Oracle 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

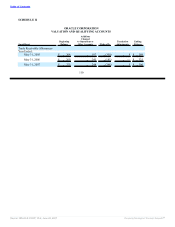

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

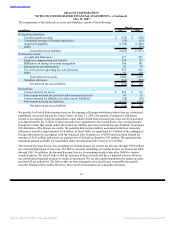

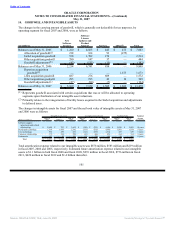

14. GOODWILL AND INTANGIBLE ASSETS

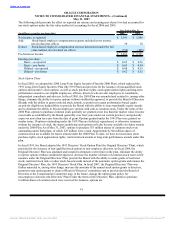

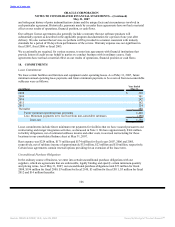

The changes in the carrying amount of goodwill, which is generally not deductible for tax purposes, by

operating segment for fiscal 2007 and 2006, were as follows:

Software

License

New Updates and

Software Product

(in millions) Licenses Support Services Other(1) Total

Balances as of May 31, 2005 $ 1,220 $ 4,863 $ 445 $ 475 $ 7,003

Allocation of goodwill(1) 218 164 93 (475) —

Siebel acquisition goodwill 538 1,702 274 — 2,514

Other acquisition goodwill 280 147 57 — 484

Goodwill adjustments(2) (42) (135) (15) — (192)

Balances as of May 31, 2006 2,214 6,741 854 — 9,809

Hyperion acquisition

goodwill(1) — — — 1,673 1,673

i-flex acquisition goodwill 687 276 609 — 1,572

Other acquisition goodwill 295 195 49 10 549

Goodwill adjustments(2) (27) (90) (7) — (124)

Balances as of May 31, 2007 $ 3,169 $ 7,122 $ 1,505 $ 1,683 $ 13,479

(1) Represents goodwill associated with certain acquisitions that was or will be allocated to operating

segments upon finalization of our intangible asset valuations.

(2) Primarily relates to the renegotiation of facility leases acquired in the Siebel acquisition and adjustments

to deferred taxes.

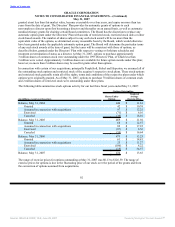

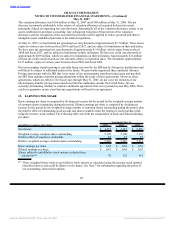

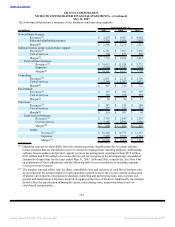

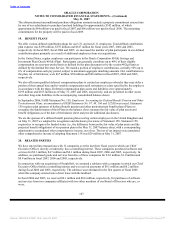

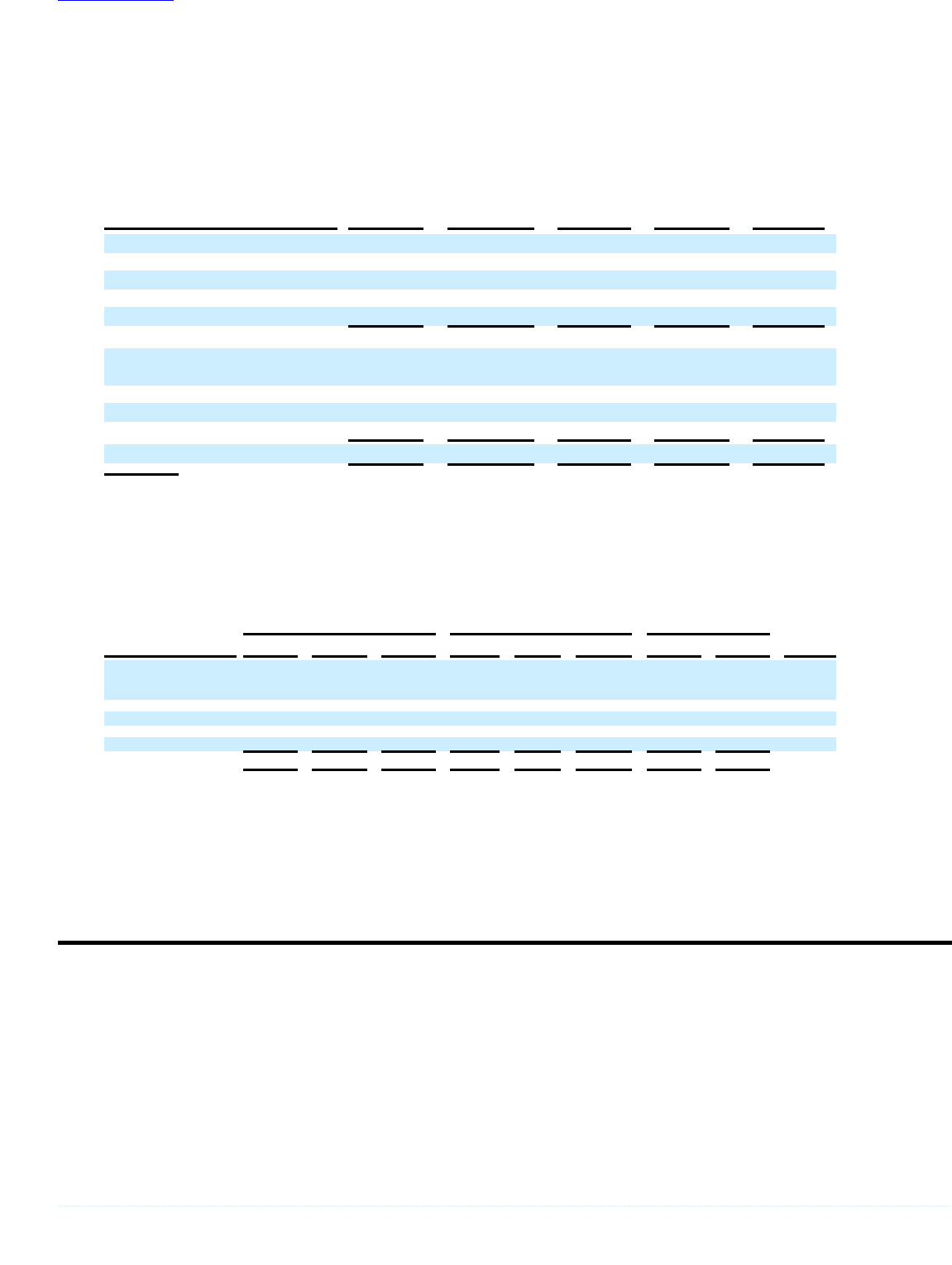

The changes in intangible assets for fiscal 2007 and the net book value of intangible assets at May 31, 2007

and 2006 were as follows:

Intangible Assets, Gross Accumulated Amortization Net Book Value Weighted

May 31, May 31, May 31, May 31, May 31, May 31, Average

(Dollars in millions) 2006 Additions 2007 2006 Expense 2007 2006 2007 Useful Life

Software support

agreements and related

relationships $ 2,949 $ 703 $ 3,652 $ (329) $ (321) $ (650) $ 2,620 $ 3,002 10 years

Developed technology 1,336 1,006 2,342 (333) (355) (688) 1,003 1,654 5 years

Core technology 594 289 883 (121) (133) (254) 473 629 5 years

Customer relationships 375 224 599 (41) (44) (85) 334 514 9 years

Trademarks 117 92 209 (19) (25) (44) 98 165 8 years

Total $ 5,371 $ 2,314 $ 7,685 $ (843) $ (878) $ (1,721) $ 4,528 $ 5,964

Total amortization expense related to our intangible assets was $878 million, $583 million and $219 million

in fiscal 2007, 2006 and 2005, respectively. Estimated future amortization expense related to our intangible

assets is $1.1 billion in both fiscal 2008 and fiscal 2009, $976 million in fiscal 2010, $756 million in fiscal

2011, $620 million in fiscal 2012 and $1.4 billion thereafter.

101

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠