OfficeMax 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

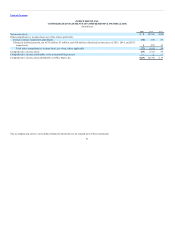

Table of Contents

We enter into economic hedge transactions for a portion of our anticipated fuel consumption in the U.S. These arrangements are marked to market at each

reporting period. Some of these arrangements may not be designated as hedges for accounting purposes and changes in value are recognized in current

earnings through the Cost of goods sold and occupancy costs line on the Consolidated Statements of Operations. Those that are designated as hedges for

accounting purposes are also marked to market at each reporting period, with the change in value deferred in accumulated other comprehensive income until

the related fuel is consumed. At December 26, 2015, we had entered into contracts for approximately 7 million gallons of fuel that will be settled monthly

through January 2017. Currently, these economic hedging transactions are not considered material. As of December 26, 2015, excluding the impact of any

hedge transaction, a 10% change in domestic commodity costs would result in an increase or decrease in our operating profit of $4 million.

Although we cannot determine the precise effects of inflation on our business, we do not believe inflation has had a material impact on our sales or the results

of our operations. We consider our business to be somewhat seasonal, with sales generally trending lower in the second quarter, following the “back-to-

business” sales cycle in the first quarter and preceding the “back-to-school” sales cycle in the third quarter and the holiday sales cycle in the fourth quarter.

Certain working capital components may build and recede during the year reflecting established selling cycles. Business cycles can and have impacted our

operations and financial position when compared to other periods.

In May 2014, the Financial Accounting Standards Board (“FASB”) issued an accounting standards update that supersedes most current revenue recognition

guidance and modifies the accounting for certain costs associated with revenue generation. The core principle of this guidance is that an entity should

recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to

be entitled in exchange for those goods or services. The guidance provides a number of steps to apply to achieve that principle and requires additional

disclosures. The standard was originally to be effective for the Company’s first quarter of 2017. In July 2015, the FASB approved a one year extension to the

required implementation date but also permits companies to adopt the standard at the original effective date of 2017. Adoption before the original effective

date of 2017 is not permitted. The new revenue standard may be applied retrospectively to each prior period presented or retrospectively with the cumulative

effect recognized as of the date of adoption. The Company is assessing what impacts this new standard will have on its Consolidated Financial Statements.

Refer to information in the “Market Sensitive Risks and Positions” subsection of Part II — Item 7. “MD&A” of this Annual Report.

Refer to Part IV — Item 15(a) of this Annual Report.

None.

51