Oracle 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

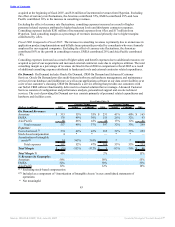

Table of Contents

exposure recorded for this lawsuit during the purchase price allocation period and the actual settlement

amount has been included in our consolidated statement of operations for fiscal 2007.

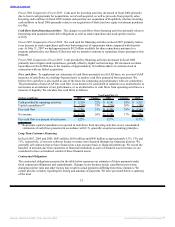

Fiscal 2006 Compared to Fiscal 2005: Acquisition related charges decreased due to lower professional fees,

stock-based compensation charges and lower transitional employee costs, partially offset by higher in-process

research and development charges primarily related to the Siebel acquisition.

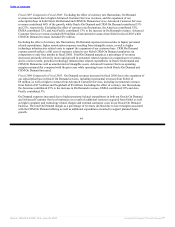

Restructuring: Restructuring expenses consist of Oracle employee severance costs and Oracle duplicate

facilities closures which were initiated to improve our cost structure as a result of acquisitions. For additional

information regarding the Oracle restructuring plans, as well as restructuring activities of our acquired

companies, please see Note 3 of Notes to Consolidated Financial Statements.

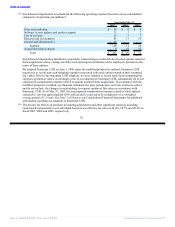

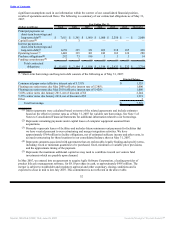

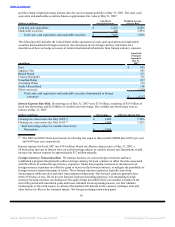

Year Ended May 31,

(Dollars in millions) 2007 Change 2006 Change 2005

Severance costs $ 19 -78% $ 85 -33% $ 126

Excess facilities — * — -100% 21

Total restructuring charges $ 19 -78% $ 85 -42% $ 147

Fiscal 2007 Compared to Fiscal 2006: Restructuring expenses decreased as our management did not initiate

and communicate any plans to restructure our Oracle-based operations during fiscal 2007. Restructuring

expenses in fiscal 2007 relate to notifications made pursuant to the Fiscal 2006 Oracle Restructuring Plan.

Fiscal 2006 Compared to Fiscal 2005: Restructuring expenses decreased in fiscal 2006 due to lower

headcount terminations and related severance costs. Additionally, the restructuring program in fiscal 2005

included $21 million of facility exit and termination costs.

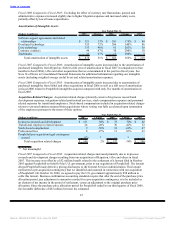

Interest Expense:

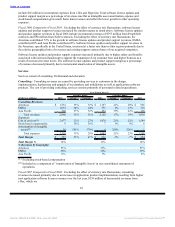

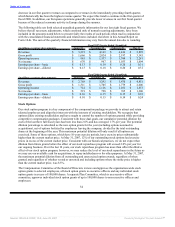

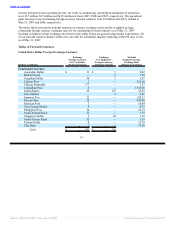

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2007 Actual Constant 2006 Actual Constant 2005

Interest expense $ 343 103% 104% $ 169 25% 26% $ 135

Fiscal 2007 Compared to Fiscal 2006: Interest expense increased in fiscal 2007 due to higher average

borrowings in fiscal 2007 related to our $5.75 billion aggregate principal amount of senior notes issued in

January 2006 (of which $1.5 billion was redeemed by us in May 2007), our $2.1 billion of commercial paper

issuances (of which approximately $1.4 billion remained outstanding as of May 31, 2007) and our $2.0 billion

of senior notes issued in May 2007.

Fiscal 2006 Compared to Fiscal 2005: Interest expense increased in fiscal 2006 compared to fiscal 2005 due

to higher average borrowings related to the $5.75 billion senior notes issued in January 2006 as well as

outstanding balances under our commercial paper program and unsecured loan facility, both of which were

repaid in fiscal 2006.

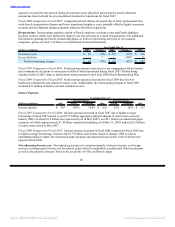

Non-Operating Income, net: Non-operating income, net consists primarily of interest income, net foreign

currency exchange gains (losses), net investment gains related to marketable securities and other investments

as well as the minority interests’ share in the net profits of i-flex and Oracle Japan.

48

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠