Oracle 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

amended. Under Opinion 25, we generally did not recognize any compensation expense for stock options

granted to employees or outside directors as the exercise price of our options was equivalent to the market

price of our common stock on the date of grant. However, we recorded stock-based compensation for the

intrinsic value associated with unvested options assumed in connection with acquisitions. For pro forma

disclosures of stock-based compensation prior to June 1, 2006, the estimated fair values for options granted

and options assumed were amortized using the accelerated expense attribution method. In addition, we

reduced pro forma stock-based compensation expense for actual forfeitures in the periods they occurred.

In accordance with Statement 123R, we recognize stock-based compensation for grants issued or assumed

after June 1, 2006 for awards that we expect to vest on a straight-line basis over the service period of the

award, which is generally four years. In determining whether an award is expected to vest, we use an

estimated, forward-looking forfeiture rate based upon our historical forfeiture rates. Stock-based

compensation expense recorded using an estimated forfeiture rate is updated for actual forfeitures quarterly.

We also consider whether there have been any significant changes in facts and circumstances that would

affect our forfeiture rate quarterly. The effect of forfeiture adjustments based on actual results was nominal

for fiscal 2007. The fair value of the unvested portion of awards granted prior to June 1, 2006 will continue to

be recognized over the remaining service period using the accelerated expense attribution method, net of

estimated forfeitures.

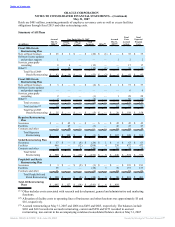

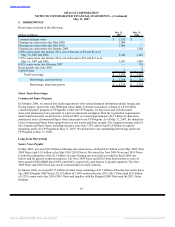

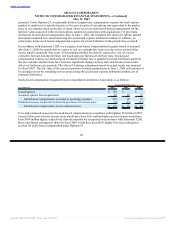

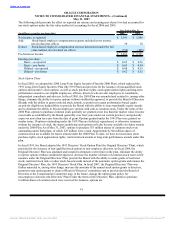

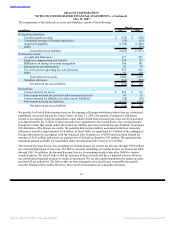

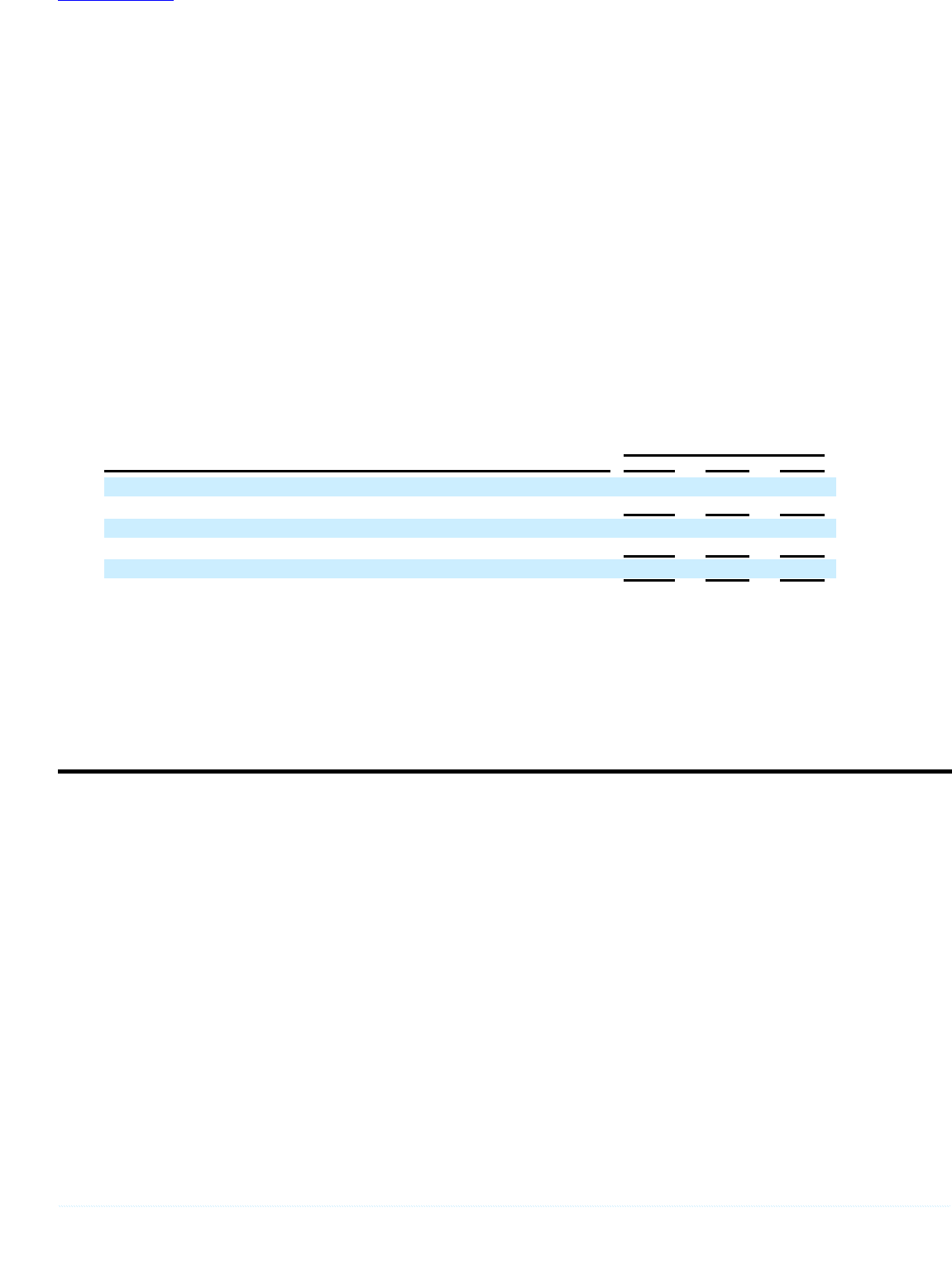

Stock-based compensation recognized in our consolidated statements of operations is as follows:

Year Ended May 31,

(in millions) 2007 2006 2005

Issued options $ 158 $ — $ —

Assumed options from acquisitions 49 49 72

Stock-based compensation, recorded in operating expenses 207 49 72

Estimated income tax benefit included in provision for income taxes (70) (10) (22)

Stock-based compensation, net of estimated taxes $ 137 $ 39 $ 50

If we had continued to account for stock-based compensation in accordance with Opinion 25 for fiscal 2007,

income before provision for income taxes would have been $161 million higher and net income would have

been $109 million higher, respectively, than the amounts we recognized in accordance with Statement 123R.

Basic and diluted earnings per share for fiscal 2007 would have been $0.02 higher if we had continued to

account for stock-based compensation under Opinion 25.

90

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠