OfficeMax 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

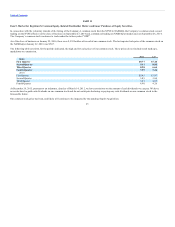

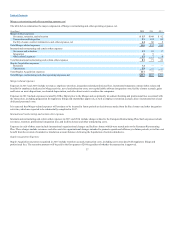

The line items in our Consolidated Statements of Operations impacted by these Corporate activities are presented in the table below, followed by a narrative

discussion of the significant matters. These activities are managed at the Corporate level and, accordingly, are not included in the determination of Division

income for management reporting or external disclosures.

(In millions) 2014 2013

Asset impairments 88 70

Merger, restructuring, and other operating expenses, net 403 201

Legal accrual 81 —

Total charges and credits impact on Operating income (loss) $572 $271

In addition to these charges and credits, certain Selling, general and administrative expenses are not allocated to the Divisions and are managed at the

Corporate level. Those expenses are addressed in the section “Unallocated Costs” below.

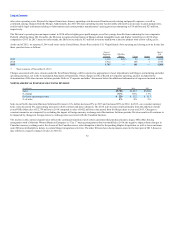

In recent years, we have taken actions to adapt to changing and competitive conditions. These actions include closing stores and distribution centers,

consolidating functional activities, eliminating redundant positions, disposing of businesses and assets, and taking actions to improve process efficiencies.

These actions have resulted in significant charges associated with the Merger, Real Estate Strategy, restructuring certain International operations and the

Staples Acquisition. These activities are expected to continue in future periods and result in additional charges.

Asset impairments

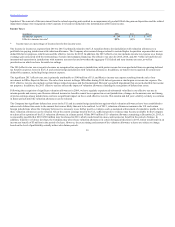

We recognized asset impairment charges of $13 million, $88 million, and $70 million in 2015, 2014, and 2013, respectively.

Asset impairment charges are comprised as follows:

(In millions) 2014 2013

North America stores $25 $26

Goodwill — 44

Software implementation project 28 —

Software 25 —

Intangible assets 10 —

Total Asset impairments $88 $70

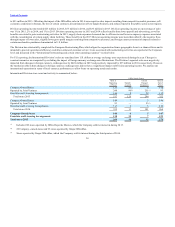

Store impairments

As a result of declining sales in recent periods and adoption of our Real Estate Strategy in 2014, the Company has conducted a detailed quarterly store

impairment analysis. The analysis includes estimates of store-level sales, gross margins, direct expenses, exercise of future lease renewal options where

applicable, and resulting cash flows and, by their nature, include judgments about how current initiatives will impact future performance. If the anticipated

cash flows of a store cannot support the carrying value of its assets, the assets are impaired and written down to estimated fair value.

35