OfficeMax 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

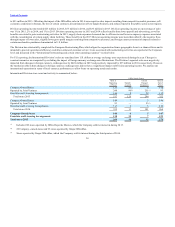

liquidated. The removal of this investment from the related reporting unit resulted in an impairment of goodwill. Both the gain on disposition and the related

impairment charge were recognized at the Corporate level and not included in the determination of Division income.

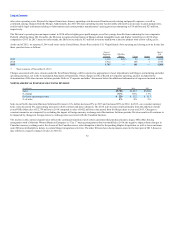

(In millions) 2014 2013

Income tax expense $ 12 $ 147

Effective income tax rate* (4)% 116%

* Income taxes as a percentage of income (loss) before income taxes.

The increase in income tax expense from 2014 to 2015 is primarily related to the U.S. transition from a loss jurisdiction with valuation allowance to a

profitable tax-paying jurisdiction with valuation allowance. The Company also incurred charges related to certain Staples Acquisition expenses that are not

deductible for tax purposes, which increased the effective tax rate for 2015. In addition, the 2015 effective tax rate includes income tax expense on a foreign

exchange gain associated with the restructuring of certain intercompany financing. The effective tax rates for 2015, 2014, and 2013 reflect a benefit for our

international operations in jurisdictions with statutory tax rates that are lower than the aggregate U.S. federal and state income tax rates, as well as

jurisdictions in which we have favorable tax rulings.

The 2014 effective tax rate is negative because we recognized tax expense in jurisdictions with pretax income but were precluded from recognizing deferred

tax benefits on pretax losses in the U.S. and certain foreign jurisdictions with valuation allowances. In addition, no benefit was recognized for certain non-

deductible expenses, including foreign interest expense.

The significant 2013 effective tax rate is primarily attributable to $140 million of U.S. and Mexico income tax expense resulting from the sale of our

investment in Office Depot de Mexico. The sale of our interest in Grupo OfficeMax during 2014 did not generate a similar gain or income tax expense. The

2013 effective tax rate also includes certain Merger related expenses and the International Division’s goodwill impairment that are not deductible for income

tax purposes. In addition, the 2013 effective tax rate reflects the impact of valuation allowances limiting the recognition of deferred tax assets.

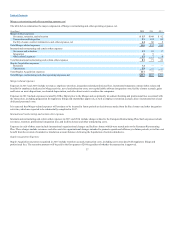

Following the recognition of significant valuation allowances in 2009, we have regularly experienced substantial volatility in our effective tax rate in

interim periods and across years. Because deferred income tax benefits cannot be recognized in several jurisdictions, changes in the amount, mix and timing

of pretax earnings among jurisdictions can have a significant impact on the overall effective tax rate. This interim and full year volatility is likely to continue

in future periods until the valuation allowances can be released.

The Company has significant deferred tax assets in the U.S. and in certain foreign jurisdictions against which valuation allowances have been established to

reduce such deferred tax assets to the amount that is more likely than not to be realized. As of 2015, valuation allowances remain in the U.S. and certain

foreign jurisdictions where the Company believes it is necessary to see further positive evidence, such as sustained achievement of cumulative profits, before

these valuation allowances can be released. Given the current earnings trend in the U.S., sufficient positive evidence may become available for the Company

to release all or a portion of the U.S. valuation allowance in a future period. Of the $493 million U.S. valuation allowance remaining at December 26, 2015, it

is reasonably possible that $265-$360 million may be released in 2016, which would result in a non-cash income tax benefit in the period of release. In

addition, if positive evidence develops, the Company may also release valuation allowances in certain foreign jurisdictions in 2016, which would result in an

income tax benefit of $3 million in the period of release. However, the exact timing and amount of the valuation allowance releases are subject to change

based on the level of profitability actually achieved in future periods.

39