Oracle 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

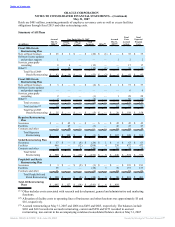

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

defined as when our cost basis exceeds the fair value for approximately six months, we recognize the

investment loss in non-operating income, net in the accompanying consolidated statements of operations. We

periodically evaluate our investments to determine if impairment charges are required.

The net carrying value of our marketable equity securities and other investments, which approximated fair

value, as of May 31, 2007 and 2006 was $67 million and $81 million, respectively. Marketable equity

securities are included in other assets in the accompanying consolidated balance sheets. Unrealized gains

(losses) in stockholders’ equity, net of tax associated with marketable equity securities were $(4) million,

$(3) million and $6 million for fiscal 2007, 2006 and 2005, respectively. We had nominal impairment losses

related to marketable equity securities and other investments in fiscal 2007, 2006 and 2005.

Property

Property is stated at the lower of cost or realizable value, net of accumulated depreciation. Depreciation is

computed using the straight-line method based on estimated useful lives of the assets, which range from one

to fifty years. Leasehold improvements are amortized over the lesser of estimated useful lives or lease terms,

as appropriate. Property is periodically reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. We did not recognize any property

impairment charges in fiscal 2007, 2006 or 2005.

Goodwill and Intangible Assets

Goodwill represents the excess of the purchase price in a business combination over the fair value of net

tangible and intangible assets acquired. Goodwill amounts are not amortized, but rather are tested for

impairment at least annually. Intangible assets that are not considered to have an indefinite useful life are

amortized over their useful lives, which range from one to ten years. The carrying amount of these assets is

reviewed whenever events or changes in circumstances indicate that the carrying value of an asset may not be

recoverable. Recoverability of these assets is measured by comparison of the carrying amount of the asset to

the future undiscounted cash flows the asset is expected to generate. If the asset is considered to be impaired,

the amount of any impairment is measured as the difference between the carrying value and the fair value of

the impaired asset. We did not recognize any goodwill or intangible asset impairment charges in fiscal 2007,

2006 or 2005.

Fair Value of Financial Instruments

The carrying value of our cash, cash equivalents and short-term borrowings approximates fair value due to the

short period of time to maturity. We record changes in fair value for our marketable securities, publicly-traded

equity securities, foreign currency forward contracts and investment hedge based on quoted market prices.

Based on the trading prices of our $6.25 billion and $5.75 billion senior notes outstanding as of May 31, 2007

and 2006, respectively, and the interest rates we could obtain for other borrowings with similar terms at those

dates, the estimated fair value of our borrowings at May 31, 2007 and 2006 was $6.16 billion and

$5.73 billion, respectively.

Legal Contingencies

We are currently involved in various claims and legal proceedings. Quarterly, we review the status of each

significant matter and assess our potential financial exposure. If the potential loss from any claim or legal

proceeding is considered probable and the amount can be reasonably estimated, we accrue a liability for the

estimated loss.

Foreign Currency

We transact business in various foreign currencies. In general, the functional currency of a foreign operation

is the local country’s currency. Consequently, revenues and expenses of operations outside the United States

are translated

75

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠