Oracle 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

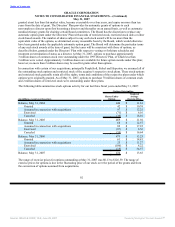

May 31, 2007

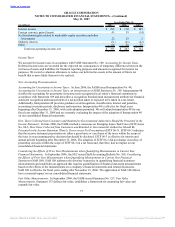

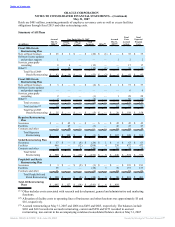

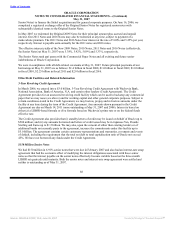

Year Ended May 31,

(in millions, except per share data) 2007 2006

Total revenues $ 18,639 $ 16,485

Net income $ 4,012 $ 2,909

Basic net income per share $ 0.78 $ 0.55

Diluted net income per share $ 0.76 $ 0.54

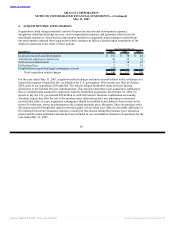

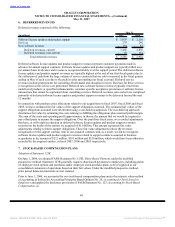

3. RESTRUCTURING ACTIVITIES

Fiscal 2007 Restructuring Plan

During the fourth quarter of our fiscal year 2007, management approved and initiated plans to restructure

certain operations of pre-merger Hyperion to eliminate redundant costs resulting from the acquisition of

Hyperion and improve efficiencies in operations. The cash restructuring charges recorded are based on

restructuring plans that have been committed to by management.

The total estimated restructuring costs associated with exiting activities of Hyperion are $108 million,

consisting primarily of excess facilities obligations through fiscal 2019 as well as severance and other

restructuring costs. These costs were recognized as a liability assumed in the purchase business combination

and included in the allocation of the cost to acquire Hyperion and, accordingly, have resulted in an increase to

goodwill. Our restructuring expenses may change as management executes the approved plan. Future

decreases to the estimates of executing the Hyperion restructuring plan will be recorded as an adjustment to

goodwill indefinitely, whereas increases to the estimates will be recorded as an adjustment to goodwill during

the purchase accounting allocation period, and as an adjustment to operating expenses thereafter.

Fiscal 2006 Restructuring Plans

During the third quarter of our fiscal year 2006, management approved and initiated plans to restructure

certain operations of Oracle and pre-merger Siebel to eliminate redundant costs resulting from the acquisition

of Siebel and improve efficiencies in operations. The cash restructuring charges recorded are based on

restructuring plans that have been committed to by management.

The total estimated severance costs associated with the Fiscal 2006 Oracle Restructuring Plan are $92 million,

all of which have been incurred to date and were recorded to the restructuring expense line within our

consolidated statements of operations. Any changes to the estimates of executing the Fiscal 2006 Oracle

Restructuring Plan will be reflected in our future results of operations.

The total estimated restructuring costs associated with exiting activities of Siebel are $574 million, consisting

primarily of excess facilities obligations through fiscal 2022 as well as severance and other restructuring costs.

These costs were recognized as a liability assumed in the purchase business combination and included in the

allocation of the cost to acquire Siebel and, accordingly, have resulted in an increase to goodwill. Our

restructuring expenses may change as management executes the approved plan. Future decreases to the

estimates of executing the Siebel restructuring plan will be recorded as an adjustment to goodwill indefinitely,

whereas increases to the estimates will be recorded as operating expenses.

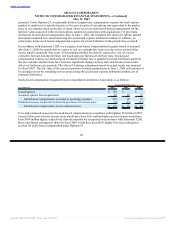

Fiscal 2005 Restructuring Plans

During the third quarter of fiscal 2005, management approved and initiated plans to restructure the operations

of Oracle, PeopleSoft, and Retek Inc. Total estimated restructuring costs associated with the Fiscal 2005

Oracle Restructuring Plan were $158 million and were recorded to the restructuring expense line within our

consolidated statements of operations. Total estimated restructuring costs associated with exiting activities of

PeopleSoft and

84

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠