Oracle 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2007

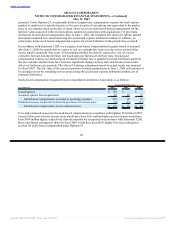

because this method reflects our risk management strategies, the economics of those strategies in our financial

statements and better manages interest rate differentials between different countries. Under this method, the

change in fair value of the forward contract attributable to the changes in spot exchange rates (the effective

portion) is reported in stockholders’ equity to offset the translation results on the net investments. The

remaining change in fair value of the forward contract (the ineffective portion) is recognized in non-operating

income, net.

Net gains (losses) on investment hedges reported in stockholders’ equity prior to tax effects were $45 million,

$23 million and $(23) million in fiscal 2007, 2006 and 2005, respectively. The net gain on investment hedges

reported in non-operating income, net were $28 million, $24 million and $14 million in fiscal 2007, 2006 and

2005, respectively.

At May 31, 2007, we had one net investment hedge in Japanese Yen. The Yen investment hedge minimizes

currency risk arising from net assets held in Yen as a result of equity capital raised during the initial public

offering and secondary offering of Oracle Japan. The fair value of our Yen investment hedge was $0.2 million

as of both May 31, 2007 and 2006. As of May 31, 2007, the Yen investment hedge has a notional amount of

$548 million and an exchange rate of 120.22 Yen for each United States dollar.

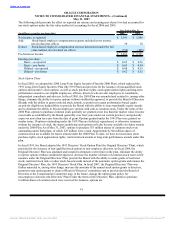

Foreign Currency Forward Contracts

We transact business in various foreign currencies and have established a program that primarily utilizes

foreign currency forward contracts to offset the risk associated with the effects of certain foreign currency

exposures. Under this program, increases or decreases in our foreign currency exposures are offset by gains or

losses on the forward contracts, to mitigate the possibility of foreign currency transaction gains or losses.

These foreign currency exposures typically arise from intercompany sublicense fees and other intercompany

transactions. Our forward contracts generally have terms of 90 days or less. We do not use forward contracts

for trading purposes. All outstanding foreign currency forward contracts used in this program are marked to

market at the end of the period with unrealized gains and losses included in non-operating income, net. Our

ultimate realized gain or loss with respect to currency fluctuations depends upon the currency exchange rates

and other factors in effect as the contracts mature. Net foreign exchange transaction gains (losses) included in

non-operating income, net in the accompanying consolidated statements of operations were $17 million,

$15 million and $(28) million in fiscal 2007, 2006 and 2005, respectively. The unrealized gains (losses) of

our outstanding foreign currency forward contracts were $5 million and $(0.3) million at May 31, 2007 and

2006, respectively.

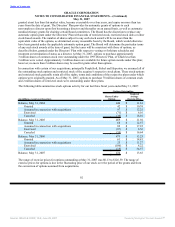

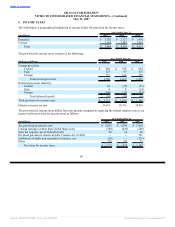

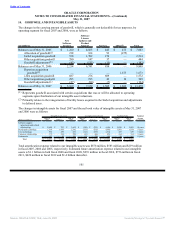

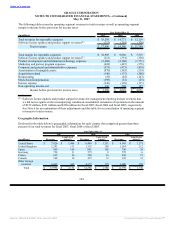

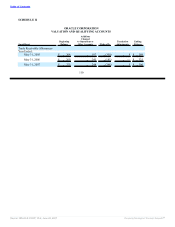

13. PROPERTY

Property consisted of the following:

Estimated May 31,

(in millions) Useful Lives 2007 2006

Computer and network equipment 2-5 years $ 1,379 $ 1,131

Buildings and improvements 1-50 years 1,350 1,274

Furniture and fixtures 3-10 years 385 369

Land — 204 200

Automobiles 5 years 5 11

Construction in progress — 136 66

Total property 1-50 years 3,459 3,051

Accumulated depreciation (1,856) (1,660)

Property, net $ 1,603 $ 1,391

100

Source: ORACLE CORP, 10-K, June 29, 2007 Powered by Morningstar® Document Research℠