and an exchange rate of 120.22 Yen for each United States dollar.

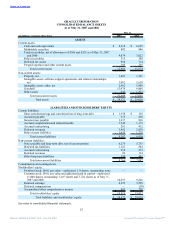

Item 8. Financial Statements and Supplementary Data

The response to this item is submitted as a separate section of this Annual Report on Form 10-K. See Part IV,

Item 15.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable.

58

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠