OfficeMax 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

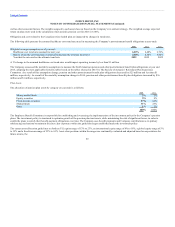

OfficeMax 2012 U.S. federal income tax return concluded, which resulted in a $6 million decrease in tax credit carryforwards. Such decrease had no impact

on income tax expense due to an offsetting change in valuation allowance. The acquired OfficeMax U.S. consolidated group is no longer subject to U.S.

federal and state and local income tax examinations for years before 2013 and 2006, respectively. The U.S. federal income tax returns for 2014 and 2015 are

currently under review. Generally, the Company is subject to routine examination for years 2008 and forward in its international tax jurisdictions.

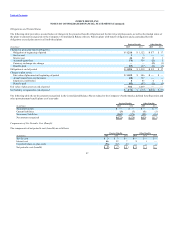

The Company leases retail stores and other facilities, vehicles, and equipment under operating lease agreements. Facility leases typically are for a fixed non-

cancellable term with one or more renewal options. In addition to minimum rentals, the Company is required to pay certain executory costs such as real estate

taxes, insurance and common area maintenance on most of the facility leases. Many lease agreements contain tenant improvement allowances, rent holidays,

and/or rent escalation clauses. Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such payments have

been immaterial during the years presented.

For tenant improvement allowances, scheduled rent increases, and rent holidays, a deferred rent liability is recognized and amortized over the terms of the

related lease as a reduction of rent expense. Rent related accruals totaled $230 million and $275 million at December 26, 2015 and December 27, 2014,

respectively. The short-term and long-term components of these liabilities are included in Accrued expenses and other current liabilities and Deferred income

taxes and other long-term liabilities, respectively, on the Consolidated Balance Sheets.

Rent expense, including equipment rental, was $579 million, $682 million and $458 million in 2015, 2014, and 2013, respectively. Rent expense was

reduced by sublease income of $4 million in 2015, $6 million in 2014, and $4 million in 2013.

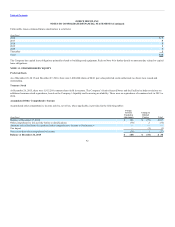

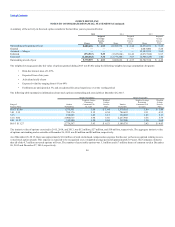

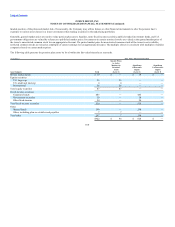

Future minimum lease payments due under the non-cancelable portions of leases as of December 26, 2015 include facility leases that were accrued as store

closure costs and are as follows:

(In millions)

2016

2017

2018

2019

2020

Thereafter

Less sublease income

Total

These minimum lease payments do not include contingent rental payments that may be due based on a percentage of sales in excess of stipulated amounts.

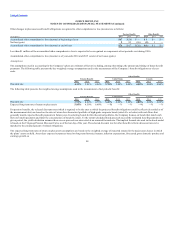

As of December 26, 2015 and December 27, 2014, unfavorable lease deferred credit for store leases with terms above market value amounted to $18 million

and $33 million, respectively, and are included in Deferred income taxes and other long-term liabilities in the Consolidated Balance Sheets. The unfavorable

lease values are amortized on a straight-line basis over the lives of the leases, unless the facility has been identified for closure under the Real Estate Strategy.

In 2015 and 2014, the net amortization of favorable and unfavorable lease values reduced rent expense by $7 million and $9 million, respectively. Refer to

Note 5 for further details on favorable leases.

91